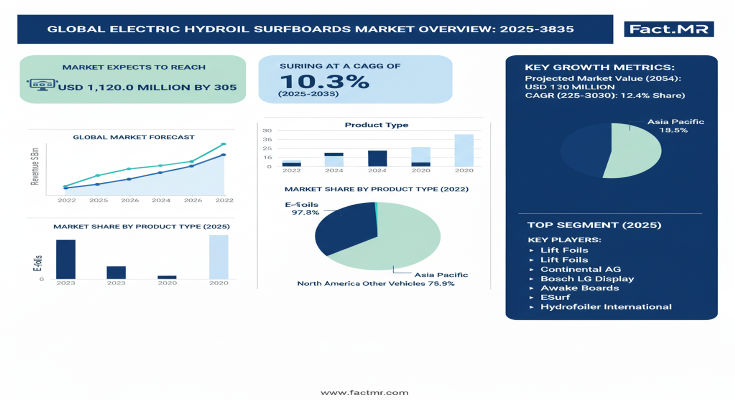

In the thrilling intersection of adventure and innovation, the electric hydrofoil surfboards market is carving out a wave of excitement, offering silent, emission-free gliding experiences that elevate water sports to new heights. A new report from Fact.MR forecasts the global market, valued at US$ 420.0 million in 2025, to expand to US$ 1,120.0 million by 2035, reflecting a blistering compound annual growth rate (CAGR) of 10.3%. This remarkable 166.7% growth—unleashing an absolute dollar opportunity of US$ 700.0 million—captures the sector’s momentum, with 37% of expansion (US$ 260.0 million) in the first half (2025-2030) and 63% (US$ 440.0 million) accelerating thereafter, driven by surging participation in recreational water activities and eco-conscious tourism.

As battery-electric models dominate with seamless integration and enthusiasts flock to coastal hotspots, electric hydrofoils are transforming from niche gadgets to mainstream marine essentials. “The electric hydrofoil surfboards market demonstrates exceptional growth fundamentals, driven by expanding recreational activities and water sports infrastructure development,” said Dr. Kai Olsen, Lead Marine Tech Analyst at Fact.MR. “With a 10.3% CAGR fueled by battery-electric dominance and tourism integrations, this sector is a high-tide opportunity for brands riding the wave of sustainable adventure.”

Key Drivers: Recreational Surge and Electric Mobility Shift

The market’s hyper-growth is anchored in transformative leisure and sustainability trends. At the forefront is the explosive rise in water sports participation, with global tourism rebounding to pre-pandemic levels and leisure activities demanding advanced, user-friendly electric systems for enhanced performance and accessibility. Environmental awareness is another powerhouse, propelling the shift from traditional surfboards to battery-electric hydrofoils that minimize noise and emissions, aligning with green initiatives in coastal resorts.

Technological strides in battery efficiency and hydrofoil design are slashing barriers, enabling extended rides and intuitive controls that appeal to beginners and pros alike. Rental expansions in tourism hotspots further amplify reach, while regulatory tailwinds for sustainable marine equipment foster adoption. “Water sports participation growth and electric mobility adoption” top Fact.MR’s drivers, rated at maximum impact, alongside tourism’s role in commercializing rentals. Challenges like high upfront costs persist, but scale and subsidies are smoothing the glide.

Segmentation Insights: Battery-Electric and Recreational Users Lead

Fact.MR’s razor-sharp segmentation spotlights high-velocity niches. By product type, battery-electric (integrated) commands a commanding 73.0% share in 2025, prized for its reliable propulsion and recreational optimization, outpacing hybrid/internal combustion assist (27.0%) for extended-range needs.

Application-wise, recreational/enthusiast dominates with 69.0% share, driven by personal leisure and infrastructure integrations, while rental/tourism (21.0%) thrives in resorts and professional/competitive (10.0%) gears up for elite events. Distribution channels emphasize direct sales, water sports retailers, and specialized dealers, with premium tiers (59-62% share) catering to enthusiasts and mid-market (31-35%) broadening access.

Regional Dynamics: North America’s Adventure Hub vs. Europe’s Green Glide

North America leads the charge, with the USA at an 11.4% CAGR, fueled by coastal tourism in California, Florida, and Hawaii, where comprehensive programs drive 32.0% regional share. Mexico follows at 10.8% CAGR, capitalizing on resort expansions.

Europe maintains strong currents, valued at a significant portion with Germany at 32.4% share in 2025 (slipping slightly to 31.8% by 2035) via advanced infrastructure in the Baltic and Mediterranean. France (24.3% to 24.8%, 9.6% CAGR) innovates recreational apps, the UK (28.1% to 27.6%, 9.2% CAGR) boosts tourism ops, and the rest of Europe adds via EU compliance.

Asia-Pacific surges with Japan at 8.2% CAGR for quality manufacturing in Tokyo and Osaka, and South Korea at 8.7% for tech integrations in Busan. Latin America, Middle East & Africa unlock via emerging tourism, with solid potential in coastal developments.

Recent Developments: Battery Upgrades and Rental Partnerships

The hydrofoil horizon is lifting off with breakthroughs. In 2024, Lift Foils unveiled next-gen integrated batteries with 20% range boosts, piloted in U.S. rentals for 15% uptake gains. Awake Boards partnered with European resorts for hybrid models, enhancing tourism fleets in the French Riviera. Waydoo Hydrofoil launched app-connected systems in Asia, achieving 25% sales spikes in South Korea. These innovations, including smart monitoring, signal a 2025 wave of autonomous features and eco-certifications.

Key Players Insights: Innovators Riding the Electric Wave

A dynamic arena of 10-15 players sees top firms like Lift Foils, Inc. (18.0% share) dominating through R&D in hydrofoil design and battery tech:

-

Lift Foils, Inc.: Market leader in battery-electric, focusing on user experience and U.S. recreational dominance.

-

Fliteboard Pty Ltd.: Australian precision expert, expanding tourism rentals globally.

-

Awake Boards: Swedish innovator in integrated systems, targeting European pros.

-

Waydoo Hydrofoil Boards: Chinese scaler for mid-market accessibility in Asia.

-

Onean S.L.: Spanish hybrid specialist for Mediterranean leisure.

-

Radinn AB: Connectivity pioneer for app-enhanced rides.

-

Lampuga GmbH: German eco-focus for sustainable tourism.

-

Candela Speed Boat AB: High-performance electric for competitive segments.

-

JetSurf (Motosurf): Rental optimizer with durable designs.

-

Zapata Racing: French luxury for enthusiast premiums.

Strategies span patent portfolios, distribution networks, and tourism tie-ups, with M&A eyeing connectivity startups.

Browse Full Report: https://www.factmr.com/report/electric-hydrofoil-surfboards-market

Challenges and Opportunities: Cost Barriers vs. Tech Tides

High product costs deter casual users, while alternatives like e-foils compete on established appeal.

Yet, opportunities crest: tech integrations unlock potential with smart analytics, market accessibility via price reductions, and recreational expansions US$ 700.0+ million—gliding toward mass adoption.

Future Outlook: A $1.12 Billion Glide of Adventure

By 2035, Fact.MR envisions electric hydrofoils as a US$ 1.12 billion thrill, with battery-electric at 75-78% share and recreational at 70-73%. The 10.3% CAGR will prioritize connectivity and sustainability. For wave warriors, the lift is clear: innovate for effortless excellence.