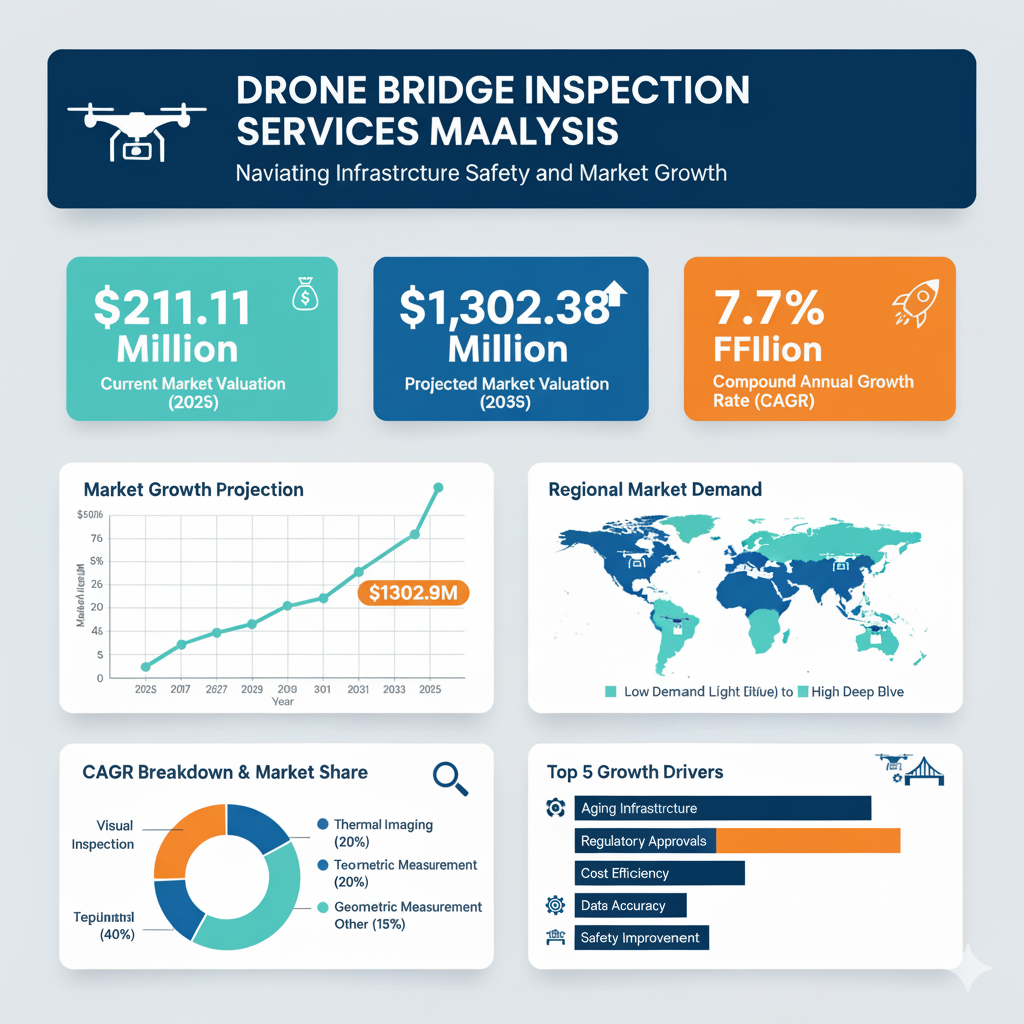

The drone bridge inspection services market is valued at USD 211.11 million in 2025. As per Fact.MR analysis, the drone bridge inspection services industry will grow at a CAGR of 21.4% and reach USD 1,467.9 million by 2035. This impressive expansion is driven by several converging factors, including government mandates for infrastructure safety, greater acceptance of autonomous technologies, and growing budgets for preventive maintenance.

In recent years, the industry has evolved from pilot projects to full-scale implementation, particularly in North America and Western Europe, where aging bridges require more frequent inspections. The shift toward proactive maintenance strategies, coupled with advancements in drone automation and artificial intelligence, has transformed the way bridge inspections are conducted. Drones equipped with high-resolution cameras, LiDAR, and AI-powered analytics can detect cracks, corrosion, and structural deformations in real time, significantly reducing the risks and costs associated with manual inspection.

Market Segmentation by Bridge Type

The drone bridge inspection services market is segmented into two primary categories based on bridge type: road bridges and railway bridges.

Road bridges account for the largest share of the market, as the global road network continues to expand and deteriorate with time, traffic, and environmental exposure. Drones are especially useful in inspecting under-deck surfaces, joints, and piers without the need for lane closures or scaffolding. These efficiencies have made drone inspections an attractive choice for governments and private contractors seeking to reduce inspection times while improving accuracy. The road bridge segment is expected to continue dominating the market through 2035.

Railway bridges, although fewer in number, represent another vital segment. These structures often span challenging terrains such as rivers and valleys, making manual inspection dangerous and logistically complex. Drone technology enables high-precision monitoring of these bridges with minimal disruption to rail operations. As global rail networks expand and modernize, the demand for drone inspections in this segment is also expected to rise significantly.

Regional Dynamics and Growth Drivers

Regionally, the market exhibits strong variation in adoption and growth. North America remains a leader, driven by large-scale infrastructure investment programs, aging bridge networks, and supportive regulatory frameworks that encourage the use of unmanned aerial systems. Europe follows closely, with its emphasis on sustainability, safety, and technology-driven asset management. The European Union’s focus on infrastructure modernization is accelerating the use of drones in inspection workflows.

East Asia, led by China, represents one of the fastest-growing regions. Government-backed infrastructure initiatives, coupled with rapid technological adoption, are creating a fertile environment for drone-based services. The region’s high population density and urbanization levels further boost demand for efficient inspection methods that minimize disruptions. Meanwhile, South Asia, Oceania, Latin America, and the Middle East & Africa are emerging as promising markets, supported by new infrastructure projects and increasing awareness of drone technology’s benefits.

Recent Developments and Competitive Landscape

Recent years have witnessed several transformative developments in the drone bridge inspection services market. The industry has shifted from experimental use to operational scaling, with governments and private companies deploying drones as a standard inspection tool. Advances in artificial intelligence, sensor integration, and cloud-based data analytics have enhanced the precision and utility of drone-collected data. These innovations enable engineers to identify potential defects, prioritize maintenance, and predict structural degradation long before visible damage occurs.

Collaborations between public agencies and private service providers are also reshaping the competitive landscape. Such partnerships often come with financial incentives or government-backed funding for preventive maintenance, helping accelerate adoption rates. Additionally, inspection cycle times have been reduced dramatically thanks to automation and improved data processing, allowing for more frequent and cost-effective monitoring.

The competitive environment is characterized by a mix of established drone manufacturers, software developers, and specialized inspection service providers. DJI Innovations holds a strong market presence due to its dominance in commercial drone production and ongoing development of inspection-specific drone models. Flyability has gained traction through its expertise in confined-space operations, while Cyberhawk Innovations continues to expand its reach through AI-powered analytics solutions tailored for infrastructure inspections. AeroVironment leverages its defense-grade unmanned systems experience to enter the civil inspection space, while Delair and PrecisionHawk focus on long-endurance drones and advanced sensor integration.

Competition increasingly centers on technological differentiation, operational scalability, and regulatory expertise. Companies capable of delivering autonomous operations, multi-sensor data fusion, and seamless integration with asset management systems are positioned to lead the market. Cost efficiency, local partnerships, and the ability to secure beyond-visual-line-of-sight (BVLOS) operational permits further strengthen competitive advantage.