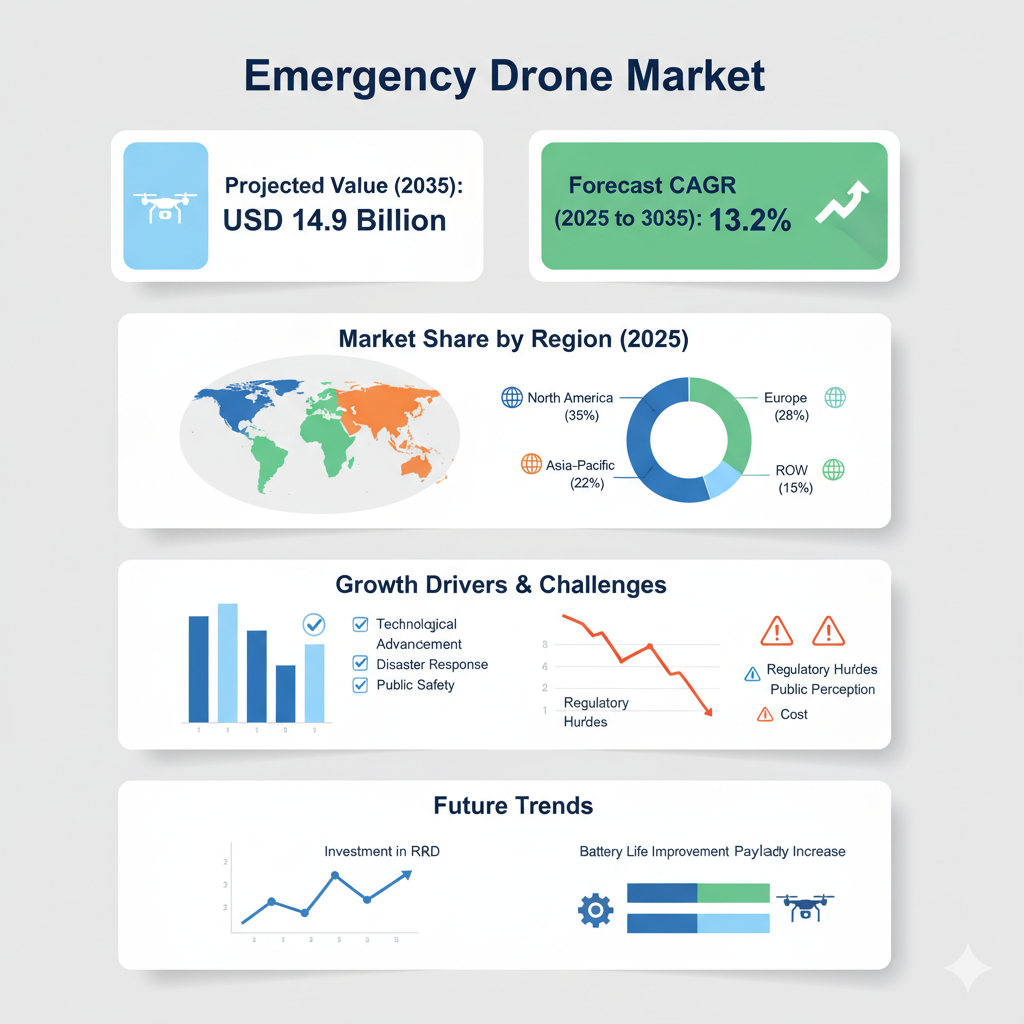

The global emergency drone market is undergoing a dramatic transformation, with forecasts projecting the sector to soar to USD 14.9 billion by 2035, up from USD 4.3 billion in 2024. During the forecast window from 2025 to 2035, the industry is expected to grow at a robust CAGR of 13.2%. This expansion is driven by increasing demand across disaster response, public safety, logistics, and defense applications, and powered by rapid technological advances in unmanned aerial systems (UAS), sensor payloads, and autonomy.

