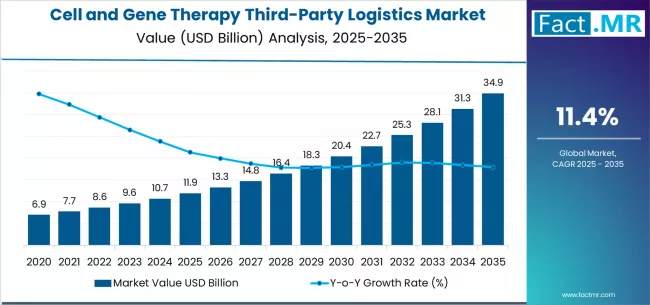

The global cell and gene therapy third-party logistics market is poised for exponential expansion over the next decade, driven by rising adoption of personalized therapeutics, sophisticated cold-chain requirements, and the rapid commercialization of advanced biopharmaceutical products. According to a recent analysis by Fact.MR, the market is projected to surge from USD 11.9 billion in 2025 to USD 34.9 billion by 2035, reflecting a CAGR of 11.4% and an absolute growth of USD 23.0 billion during the forecast period.

As cell and gene therapies (CGTs) move toward mainstream medical application—especially in oncology, rare diseases, and regenerative medicine—the demand for ultra-reliable, temperature-controlled, and time-sensitive logistics has intensified. Specialized third-party logistics (3PL) providers are playing a crucial role in bridging complex supply chain gaps.

Strategic Market Drivers

Precision Medicine and CGT Commercialization Expand Global Logistics Demand

The rapid increase in cell and gene therapy approvals worldwide is redefining the biopharma logistics landscape. CGTs require stringent temperature control (ranging from -20°C to -196°C), real-time monitoring, and rapid delivery to maintain product integrity. As more CGTs progress from clinical trials to commercial availability, demand for high-performance, end-to-end logistics solutions continues to accelerate.

Cold-Chain & Cryogenic Infrastructure Becomes a Competitive Necessity

The unique nature of therapies such as CAR-T cell treatments necessitates robust cryogenic storage, high-quality dry shippers, and advanced tracking systems. 3PL providers are expanding investments into cryogenic freezers, vapor-phase LN2 containers, and validated packaging solutions. Enhanced visibility and chain-of-custody technologies—including RFID, GPS-enabled trackers, and IoT-based sensors—are strengthening reliability.

Global Distribution Networks Boost Accessibility

As biotechnology companies expand clinical research and treatment accessibility across North America, Europe, and Asia, specialized CGT logistics networks are scaling correspondingly. Integration of centralized manufacturing hubs with decentralized treatment centers demands seamless coordination, standardized protocols, and 24/7 operational readiness. Evolving regulatory harmonization is further easing cross-border distribution.

Digitalization & Automation Elevate Efficiency

Digital cold-chain management, AI-driven route optimization, and automated storage solutions are emerging as critical differentiators. Real-time risk alerts, temperature deviation detection, and digital chain-of-custody systems reduce spoilage while improving delivery timelines. Data-driven logistics platforms help manage complex workflows from material collection to final infusion.

Browse Full Report: https://www.factmr.com/report/cell-and-gene-therapy-third-party-logistics-market

Regional Growth Highlights

North America: Largest and Most Advanced Logistics Ecosystem

North America leads the global market, supported by robust biopharmaceutical R&D, high CGT adoption, and strong regulatory frameworks. The U.S. is a major hub for CAR-T manufacturing and clinical trial activity, driving demand for specialized 3PL partnerships.

Europe: Strong Regulatory Backing & Cold-Chain Standardization

Europe’s focus on quality assurance, GxP compliance, and sustainable logistics is shaping the regional market. The U.K., Germany, France, and Switzerland are witnessing rapid expansion of cryogenic storage and qualified cold-chain transport. Investments in advanced packaging and clinical supply chain services remain strong.

East Asia: Fastest-Growing Market with Expanding Biotech Clusters

China, Japan, and South Korea are emerging as biotechnology powerhouses, supported by government incentives and growing CGT pipelines. Upgraded clinical trial infrastructure and expanding treatment centers are accelerating demand for regionally integrated logistics solutions.

Emerging Markets: Growing Biopharma Footprint Creates New Opportunities

India, Southeast Asia, Latin America, and the Middle East are witnessing increased investments in oncology treatment centers and regenerative medicine facilities. Global logistics providers are expanding their presence through collaborations, strategic alliances, and infrastructure upgrades.

Market Segmentation Insights

By Service Type

- Transportation & Distribution – Largest share driven by stringent shipping requirements.

- Cold Chain Storage & Warehousing – Fast-growing segment with focus on deep-freeze & cryogenic capabilities.

- Packaging & Labeling – Increasing need for validated, compliant, and tamper-proof packaging.

- Inventory & Order Management – Rising demand for track-and-trace systems.

By Therapy Type

- Gene Therapy Products – Driven by rising approvals for AAV- and lentivirus-based therapies.

- Cell Therapy Products – Significant growth from CAR-T and stem-cell-based treatments.

By End User

- Biopharmaceutical Companies – Key revenue drivers due to large-scale CGT commercialization.

- Clinical Research Organizations (CROs) – Strong demand for clinical-stage logistics support.

- Hospitals & Treatment Centers – Expanding infusion centers increase direct service requirements.

Challenges Impacting Market Growth

- High Operational Costs – Advanced cold-chain segments require significant capital.

- Regulatory Complexity – Strict GxP and regional compliance standards add layers of oversight.

- Supply Chain Fragility – CGTs have zero tolerance for temperature deviations or delays.

- Limited Skilled Workforce – Handling cryogenic and time-sensitive therapies requires specialized training.

Competitive Landscape

The cell and gene therapy 3PL market is moderately consolidated, with providers focusing on global network expansion, advanced packaging, cryogenic capabilities, and digital cold-chain solutions.

Key Companies Profiled:

- Cryoport Systems

- Catalent Pharma Solutions

- Thermo Fisher Scientific

- Lonza Group

- McKesson Corporation

- Marken (UPS Healthcare)

- World Courier (AmerisourceBergen)

- PCI Pharma Services

- BioLife Solutions

Providers are prioritizing chain-of-identity (COI) and chain-of-custody (COC) systems, sustainability-focused cold-chain solutions, and global clinical trial logistics.

Recent Developments

- 2024: Expansion of cryogenic logistics hubs across North America and Europe; integration of AI-driven tracking systems.

- 2023: Accelerated investment in -80°C to -196°C cold chain infrastructure for CAR-T supply chains.

- 2022: Launch of next-gen validated packaging solutions featuring enhanced thermal stability and IoT sensors.

Future Outlook: A Decade of Biologic Supply Chain Transformation

The coming decade will witness transformative growth in the cell and gene therapy logistics sector, fueled by innovation in cryogenic technologies, real-time digital monitoring, global distribution expansion, and collaborations between biopharma and specialized 3PL partners. Companies that invest in resilient, automated, and sustainable logistics frameworks will lead the next wave of CGT commercialization.

With rising therapy approvals, expanding patient access, and increasing R&D activity, the cell and gene therapy third-party logistics market is set for strong, resilient, and long-term growth through 2035.