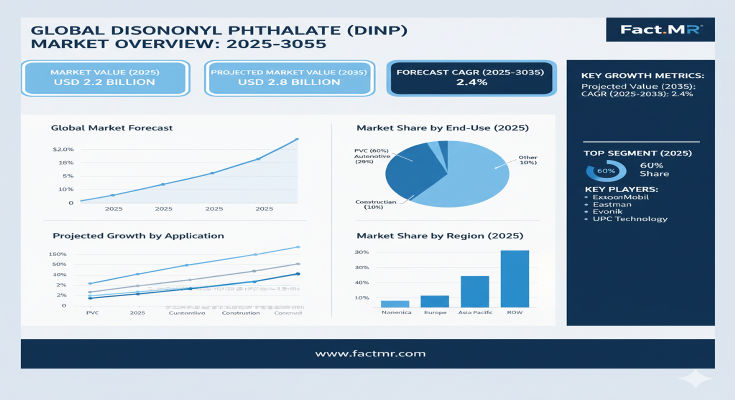

In the backbone of modern manufacturing, the diisononyl phthalate (DINP) market is solidifying its role as a versatile, cost-effective plasticizer, enhancing flexibility in everything from durable flooring to resilient cables. A new report from Fact.MR projects the global market, valued at US$ 2.2 billion in 2025, to expand to US$ 2.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 2.4%. This 27.3% total growth—delivering an absolute dollar opportunity of US$ 0.6 billion—highlights the sector’s resilience amid regulatory scrutiny, with 33% of expansion (US$ 0.2 billion) in the first half (2025-2030) and 67% (US$ 0.4 billion) accelerating thereafter, propelled by infrastructure investments and sustainable polymer demands.

As industrial-grade formulations lead with proven reliability, DINP is evolving to meet eco-standards while powering key industries. “DINP’s market trajectory reflects a balanced evolution toward compliant, high-performance solutions, with a 2.4% CAGR underscoring its enduring value in PVC applications,” said Dr. Elena Vasquez, Lead Chemicals Analyst at Fact.MR. “From Asia’s manufacturing hubs to Europe’s green infrastructure, this sector is fortifying supply chains for a more flexible future.”

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=7407

Key Drivers: Construction Surge and Electrical Infrastructure

The market’s steady ascent is underpinned by industrial megatrends and policy support. Foremost is the global construction boom, where residential and commercial flooring demands DINP-infused PVC for durability and cost-efficiency, amplified by urbanization in emerging economies. Electrical infrastructure expansions—driven by power transmission and telecommunications—further boost wire & cable needs, with DINP ensuring insulation flexibility under high loads.

Technological refinements in masterbatch forms and lifecycle management are enhancing recyclability, aligning with circular economy goals. Regulatory frameworks promoting phthalate alternatives are spurring compliant innovations, while automotive polymer integrations add momentum. “Construction industry growth and electrical infrastructure expansion” are primary drivers, per Fact.MR, alongside DINP’s edge in processing reliability. Challenges like health regulations and non-phthalate substitutes loom, but quality-by-design approaches are mitigating risks.

Segmentation Insights: Industrial Grade and PVC Flooring Dominate

Fact.MR’s granular segmentation reveals targeted growth pockets. By grade, industrial grade holds a commanding 69.0% share in 2025, valued for cost-effective scalability in mass applications, while specialty high-purity (31.0%) caters to premium, high-performance polymers.

Application-wise, PVC flooring & cables lead with 52.0% share, leveraging DINP’s compatibility for resilient surfaces, followed by wire & cable (28.0%) for insulation demands, and others (20.0%) spanning automotive and consumer goods. Form segmentation favors liquid plasticizer at 83.0% for efficient handling, with masterbatch (17.0%) rising for custom formulations.

Regional Dynamics: North America’s Infrastructure Lead Meets Asia-Pacific’s Scale

North America anchors maturity, led by the U.S. at a 2.8% CAGR, fueled by polymer infrastructure in manufacturing corridors like Texas and California. Mexico complements at 2.6% CAGR via modernization.

Europe projects balanced progress, valued at a key portion with Germany at 2.3% CAGR (31.4% regional share in 2025), innovating compliant systems in chemical hubs like Ludwigshafen. The UK (26.8% share) and France (23.1%) emphasize flooring for construction, while the rest of Europe adds via green directives.

Asia-Pacific scales steadily, with Japan at 1.7% CAGR (PVC flooring & cables at 60.0% share, industrial grade 75.0%) and South Korea at 1.9% for cable tech. Latin America emerges through Mexico’s growth, unlocking via export manufacturing.

Recent Developments: Sustainable Formulations and Compliance Tech

The DINP domain is refining with eco-focus. In 2024, BASF piloted bio-based DINP variants in Europe, achieving 20% recyclability gains for flooring trials. ExxonMobil enhanced masterbatch processing in the U.S., reducing emissions 15% in cable production. Lanxess partnered with Asian suppliers for high-purity grades, aligning with REACH standards. These advancements, including AI-optimized blending, herald a 2025 push toward lifecycle-compatible plasticizers.

Key Players Insights: Chemical Titans Fortifying Plasticizer Portfolios

A concentrated landscape of 10-12 players sees top firms like BASF SE (leading share) commanding 58-63% through production scale and compliance:

-

BASF SE: Industrial grade powerhouse, emphasizing PVC flooring with global reliability.

-

ExxonMobil Chemical Company: Liquid specialist, innovating wire & cable solutions.

-

Shell Chemicals Ltd.: High-purity expert for automotive apps.

-

Eastman Chemical Company: Masterbatch innovator, targeting Europe.

-

Lanxess AG: Regulatory-compliant blends for Asia-Pacific.

-

Perstorp Holding AB: Sustainable sourcing focus.

-

Repsol S.A.: Spanish scaler for construction.

-

UBE Industries, Ltd.: Japanese precision for cables.

-

Kaneka Corporation: Versatile processor.

-

LG Chem, Ltd.: Korean exporter for emerging markets.

Strategies include R&D for alternatives and M&A for supply integration.

Challenges and Opportunities: Regulations vs. Polymer Horizons

Regulatory scrutiny on phthalates and alternative plasticizers challenge margins, compounded by raw material volatility.

Yet, opportunities abound: PVC flooring unlocks US$ 1.46 billion, industrial grade US$ 1.93 billion, and North America US$ 0.5+ billion. Compliance tech adds US$ 0.2 billion—solid foundations for growth.

Browse Full Report: https://www.factmr.com/report/diisononyl-phthalate-dinp-market

Future Outlook: A $2.8 Billion Backbone of Flexible Materials

By 2035, Fact.MR envisions DINP as a US$ 2.8 billion staple, with PVC apps at 53-56% share and Asia-Pacific scaling. The 2.4% CAGR will prioritize green-compliant innovations. For chemical captains, the blend is clear: fortify sustainability to plasticize prosperity.