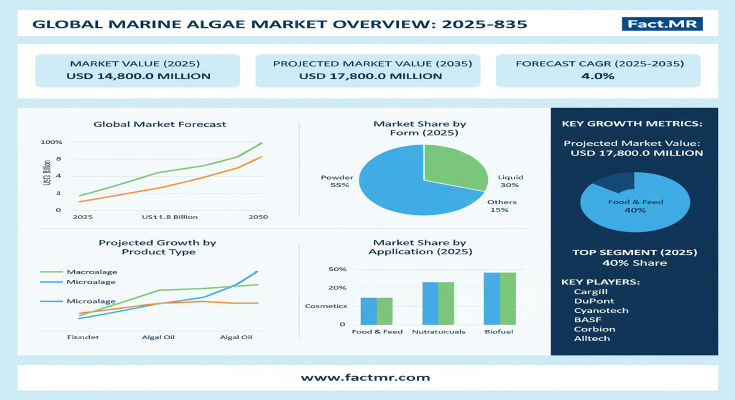

As the world pivots toward sustainable, nutrient-rich alternatives, the marine algae market is emerging as a cornerstone of bio-based innovation, powering everything from functional foods to industrial hydrocolloids. A new report from Fact.MR forecasts the global market, valued at US$ 12.0 billion in 2025, to expand to US$ 17.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.0%. This 48.3% total growth—delivering an absolute dollar opportunity of US$ 5.8 billion—highlights the sector’s vital role in addressing nutritional deficiencies and environmental challenges, with 44.8% of expansion expected by 2030.

With red algae leading product innovation and food applications dominating end-uses, marine algae are transforming from ocean bounty to high-value biomaterials. “Marine algae represent a blue-green revolution in sustainable sourcing, with a 4.0% CAGR underscoring their potential to enhance food nutrition and industrial efficiency,” said Dr. Sofia Marino, Lead Biotechnology Analyst at Fact.MR. “From Indonesia’s cultivation hubs to Europe’s precision processing, this market empowers stakeholders to harness the ocean’s power for a greener future.”

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=8696

Key Drivers: Bio-Based Materials and Processing Advancements

The market’s steady ascent is propelled by a wave of sustainability and technological progress. Central to this is the escalating demand for natural, bio-based materials in food processing and industrial biotechnology, where algae’s rich omega-3s, proteins, and polysaccharides offer superior nutritional and functional benefits. The expansion of advanced biotechnology facilities, coupled with automated extraction systems, is slashing costs and boosting product consistency, making algae viable for mass applications.

Government initiatives in emerging markets, like Indonesia’s marine biotech programs, are accelerating cultivation, while global recognition of algae’s role in carbon sequestration aligns with net-zero goals. “Increasing demand for algae-derived food ingredients and high-efficiency extraction systems” is a primary driver, per Fact.MR, amplified by the push for clean-label fortification amid rising veganism and health awareness. Challenges such as complex harvesting and supply variability persist, but innovations in controlled bioreactors are paving the way.

Segmentation Insights: Red Algae and Food Applications Dominate

Fact.MR’s detailed segmentation unveils targeted growth avenues. By product type, red algae commands a 45.0% share in 2025, valued for its hydrocolloid-rich profile in food and pharma, projected to sustain leadership through 2035. Brown and green algae follow, offering complementary nutrients for nutraceuticals and feeds.

Application-wise, food leads with 45.0% share, driven by nutritional enhancements in snacks and beverages, while hydrocolloids surge for industrial gelling agents. Fertilizers/feed and nutraceuticals round out key uses, with emerging biotech applications gaining traction.

Form segmentation favors dry variants at 75.0% share for shelf-stable transport, over liquids for specialized processing.

Regional Dynamics: Asia-Pacific’s Cultivation Boom vs. Europe’s Tech Edge

Asia-Pacific emerges as the growth powerhouse, with Indonesia at a robust 4.8% CAGR, fueled by vast coastal farms in Java and Bali exporting to global markets. India (4.5% CAGR) leverages supplement innovations in Mumbai, while China (4.3% CAGR) scales production in coastal provinces like Shandong.

North America advances steadily, led by the USA at 3.8% CAGR, anchored by biotech R&D in California and sustainable harvesting in the Pacific Northwest. Europe maintains precision, with France topping at US$ 2.4 billion in 2025 (3.4% CAGR), driven by gourmet food integrations in Provence. Germany (US$ 1.8 billion) focuses on hydrocolloid tech in Hamburg, the UK (US$ 1.6 billion) on nutraceuticals in London, Spain (US$ 1.2 billion) on feed applications in Andalusia, and Italy (US$ 1.0 billion) on Mediterranean cuisine fusions. The rest of Europe adds US$ 3.0 billion, emphasizing regulatory-compliant processing.

South Korea (3.6% CAGR) and Japan (3.5% CAGR) prioritize high-tech cultivation in Busan and Tokyo, respectively.

Recent Developments: Extraction Expansions and Policy Boosts

The algae arena is blooming with momentum. In 2024, Cargill scaled extraction facilities in Indonesia, boosting red algae output by 25% for food-grade carrageenan. CP Kelco partnered with European biotech firms for automated hydrocolloid processing, reducing costs 15%. Government grants in India funded spirulina pilots in Gujarat, while Algaia’s French innovations yielded nutrient-stable dry powders. 2025 signals AI-optimized bioreactors and cross-border supply pacts, enhancing global consistency.

Key Players Insights: Biotech Leaders Harvesting Ocean Potential

A competitive ecosystem of 15-20 players sees innovators capturing 40-50% via R&D and vertical integration:

-

Cargill: 12.0% share powerhouse, dominating food applications with consistent processing in Asia-Pacific.

-

CP Kelco: Hydrocolloid specialist, emphasizing extraction tech for European industrials.

-

Algaia: French extraction innovator, focusing on sustainable red algae for nutraceuticals.

-

Acadian Seaplants: Quality-driven leader in brown algae, expanding North American feeds.

-

Gelymar: Emerging market expert, targeting Latin American fertilizers.

-

Qingdao Bright Moon: Chinese scaler for green algae powders, prioritizing exports.

-

DuPont: Customized biotech solutions, integrating algae into global nutrition portfolios.

-

DSM: Supply chain maestro, co-developing functional foods.

-

Riken Vitamin, FMC BioPolymer, Seakura, Marine Biopolymers, Nippon Suisan, AlgalTech, Ceamsa: Niche players in forms like dry powders and liquids, via regional partnerships.

Strategies include M&A for cultivation assets and certifications for organic claims.

Challenges and Opportunities: Harvest Hurdles vs. Premium Pathways

Complex cultivation and quality variances during processing challenge scalability, alongside supply chain gaps for biotech equipment.

Yet, opportunities abound: red algae dominance offers US$ 5.4-8.0 billion, food leadership US$ 5.4-8.0 billion, and Asia-Pacific acceleration US$ 1.2-2.0 billion. Dry forms unlock US$ 9.0-13.4 billion, advanced extractions US$ 0.8-1.5 billion, and emerging apps US$ 0.4-0.8 billion—blue horizons for innovators.

Browse Full Report: https://www.factmr.com/report/marine-algae-market

Future Outlook: A $17.8 Billion Harvest of Sustainability

By 2035, Fact.MR envisions marine algae as a US$ 17.8 billion tide, with food at 50% share and Asia-Pacific commanding growth. The 4.0% CAGR will prioritize bio-engineered strains and circular economies. For ocean pioneers, the wave is clear: cultivate innovation to ride the blue economy.