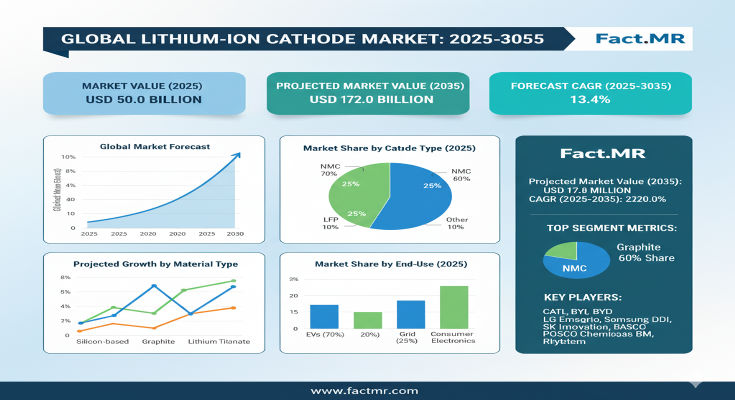

The global lithium-ion battery cathode market is projected to grow from USD 48.5 billion in 2025 to USD 172.0 billion by 2035, representing a compound annual growth rate (CAGR) of 13.4% over the decade. This expansion reflects the surging demand for high-performance cathode materials driven by the proliferation of electric vehicles, stationary energy storage systems, and consumer electronics requiring more powerful, efficient and long-life battery chemistries.

Premium Market Report at Discounted Price | Check Details Inside:- https://www.factmr.com/connectus/sample?flag=S&rep_id=3816

Market Drivers & Growth Catalysts

Key drivers fueling this growth include the rapid electrification of transportation, where automotive OEMs are demanding advanced cathode materials (especially high-nickel / NMC cathodes) to enable longer driving ranges, faster charging, and improved battery longevity. At the same time, the deployment of utility-scale and residential energy storage systems is driving demand for cathodes capable of handling deep cycling while maintaining stability. In consumer electronics, growing demand for portable, high-capacity batteries in devices intensifies the need for optimized cathode materials. Advances in cathode active material technology, coating and processing, and improvements in precursor and active powder quality are enabling performance enhancements that align with industry requirements.

Product & Material / Form Segmentation

Within the cathode market, NMC (nickel-manganese-cobalt) or high-nickel cathodes are expected to maintain a dominant position, capturing significant share due to their favorable energy density and performance characteristics. Other chemistry types such as LFP or specialty cathodes continue to serve cost-sensitive or safety-focused applications. In terms of form, active material powders (precursor + active cathode materials) are projected to hold a strong share, as they serve as the feedstock for cathode electrode fabrication, coating, and cell assembly processes.

Application & End-Use Insights

Electric vehicle batteries represent a primary application area, driving substantial portion of demand for cathode materials, as automakers scale up battery production and require higher performance chemistries. Stationary energy storage systems (ESS) also contribute significantly, especially where long cycle life and stability over multiple charge/discharge cycles are essential. Consumer electronics is another relevant segment, where demand for compact battery packs with high energy density pushes the need for advanced cathode chemistries.

Regional Outlook & Growth Opportunities

Regions with mature battery manufacturing ecosystems and strong electrification push—such as Asia-Pacific, North America and Europe—are expected to be leading markets for cathode materials. Asia-Pacific benefits from the presence of battery cell manufacturers, cathode producers, and raw material supply chains. North America and Europe also show strong growth potential, driven by local battery gigafactories, automotive electrification mandates, and domestic value chain initiatives. Emerging regions or fleets adopting EVs and energy storage may also provide incremental demand as electrification spreads globally.

Competitive Landscape & Strategic Trends

The competitive landscape comprises cathode active material producers, electrode manufacturers, precursor material suppliers, and battery cell makers collaborating to optimize cathode performance. Key players are investing in developing high-nickel / low-cobalt cathodes, optimizing precursor chemistry, improving coating uniformity, and scaling powder or coated electrode production. Partnerships between cathode suppliers and battery or automotive companies are becoming more common, enabling co-development of materials tuned for specific battery designs and performance requirements.

Challenges & Market Restraints

Despite the robust outlook, there are constraints. Sourcing of raw materials (nickel, cobalt, manganese, lithium, etc.) may face supply chain constraints or price volatility, affecting material cost and availability. Manufacturing of high-performance cathodes requires precision in synthesis, coating and heat treatment to avoid defects, which raises manufacturing costs and quality control complexity. Also, regulatory requirements around raw materials (e.g. cobalt sourcing or sustainability standards) may introduce compliance burdens. In cost-sensitive markets, lower-cost cathode alternatives (e.g. LFP) may compete, limiting adoption of premium chemistries.

Forecast & Strategic Recommendations

With forecasts showing growth from USD 48.5 billion in 2025 to USD 172.0 billion by 2035 at a CAGR of 13.4%, the cathode materials market offers tremendous opportunity. Producers should invest in scaling production of high-nickel cathodes and precursor materials, strengthen raw material supply chains, and enhance powder coating / electrode formulation capabilities. Focusing on regions with growing EV and energy storage demand will be essential to capturing market share. Co-development with battery pack manufacturers or OEMs will help align cathode specifications with cell design and performance targets, thereby optimizing battery systems.

Browse Full Report: https://www.factmr.com/report/3816/lithium-ion-battery-cathode-market

Editorial Perspective

The lithium-ion battery cathode market is at the heart of the energy transition and mobility revolution. As battery performance demands grow—driven by electrification of transport, expansion of energy storage, and miniaturization in electronics—the quality, availability and innovation in cathode materials becomes a critical competitive edge. Suppliers that can deliver high-performance cathode powders or coated materials at scale, reliably and sustainably, will be central to enabling next-generation battery systems. The projected rise to USD 172.0 billion by 2035 underscores the magnitude of opportunity in this critical segment of the battery materials ecosystem.