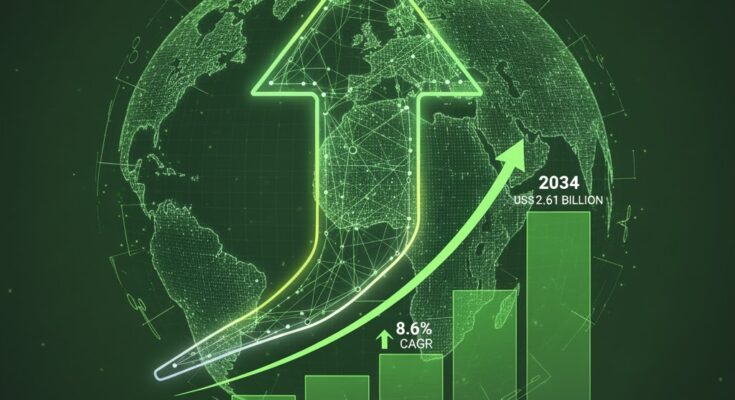

The global lyophilization market, valued at US$ 1.14 billion in 2024, is set to more than double to US$ 2.61 billion by 2034, according to new market intelligence. This robust growth, with a compound annual growth rate (CAGR) of 8.6%, is being propelled by the increasing need for stable biologics, vaccines, and high-value food products.

What’s Driving the Lyophilization Surge?

1. Biopharmaceutical Boom:

The rise of biologics, such as monoclonal antibodies, vaccines, and peptides, is a key driver. These delicate molecules often require lyophilization to maintain stability, prolong shelf life, and simplify distribution.

2. Technological Innovation:

Advances in freeze-drying equipment—such as improved vacuum control, better shelf temperature regulation, and automated systems—are making lyophilization more efficient, scalable, and reliable.

3. Food & Beverage Growth:

Consumer demand for freeze-dried food items—like fruits, meats, and specialty snacks—is rising, especially in developed markets where convenience, portability, and long shelf life matter. Lyophilization helps lock in flavor and nutrition while extending product life.

4. Outsourced Services:

Contract development and manufacturing organizations (CDMOs) and CMOs are increasingly offering lyophilization as a service, enabling biotech firms to access freeze-drying capacity without major capital expenditure.

Market Segmentation & Key Trends

By Equipment Type:

-

Tray-style freeze dryers dominate the equipment market. Their simplicity, reliability, and flexibility make them highly preferred in both the pharmaceutical and food sectors.

By Scale of Operation:

-

The industrial-scale segment (large freeze dryers) is expected to lead. These systems are ideal for high-volume biopharma production and large batch food processing.

By End Use / Application:

-

Biopharmaceutical manufacturing: The largest and fastest-growing application, driven by increasing biologics research and production.

-

Academic & research institutes: Also significant, as small‑scale freeze dryers support R&D, vaccine formulation, and other scientific work.

-

Food processing: Growing rapidly as freeze-dried foods gain popularity for their shelf stability and taste retention.

Regional Dynamics

-

North America is projected to maintain a dominant share, accounting for close to 36% of the global market by 2034, thanks to strong biopharma infrastructure and high lyophilization adoption.

-

Asia-Pacific, particularly East Asia, is emerging as a high-growth region. Expanding pharmaceutical manufacturing, rising consumer demand for freeze-dried foods, and increasing investments in biomanufacturing are contributing to rapid market expansion.

Competitive Landscape

Leading companies are investing heavily in R&D to improve equipment performance, reduce cycle times, and develop scalable solutions. Key players include:

-

BÜCHI Labortechnik AG

-

Millrock Technology, Inc.

-

SP Industries, Inc.

-

Azbil Corporation

-

Labconco Corporation

-

Cryotec.Fr

-

Martin Christ Gefriertrocknungsanlagen GmbH

-

HOF Sonderanlagenbau GmbH

-

Cuddon Freeze Dry

-

Lyophilization Systems Ltd.

These firms are focusing on innovation, partnerships, and regional expansion to meet growing demand from biopharmaceutical and food processing sectors.

Challenges & Market Risks

-

High Capital Costs: Industrial-scale freeze dryers are expensive, making it difficult for smaller firms or startups to invest.

-

Skill Requirements: Running a freeze-drying cycle involves specialized expertise—poorly optimized cycles can compromise product quality.

-

Energy Consumption: Freeze-drying is energy-intensive, and users are wary of operating costs and sustainability.

-

Regulatory Compliance: In pharmaceuticals, lyophilization must meet rigorous quality standards, including validation of freeze-drying cycles—this can slow down scale-up.

Browse Full Report : https://www.factmr.com/report/lyophilization-market

Strategic Implications & Future Outlook

For Biotech & Pharma Companies:

Investing in or partnering with CDMOs that offer lyophilization can accelerate time to market. Manufacturers should also look for more efficient freeze-dryers to balance cost and quality.

For Equipment Manufacturers:

There’s strong opportunity in developing modular, scalable, and more energy-efficient systems. Automation and digital process control (e.g., real‑time monitoring) can offer differentiation.

For Food Processors:

As demand for premium, freeze-dried foods increases, food companies can leverage lyophilization to tap into niche, high-value segments. Investing in freeze-drying capacity—or outsourcing—can boost product lines.

For Investors & Policy Makers:

Funding infrastructure development, especially in emerging markets, can spur lyophilization adoption. Support for training programs and energy-efficient technologies will be crucial to long-term sustainable growth.