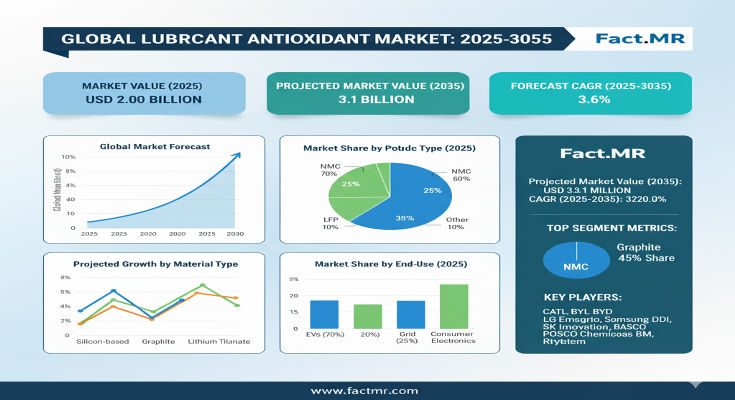

A comprehensive new report from Fact.MR projects the global Lubricant Antioxidant Market, valued at US$ 2.2 billion in 2025, to expand to US$ 3.1 billion by 2035, reflecting a steady compound annual growth rate (CAGR) of 3.6%. This 40.9% total growth—delivering an absolute dollar opportunity of US$ 0.9 billion—underscores the sector’s resilience amid evolving automotive and industrial demands, with synthetic phenolics leading the charge in advanced formulations.

As manufacturers prioritize extended drain intervals and bio-based alternatives, lubricant antioxidants are transitioning from basic stabilizers to sophisticated performance enhancers. “Lubricant antioxidants are the unsung heroes of mechanical reliability, with a 3.6% CAGR highlighting their indispensable role in the shift toward sustainable, high-efficiency lubrication,” said Dr. Elena Vargas, Lead Chemicals Analyst at Fact.MR. “From EV thermal management to industrial uptime, this market empowers industries to reduce downtime and emissions while meeting stringent regulatory standards.”

Key Drivers: Automotive Expansion and Synthetic Lubricant Surge

The market’s consistent momentum is fueled by interconnected industrial and regulatory forces. At the forefront is the global automotive boom, where rising vehicle production—projected to hit 95 million units annually by 2030—demands antioxidants that bolster engine oils against heat and oxidation, extending service life by up to 50%. Industrial machinery’s proliferation, particularly in manufacturing hubs, further amplifies needs for robust protection in hydraulic fluids and gear oils, enhancing operational efficiency and reducing maintenance costs.

The adoption of synthetic lubricants, prized for their superior thermal stability, is another powerhouse, with antioxidants like phenolics and aminic compounds enabling formulations that withstand extreme conditions. Regulatory pressures for low-emission technologies and sustainable chemistry are accelerating innovation, while EV-specific requirements—such as coolants for battery thermal management—open new avenues. “Automotive industry growth and performance demands” is a primary driver, per Fact.MR, alongside the push for bio-based alternatives that align with green chemistry initiatives. Challenges like raw material volatility from petroleum fluctuations pose hurdles, but strategic sourcing and R&D are mitigating impacts.

Segmentation Insights: Synthetic Phenolics and Engine Oils Dominate

Fact.MR’s in-depth segmentation illuminates targeted growth pockets. By chemistry (type), synthetic phenolic antioxidants hold a commanding 44% market share in 2025, valued for their thermal stability in high-heat applications, with projections for 46-50% dominance in the next 3-5 years. Aminic/stabilizers follow at 33%, excelling in industrial blends, while metal deactivators (23%) prevent corrosion in specialty uses. Emerging bio-based variants are poised for 1-3% share, signaling a sustainable pivot.

