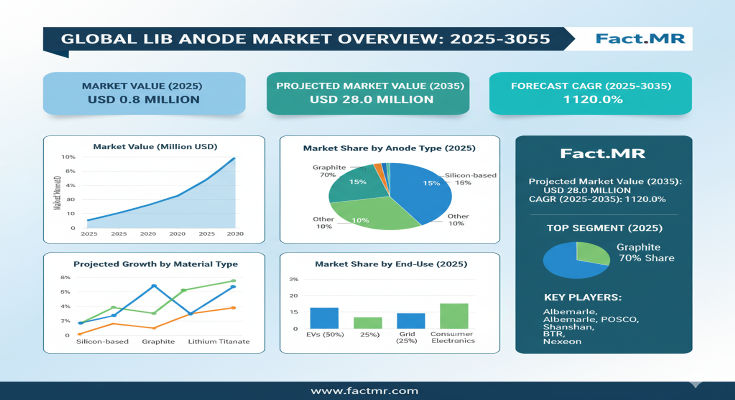

The LIB anode market is at the precipice of significant transformation, growing from USD 9.5 million in 2025 to USD 28.0 million by 2035, equating to a compelling compound annual growth rate (CAGR) of 11.2% over the the forecast period. This trajectory highlights accelerating investment in advanced electrode materials as battery makers, EV OEMs, and energy storage system manufacturers increasingly demand high-performance anode solutions—driving evolution in anode chemistries, coating technologies, and electrode manufacturing capacity.

Market Drivers & Growth Catalysts

Several key factors are fueling this expansion. The sharp growth in electric vehicle adoption and energy storage installations is increasing demand for high-quality anode materials that offer improved energy density, longer cycle life, and better fast-charging performance. Manufacturers are placing more emphasis on anode innovations—such as coated electrodes or silicon enhancements—to meet stricter performance targets. In parallel, advances in anode electrode processing, coating technologies, and specialization of anode electrodes (e.g. coated or modified graphite or hybrid material blends) are supporting improved performance and reliability in lithium-ion battery cells.

Product & Technology Segmentation

Within the market, graphite anodes (both natural and synthetic) dominate the material side, capturing a significant share of demand. Coated anode electrodes lead the form segment, with their superior interface properties and improved cycle stability being preferred in many high-performance battery designs. As battery designers push for higher capacity and faster charge capability, coated and enhanced anode electrodes are increasingly becoming standard components rather than niche premium options.

Application & End-Use Insights

The strongest application remains in EV battery systems, where high-performance anodes contribute directly to vehicle range, charging speed, and longevity. Other important applications include energy storage systems (stationary storage) and consumer electronics or portable battery systems, though EV battery applications remain the primary driver of demand. As battery cell manufacturers scale up production, the upstream demand for high-quality anode electrodes grows accordingly.

Regional Outlook & Growth Opportunities

Growth opportunities are particularly strong in regions with established or expanding battery manufacturing ecosystems. Asia-Pacific leads the market due to significant battery production, electric vehicle industry scale, and established supply chain for anode materials and electrode manufacturing. North America and Europe are also important markets, driven by EV adoption, battery gigafactories, and local battery material supply chains. Emerging markets are expected to grow as well as battery and EV ecosystems expand globally.

Competitive Landscape & Strategic Trends

Key players in the LIB anode market include established electrode and material manufacturers focusing on coated anode technologies, enhanced graphite anode materials, and advanced manufacturing. These companies are investing in R&D to optimize coating formulation, electrode structure, and interface stability. There is also growing collaboration between battery cell manufacturers and anode suppliers to co-design electrode properties for better performance. As market maturity increases, the focus shifts from baseline graphite to enhanced or specialty coated electrodes to better meet demands for performance and longevity.

Challenges & Market Restraints

Despite strong growth prospects, the market faces some restraints. Anode material supply (natural or synthetic graphite or other high performance materials) can face raw material availability constraints or cost fluctuations. Manufacturing of coated electrodes requires precision coating and quality control, which increases complexity and cost. As performance demands increase (faster charging, higher capacity, wide temperature operation), the quality and consistency of anode electrodes need to be maintained across large scale production.

Forecast & Strategic Recommendations

With the market forecast to expand from USD 9.5 million in 2025 to USD 28.0 million in 2035, at 11.2% CAGR, anode material manufacturers should prioritize scaling capacity for coated or enhanced anode electrodes, optimizing electrode formulations, and ensuring supply chain resilience for key materials. Partnerships with battery cell makers and EV OEMs will be critical to align electrode properties with cell design and performance requirements. Expanding manufacturing presence in battery-production hubs (Asia-Pacific, North America, Europe) will help meet global demand and reduce lead times.

Browse Full Report: https://www.factmr.com/report/4068/lib-anode-market

Editorial Perspective

The LIB anode market is shifting from niche or technical specialty to a central component of the battery ecosystem. As battery performance demands increase across EVs and energy storage, anode electrode materials and coating technologies will be key differentiators. Suppliers that can deliver high-quality, coated electrodes at scale will play a pivotal role in enabling next-generation battery performance. The projected growth to USD 28.0 million by 2035 underscores how anode electrodes are becoming core value drivers in the battery materials supply chain.