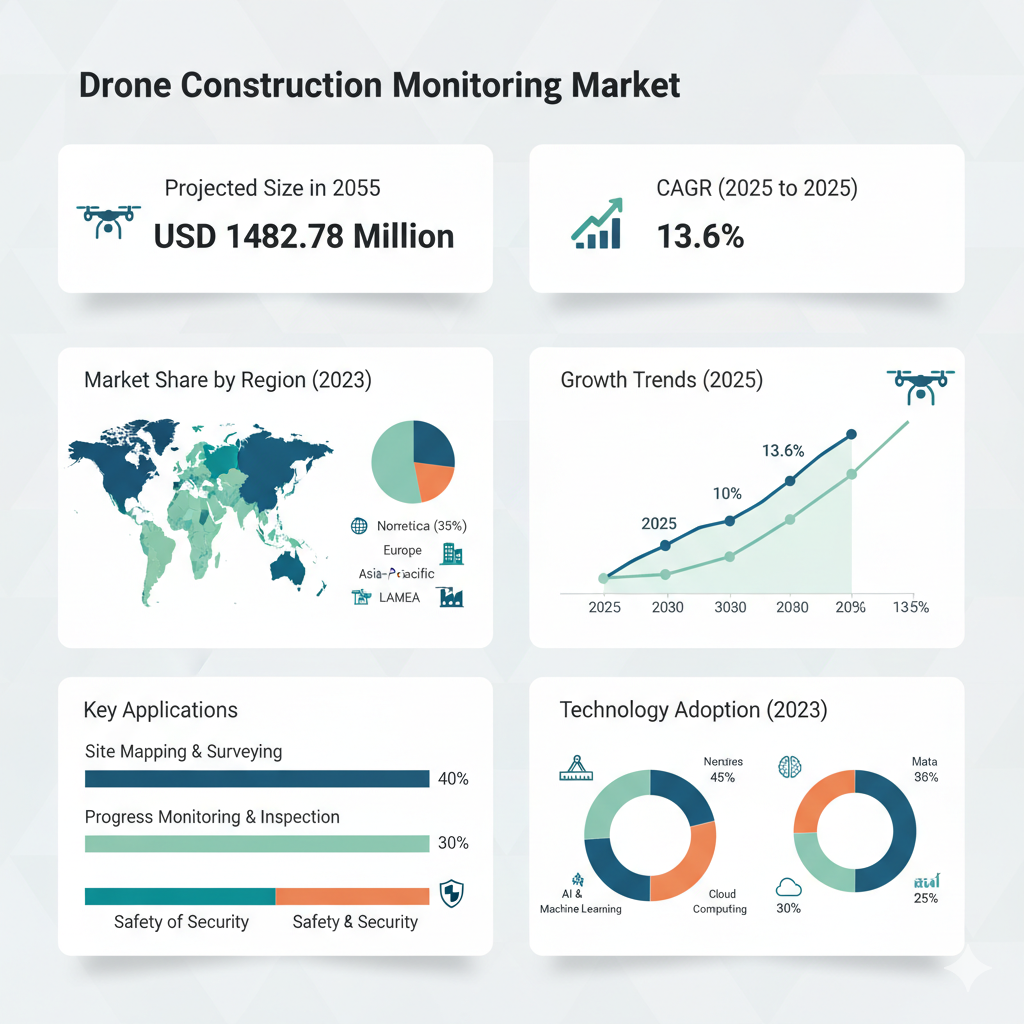

The drone construction monitoring market is valued at USD 414.28 million in 2025. As per Fact.MR analysis, the market is expected to grow at a compound annual growth rate (CAGR) of 13.6%, reaching approximately USD 1,482.78 million by 2035. This expansion reflects the shift from pilot programs to mainstream adoption across residential, commercial, industrial, and infrastructure construction projects. The increasing need for real-time site data, accuracy, and safety compliance continues to drive demand, positioning drones as indispensable tools for the construction sector’s digital transformation.