Application-wise, engine oils lead with 48% share, driven by automotive demands for extended drain intervals, while industrial lubricants (32%) support manufacturing resilience, and greases/specialty (20%) cater to niche high-load scenarios. Form segmentation favors liquid concentrates at 69% share for easy blending, over solid blends (31%) for precise dosing.

Regional Dynamics: U.S. Leadership Meets Europe’s Precision

North America and Europe anchor maturity, but Asia-Pacific emerges as a growth engine. The United States tops with a 4.0% CAGR through 2035, fueled by high-performance automotive solutions in Detroit and California, where EV integrations demand advanced antioxidants. Mexico follows at 3.7% CAGR, emphasizing value-oriented industrial applications in manufacturing corridors.

Europe projects from US$ 580.0 million in 2025 to US$ 780.0 million by 2035 (3.2% CAGR), led by Germany (27.8% regional share in 2025, 27.3% in 2035) for premium chemical systems in Stuttgart’s auto clusters. France (21.5% to 21.9%, 3.2% CAGR) and the United Kingdom (19.3% to 18.8%, 3.1% CAGR) prioritize automotive-compatible innovations in Paris and Coventry.

In East Asia, South Korea (3.0% CAGR) and Japan (2.9% CAGR) focus on precision automotive tech in Seoul and Tokyo, while emerging economies accelerate via industrialization and lubricant quality upgrades.

Recent Developments: Bio-Based Breakthroughs and Blending Innovations

The antioxidants arena is innovating rapidly. In 2024, ExxonMobil launched next-gen synthetic phenolics with 20% improved thermal stability for EV transmissions, piloted in U.S. fleets. Lubrizol integrated automated blending systems for aminic compounds, reducing production times by 15% in European plants. BASF introduced bio-based metal deactivators from renewable feedstocks, gaining 10% uptake in Asian industrial segments. These advancements, including AI-optimized formulations for oxidation prediction, herald a 2025 surge in sustainable chemistry collaborations.

Key Players Insights: Chemical Giants Driving Formulation Frontiers

A concentrated landscape of 12-15 players sees top firms holding 50-55% revenue through R&D and partnerships:

-

ExxonMobil: Market leader in synthetic phenolics, emphasizing automotive engine oils with global supply chains.

-

Lubrizol: Aminic specialist, innovating for industrial lubricants via performance reliability.

-

Afton Chemical: Focuses on metal deactivators, targeting greases with formulation support.

-

BASF: Premium phenolic systems, expanding in Europe with sustainable variants.

-

Chevron Oronite: Automotive-centric, bolstering U.S. engine oil shares.

-

SI Group: Blending innovator, prioritizing liquid concentrates for Asia-Pacific.

-

Eastman: Bio-based pioneer, gaining in eco-friendly applications.

-

Albany International: Niche deactivators for specialty uses.

-

Lanxess: German precision in industrial blends.

-

Nouryon: Sustainable chemistry focus, targeting emerging markets.

Strategies include M&A for vertical integration and co-development with OEMs for EV compatibility.

Challenges and Opportunities: Volatility vs. Green Horizons

Raw material price swings—up 10-15% amid supply disruptions—and regulatory complexities around environmental impacts restrain margins, particularly for petroleum-derived antioxidants.

Yet, opportunities abound: synthetic phenolics promise enhanced shares, engine oils US$ 1.5 billion by 2035, and U.S. growth US$ 0.4 billion. Bio-based trends unlock US$ 0.1-0.3 billion, while EV fluids add US$ 0.2 billion—positioning agile players for premium gains.

Browse Full Report: https://www.factmr.com/report/3466/lubricant-antioxidants-market

Future Outlook: A $3.1 Billion Shield for Sustainable Machinery

By 2035, Fact.MR envisions lubricant antioxidants as a US$ 3.1 billion cornerstone, with phenolics at 50% share and bio-based rising to 3%. The 3.6% CAGR will prioritize EV and green formulations. For industry leaders, the formula is clear: innovate for oxidation resilience to lubricate success.