Segmentation by Configuration

When examining the market by configuration, three primary types dominate: fixed-wing, rotary-wing, and hybrid-wing systems. Among these, the rotary-wing segment has emerged as the leading configuration. Its vertical take-off and landing (VTOL) capability, ability to hover, and ease of maneuvering in confined environments make it especially well-suited for emergency deployments such as search and rescue, medical supply drops, and disaster assessments. Hybrid-wing systems are also gaining traction due to their longer endurance and extended range, bridging the gap between the speed of fixed-wing drones and the agility of rotary designs.

Segmentation by Drone Type

By drone type, the market is divided into consumer/civil, commercial, and military segments. The commercial segment is expected to witness particularly strong growth as municipalities, healthcare services, and private emergency response organizations increasingly adopt drones for logistics, monitoring, and first-responder support. Military drones, on the other hand, continue to advance in terms of autonomy and payload capabilities, and many of the innovations developed for defense applications are being transferred to civil and emergency use cases.

Segmentation by Application

Emergency drones are employed across a wide range of applications, including search and rescue, disaster response, medical-supply delivery, surveillance and reconnaissance, fire suppression and evacuation support, hazardous-materials handling, and crowd-control operations. Among these, medical-supply delivery is gaining significant momentum as drones are used to transport blood, antidotes, test kits, and other life-saving materials to hard-to-reach or infrastructure-damaged zones. This role is expanding rapidly as public health systems and emergency logistics providers recognize the efficiency and reliability of drones in time-critical scenarios.

Segmentation by End User

The main end users of emergency drones include police and homeland security agencies, fire departments, healthcare and emergency medical services, defense organizations, and disaster-management agencies. As drones become an integral component of first-responder toolkits, their use is spreading across all organizations responsible for rapid incident response. Integration with command-and-control systems, multi-sensor payloads, and real-time data transmission is increasingly vital for operational success.

Regional Outlook

Regionally, the market shows diverse dynamics. North America currently leads the global emergency drone market due to the early adoption of drone technologies by public safety departments, favorable regulatory frameworks, and widespread pilot programs. Europe follows closely, supported by growing investments in civil protection agencies and harmonized regulations across the European Union, encouraging cross-border disaster-response collaborations.

In the Asia-Pacific region, growth is the most dynamic, fueled by rapid urbanization, frequent natural disasters, and significant government investments in public safety modernization. Countries such as India and China stand out as key markets, with India expected to grow at a CAGR of approximately 15.7% during the forecast period. The Middle East, Africa, and Latin America are emerging as new frontiers, with growing use of drones for medical deliveries, humanitarian missions, and operations in remote terrains.

Key Players and Competitive Analysis

The emergency drone market features a competitive mix of major defense contractors, specialized drone manufacturers, and emerging technology firms. Leading companies in the sector include Lockheed Martin Corporation, Textron Inc., Elroy Air, AeroVironment, and Quantum-Systems GmbH. Other significant players such as ideaForge Technology, Autel Robotics, AVY Unmanned Systems, Bluebird Aero Systems, Carbonix, A-Techsyn, ALTI UAS, and Height Technologies are also contributing to innovation and diversification within the market.

Competition among these players is intensifying, particularly in areas such as VTOL capabilities, endurance, autonomous navigation, modular payloads, and integration into emergency-response ecosystems. Companies are investing heavily in reducing response times, extending operational range, and enabling multi-drone fleet coordination for large-scale missions. Additionally, mergers and acquisitions, drone-as-a-service models, and partnerships between defense contractors and UAV specialists are shaping the future of the industry.

Recent Developments

Recent years have witnessed several pivotal developments in the emergency drone market. In May 2024, BRINC Inc. launched its “Responder” drone, designed specifically for 911 drone-as-first-responder programs. The system can reach emergencies in under 70 seconds, provide two-way communication, and deliver essential medical supplies. In October 2024, Flock Safety acquired Aerodome Inc. to enhance its public safety drone capabilities and strengthen its presence in the drone-as-first-responder sector. These innovations illustrate how the market is evolving beyond hardware toward complete ecosystems that integrate software, sensor networks, fleet orchestration, and real-time data solutions.