Market Segmentation

By Drone Type

Fixed-wing drones are designed for long-range and high-endurance missions. They are commonly used for surveying large infrastructure projects such as highways, bridges, and energy installations. Their aerodynamic design allows them to cover greater distances with higher efficiency.

Rotary-wing drones, including quadcopters and multirotors, are favored for close-proximity inspections, progress monitoring, and safety assessments. Their ability to hover and maneuver in confined spaces makes them ideal for tasks requiring flexibility and precision.

By End Use

In residential construction, drones provide aerial views and site progress documentation to verify that work aligns with plans. Commercial construction benefits from drones through detailed mapping and façade inspections, ensuring timely updates and minimizing project delays. Industrial construction uses drones for safety audits, asset tracking, and structural verification in complex environments such as manufacturing plants or refineries. Infrastructure projects—including roads, bridges, tunnels, and energy systems—are major users of drone monitoring for surveying, quality control, and progress reporting.

By Application

Site surveying and mapping remains the foundational application of drones in construction, converting aerial imagery into accurate topographical data. Progress monitoring allows stakeholders to visualize site evolution through regular imaging and mapping. Safety inspections leverage drones to identify hazards and ensure compliance without exposing workers to risk. Equipment tracking helps monitor heavy machinery and valuable on-site assets. Post-construction audits confirm as-built conditions and provide final project documentation. Other emerging applications include environmental monitoring, thermal imaging, and marketing visuals for project promotion.

By Region

The market spans North America, Latin America, Europe, East Asia, South Asia & Oceania, and the Middle East & Africa. Each region’s adoption is shaped by regulatory frameworks, infrastructure development priorities, and construction technology readiness. North America leads in technology integration and regulatory support, while Asia-Pacific is witnessing rapid growth due to expanding urbanization and government-led infrastructure programs.

Recent Developments and Competitive Landscape

The drone construction monitoring market has undergone several notable developments in recent years. Many engineering and construction firms have transitioned from small-scale pilots to enterprise-wide drone programs. The integration of artificial intelligence and automation now enables drones to execute autonomous flight paths, process data in real time, and identify defects or deviations automatically. Additionally, evolving drone regulations—such as mandatory identification systems and relaxed flight permissions for commercial use—are broadening operational scope and encouraging investment.

Environmental, social, and governance (ESG) factors have also influenced market direction. Developers and investors are increasingly using drone data for sustainability reporting, environmental compliance, and transparent project documentation. This reflects a broader push toward digital accountability and responsible construction practices.

The market remains moderately consolidated, with several leading players shaping its competitive environment. DJI Innovations holds a dominant position through its advanced hardware and widespread adoption. Skydio Inc. has made significant progress with autonomous flight technology, while DroneDeploy leads in cloud-based analytics and building information modeling (BIM) integration. Trimble Inc. leverages its strong geospatial background to connect drone insights with broader project management systems. Parrot SA and Kespry continue to serve specialized segments, focusing on affordability and heavy-industry applications respectively. Other contributors, including Teledyne FLIR, AeroVironment, and PrecisionHawk, support the ecosystem through imaging and sensor innovations.

Competition in this market revolves around performance, software integration, regulatory compliance, and service reliability. Companies are focusing on offering complete end-to-end solutions that merge hardware, analytics, and workflow management, thereby enhancing efficiency and decision-making for construction clients.

Strategic Insights and Conclusion

As the drone construction monitoring market evolves toward maturity, success will depend on innovation, scalability, and seamless integration with existing construction technologies. Companies investing in AI-driven autonomy, data analytics, and cloud-based platforms are likely to maintain a competitive advantage. Additionally, firms that can navigate complex regional regulatory frameworks and tailor offerings to local construction environments will capture significant market share.

The projected rise from USD 414.28 million in 2025 to USD 1,482.78 million by 2035 underscores the strong growth potential of this sector. With the increasing importance of data-driven construction management, drones are set to become a standard component of modern construction practices. The next decade will likely witness deeper integration between drones, AI, and digital construction platforms—redefining how projects are monitored, managed, and delivered.