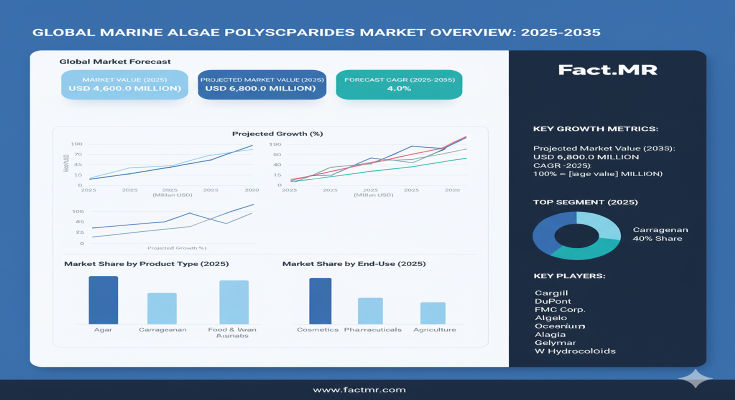

In the blue frontier of biotechnology, the marine algae polysaccharides market is swelling with potential, offering versatile hydrocolloids and bioactive molecules that revolutionize industries from pharmaceuticals to food fortification. A groundbreaking report from Fact.MR projects the global market, valued at US$ 6.8 billion in 2025, to surge to US$ 12.5 billion by 2035, achieving a robust compound annual growth rate (CAGR) of 6.2%. This nearly 84% expansion—representing an absolute dollar opportunity of US$ 5.7 billion—underscores the sector’s pivotal role in sustainable sourcing, with carrageenan and alginate leading as multifunctional stabilizers and drug delivery agents.

As ocean-derived polymers gain favor over synthetic alternatives, marine algae polysaccharides are becoming indispensable for clean-label products and regenerative medicine. “Marine algae polysaccharides aren’t just ingredients—they’re the ocean’s gift to modern innovation, with a 6.2% CAGR highlighting their scalability in health and industrial applications,” said Dr. Kai Olsen, Lead Biomaterials Analyst at Fact.MR. “From Asia’s aquaculture hubs to Europe’s pharma labs, this market is a tide of opportunity for stakeholders harnessing nature’s polymers for a greener tomorrow.”

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=8700

Key Drivers: Biomedical Breakthroughs and Sustainable Sourcing

The market’s dynamic growth is anchored in transformative demands across sectors. Foremost is the biomedical surge, where polysaccharides like fucoidan and ulvan enable targeted drug delivery, wound healing, and anti-inflammatory therapies, addressing chronic diseases affecting 1.7 billion people globally. In food and beverage, their gelling and thickening prowess supports low-sugar formulations and plant-based mimics, aligning with veganism’s 600% rise over the past decade.

Sustainable harvesting advancements, including eco-friendly extraction via enzymatic processes, reduce environmental impact while boosting yields by 30%. Regulatory endorsements for natural additives and biotech incentives further propel adoption. “Increasing demand for bioactive compounds in pharmaceuticals and functional foods” is a core driver, per Fact.MR, amplified by the shift to circular bioeconomies. Challenges like seasonal variability and high purification costs linger, but AI-optimized cultivation is charting solutions.

Segmentation Insights: Carrageenan and Food Applications Dominate

Fact.MR’s in-depth segmentation spotlights lucrative streams. By type, carrageenan holds a commanding 40.0% share in 2025, prized for its versatility in dairy and meat analogs, projected to reach US$ 5.0 billion by 2035 at 6.3% CAGR. Alginate follows at 30.0% for encapsulation tech, while agar and others like laminarin carve niches in pharma and cosmetics.

Application-wise, food & beverages lead with 45.0% share (US$ 3.1 billion in 2025 to US$ 5.6 billion by 2035, 6.1% CAGR), driven by texture enhancers in plant milks. Pharmaceuticals surge for drug vectors, nutraceuticals for immune boosters, and cosmetics for hydrators.

Source segmentation favors red algae at 55.0% for carrageenan-rich yields, with brown and green variants complementing.

Regional Dynamics: Asia-Pacific’s Harvest Leads Global Tide

Asia-Pacific commands the wave, with Indonesia at 7.0% CAGR, fueled by vast seaweed farms in Sulawesi exporting to Europe. China (6.5% CAGR) scales alginate production in Qingdao, while India’s coastal initiatives in Tamil Nadu boost carrageenan output.

North America advances, led by the U.S. at 5.8% CAGR (US$ 1.0 billion in 2025 to US$ 1.8 billion by 2035), anchored by biotech in San Diego for pharma apps. Europe maintains sophistication, with France at US$ 800 million (5.5% CAGR) innovating in Paris labs, Germany (US$ 600 million) for industrial gels in Munich, and the UK (US$ 500 million) for nutraceuticals in London. Spain and Italy add Mediterranean flair, emphasizing sustainable sourcing.

Japan (5.9% CAGR) refines agar tech in Tokyo, unlocking via precision biotech.

Recent Developments: Extraction Tech and Partnership Waves

The polysaccharides pool is deepening with innovation. In 2024, DuPont scaled enzymatic extraction in Indonesia, yielding 25% purer carrageenan for food giants. CEVA Santé Animale partnered with French startups for ulvan-based vet meds, trialing anti-viral coatings. Algalif’s Icelandic fucoidan pilots hit 90% bioavailability, while Cargill’s U.S. alginate microbeads advanced drug delivery trials. 2025 forecasts nano-encapsulation breakthroughs and ASEAN supply pacts, enhancing global flows.

Key Players Insights: Ocean Innovators Scaling Depths

A competitive sea of 15-20 players sees leaders netting 45-55% via R&D and alliances:

-

Cargill: Carrageenan titan, dominating food apps with sustainable farms.

-

DuPont: Alginate expert, innovating pharma encapsulation.

-

CEVA Santé Animale: Fucoidan specialist, targeting biomedical vectors.

-

Algalif: Purity leader in Iceland, focusing on nutraceuticals.

-

Gumlink: Danish agar innovator for cosmetics.

-

Shepherd Chemical: U.S. processor for industrial hydrocolloids.

-

Bright Moon Seaweed: Chinese scaler for red algae extracts.

-

MCBI, Setalg, Algatechnologies, DIC Corporation, Shemberg: Niche players in brown/green variants, via regional co-ops.

Strategies include M&A for cultivation IP and certifications for organic status.

Challenges and Opportunities: Supply Swells vs. Purity Peaks

Harvesting inconsistencies and extraction complexities inflate costs by 15-20%, with regulatory variances hindering exports.

Yet, opportunities crest: carrageenan unlocks US$ 5.0 billion, food dominance US$ 5.6 billion, and Asia-Pacific US$ 3.0+ billion. Pharma surges add US$ 2.5 billion, sustainable tech US$ 1.0 billion—high tides for bio-pioneers.

Browse Full Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8700

Future Outlook: A $12.5 Billion Ocean of Innovation

By 2035, Fact.MR envisions marine algae polysaccharides as a US$ 12.5 billion current, with food at 50% share and Asia-Pacific steering growth. The 6.2% CAGR will favor engineered strains and zero-waste processes. For sea strategists, the current is clear: dive into bioactives to polysaccharide prosperity.