According to a recent report by Fact.MR, the global high throughput process development market is valued at USD 10,868.3 million in 2024 and is projected to reach USD 25,746.9 million by 2034, expanding at a CAGR of 9.0% during the forecast period. This substantial growth is propelled by the increasing demand for rapid biopharmaceutical development, automated process optimization, and scalable production technologies across the global life sciences industry.

Strategic Market Drivers

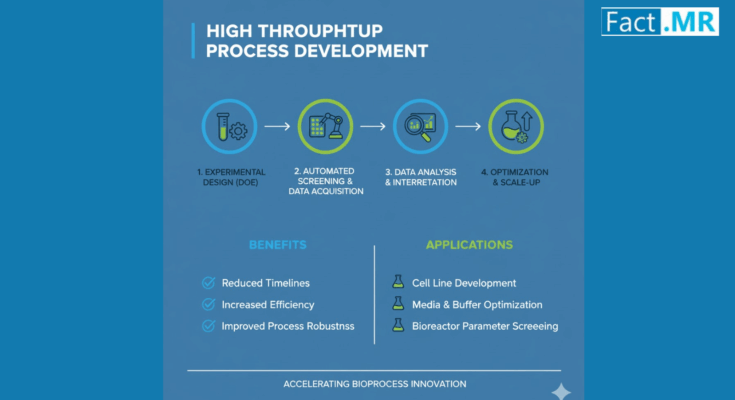

The strong market momentum for HTPD is supported by a convergence of technological advancement, industrial demand, and regulatory acceleration:

Accelerating Biopharmaceutical R&D:

The rising complexity of biologics, biosimilars, and cell and gene therapies has intensified the need for faster and more efficient process development. High throughput process development enables rapid screening, optimization, and scale-up, significantly reducing development timelines and production costs.

Automation and AI Integration:

Automation, robotics, and artificial intelligence are reshaping process development workflows. High-throughput platforms integrated with AI-driven analytics enhance data precision, reproducibility, and predictive modeling, enabling pharmaceutical manufacturers to streamline experimentation and decision-making.

Regulatory and Quality Demands:

Regulatory authorities such as the FDA and EMA emphasize process robustness and reproducibility. HTPD technologies enable enhanced process understanding through parallel experimentation and advanced data analytics, supporting regulatory compliance and quality-by-design (QbD) initiatives.

Biomanufacturing Scale-up Needs:

The expansion of global biomanufacturing facilities, especially in biologics and vaccine production, fuels the demand for efficient HTPD systems. These solutions enable manufacturers to transfer laboratory-scale processes into commercial-scale production seamlessly.

Growing Focus on Personalized Medicine:

As precision medicine gains momentum, biopharma companies are adopting HTPD tools to accelerate process optimization for patient-specific treatments, particularly in monoclonal antibodies, cell therapies, and recombinant proteins.

Regional Growth Highlights

North America:

North America dominates the HTPD market due to strong biopharmaceutical infrastructure, heavy R&D investments, and early adoption of advanced automation tools. The U.S., home to leading biotechnology and contract development and manufacturing organizations (CDMOs), continues to lead innovation and technology integration.

Europe:

Europe remains a key growth hub, driven by robust bioprocessing research and EU funding for life sciences innovation. Germany, Switzerland, and the U.K. host leading biopharma companies and academic research centers, fostering collaboration in process optimization and digital biomanufacturing.

Asia-Pacific:

The Asia-Pacific region is witnessing rapid expansion, led by countries like China, India, and South Korea. Investments in biotechnology infrastructure, expanding biologics pipelines, and favorable government policies are creating strong growth opportunities for HTPD system providers.

Emerging Markets:

Latin America and the Middle East are showing increasing interest in HTPD technologies as they expand their biomanufacturing capabilities and seek partnerships with global biopharma leaders to enhance local production capacity.

Market Segmentation Insights

Product Type:

Automation platforms and integrated software solutions dominate the market, enabling real-time monitoring and parallel experimentation.

Application:

Bioprocess optimization holds the largest share, while screening and scale-up applications are growing rapidly with advancements in digital and robotic technologies.

End User:

Pharmaceutical and biotechnology companies remain the primary end users, followed by research institutes and CDMOs adopting HTPD tools to improve production efficiency and speed-to-market.

Challenges and Market Considerations

Despite its promising growth, the market faces several challenges:

- High Equipment and Setup Costs: Advanced HTPD systems require substantial initial investments, particularly for small- and mid-sized companies.

- Data Management Complexity: Managing and analyzing large datasets from high-throughput experiments demands sophisticated informatics solutions.

- Skilled Workforce Shortage: There is a growing need for trained professionals to operate and interpret high-throughput automation systems.

- Integration Challenges: Seamless integration with existing bioprocessing workflows and legacy systems remains a technical hurdle for some facilities.

Competitive Landscape

The global HTPD market is highly competitive, characterized by innovation, strategic partnerships, and mergers among leading technology providers.

Key Companies Profiled:

Thermo Fisher Scientific Inc.; Merck KGaA (Merck Group); Danaher Corporation; Agilent Technologies, Inc.; Sartorius AG; Tecan Group Ltd.; Hamilton Company; Eppendorf AG; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; Pall Corporation (acquired by Danaher); Bruker Corporation; Shimadzu Corporation; Waters Corporation; GE Healthcare (part of Cytiva, a Danaher company); Bio-Techne Corporation; Corning Incorporated; Unchained Labs; IntelliCyt Corporation (acquired by Sartorius AG); and Molecular Devices, LLC (a Danaher company).

These companies are focusing on next-generation automation, data integration, and platform scalability. Strategic collaborations and acquisitions are key to expanding market presence and enhancing technology portfolios.

Recent Developments

- September 2023: Benchling Bioprocess launched a cloud-native, end-to-end solution for modern high-throughput process development at its annual Benchtalk event, offering enhanced workflow integration and data traceability.

- February 2023: Carterra Inc. introduced the LSAXT, an advanced HT-SPR instrument that significantly improves the sensitivity of its LSA platform. This innovation supports new drug discovery and development applications with unprecedented throughput levels.

Market Outlook and Industry Leadership

The high throughput process development market is poised to revolutionize the biopharmaceutical landscape. By 2034, the industry’s value is expected to reach USD 25.7 billion, reflecting growing reliance on automation, AI, and integrated analytics to accelerate therapeutic development.

As companies strive to enhance productivity, reduce costs, and ensure process robustness, HTPD technologies will become indispensable to modern bioprocessing. Industry leaders such as Thermo Fisher, Merck, and Danaher are well-positioned to capitalize on this transformation, driving innovation in next-generation biomanufacturing and paving the way for faster, smarter, and more efficient drug development.