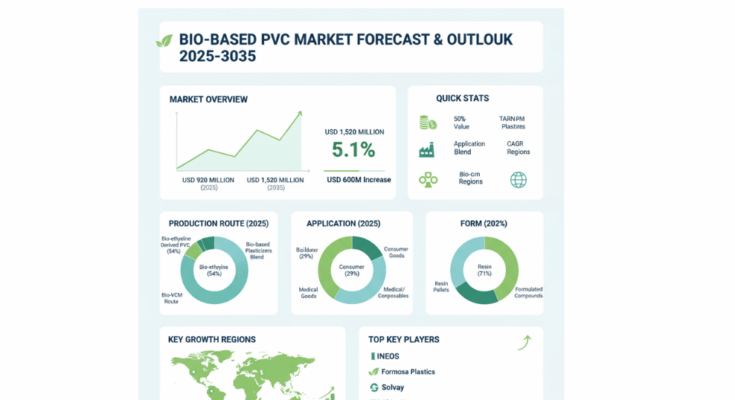

The global Bio-Based Polyvinyl Chloride (PVC) Market is entering a decisive growth decade, forecasted to expand from USD 920.0 million in 2025 to USD 1,520.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.1%. The sector’s rise underscores a major shift toward renewable polymer sources, low-carbon production systems, and eco-efficient construction materials, signaling strategic opportunities for forward-looking manufacturers.

The transformation of the PVC industry represents not just a response to environmental imperatives but a complete reinvention of polymer chemistry, process integration, and sustainable construction engineering. As market adoption accelerates, bio-based PVC (Bio-PVC) is emerging as the cornerstone of the next generation of circular economy materials, unlocking efficiency, compliance, and profitability across multiple industrial verticals.

From USD 920 Million to USD 1.52 Billion: The Decade of Bio-Based Transformation

The Bio-Based PVC market’s journey from USD 920.0 million in 2025 to USD 1,520.0 million in 2035 reflects a two-phase expansion path:

- 2025–2030: The “foundation phase,” marked by rapid adoption of bio-ethylene-derived PVC systems and standardized sustainable manufacturing processes. Market value climbs to USD 1,140.0 million, adding USD 220.0 million (37% of decade growth).

- 2030–2035: The “acceleration phase,” where advanced bio-PVC becomes mainstream. Market value surges by another USD 380.0 million, accounting for 63% of total expansion, driven by technology integration, construction modernization, and material performance parity with petroleum-based systems.

The building & construction sector dominates market share at 48.0%, leveraging bio-based PVC’s superior sustainability profile and proven performance efficiency of 95–98% in structural and environmental applications. Meanwhile, resin pellets remain the preferred form, representing 71.0% of market demand.

Why Manufacturers Are Moving Toward Bio-Based PVC

Bio-based PVC offers an unmatched value proposition for manufacturers balancing sustainability mandates with performance reliability. Derived from bio-ethylene feedstock, it reduces lifecycle carbon emissions, maintains equivalent tensile and thermal stability to conventional PVC, and integrates seamlessly with existing production infrastructure.

Key drivers of adoption include:

- Sustainability Without Compromise: Delivers environmental compliance and carbon reduction targets while maintaining high material strength and versatility.

- Circular Economy Integration: Enables resource-efficient, closed-loop production models aligned with global ESG frameworks.

- Construction Modernization: Aligns with green building certifications (LEED, BREEAM) and sustainable procurement standards.

- Regulatory Compliance: Meets evolving environmental standards in North America, the EU, and Asia Pacific.

For construction, consumer goods, and healthcare manufacturers, bio-based PVC ensures continuity of material performance while transitioning toward renewable value chains—a combination few other polymers can offer at scale.

Regional Growth Hotspots: North America and Europe Lead

The North American market stands as a catalyst for global bio-based PVC expansion, with the United States expected to grow at 5.6% CAGR, supported by green construction incentives and advanced manufacturing networks in California, Texas, and New York.

In Europe, the market is forecast to increase from USD 276 million in 2025 to USD 456 million in 2035, led by Germany (4.8% CAGR), France (4.7%), and the United Kingdom (4.5%). These countries are setting the benchmark for industrial standardization, bio-material certification, and construction sustainability integration.

Asia Pacific represents the next frontier, with Japan (4.2% CAGR) and South Korea (4.3%) emphasizing precision bio-processing systems that meet exacting performance and durability standards. Mexico emerges as a high-growth market (5.1% CAGR) through construction modernization and expanding manufacturing capabilities.

Strategic Opportunity Pathways for Industry Leaders

Manufacturers entering or expanding within the bio-based PVC market can pursue multiple growth pathways aligned with operational expertise and market positioning:

- Building & Construction Leadership – Enhance renewable concentration and optimize bio-polymer formulations to achieve 95–98% material performance parity. Estimated revenue pool: USD 73–98 million.

- North America Localization & Distribution Expansion – Develop regional supply chains and green partnerships for cost-effective, compliant, and accessible bio-materials. USD 58–78 million opportunity.

- Resin Pellets Segment Dominance – Capitalize on manufacturers’ demand for standardized, easy-to-integrate material forms. USD 47–63 million potential.

- Consumer Goods Diversification – Leverage advanced bio-processing for high-performance packaging and household applications. USD 38–51 million range.

- Healthcare Integration – Expand bio-compatible formulations for medical and disposable applications. USD 26–35 million opportunity.

These pathways reflect an estimated combined strategic potential exceeding USD 400 million by 2035, emphasizing broad, scalable opportunities for polymer producers, construction material suppliers, and sustainability-driven manufacturers.

Competitive Landscape: Innovation, Not Price, Defines Leadership

The bio-based PVC market remains moderately concentrated, with 8–10 major players controlling nearly half the market share. Leaders such as INEOS, Formosa Plastics, and Solvay maintain competitive edges through advanced bio-processing expertise, supply chain integration, and global construction partnerships.

Technology innovators like Vinnolit, Shin-Etsu, and Westlake Chemical are accelerating R&D in high-performance bio-ethylene formulations and automated sustainability monitoring. Regional players such as Arkema, Covestro, Dow, and Braskem focus on localized production models that support regional construction standards and sustainable development initiatives.

Industry Outlook: The Next Decade of Sustainable Manufacturing

The Bio-Based PVC Market Forecast 2025–2035 marks a pivotal turning point for sustainable manufacturing. As global industries face tightening carbon regulations, evolving consumer expectations, and competitive innovation pressures, bio-based PVC stands as the viable bridge between sustainability imperatives and industrial scalability.

Manufacturers aligning early with this transformation will not only secure operational and regulatory advantages but also establish leadership in a USD 1.5 billion global industry redefining the material foundation of sustainable construction and advanced polymer manufacturing.

Browse Full Report : https://www.factmr.com/report/3703/bio-based-pvc-market

About the Report

The Bio-Based PVC Market Forecast and Outlook 2025–2035 provides a comprehensive quantitative and qualitative assessment of the industry, covering production routes (bio-ethylene, plasticizers blend, bio-VCM), applications (construction, consumer goods, medical), forms (resin pellets, formulated compounds), and regional performance across North America, Europe, and Asia Pacific. Key players profiled include INEOS, Formosa Plastics, Solvay, Vinnolit, Shin-Etsu, Westlake Chemical, Arkema, Covestro, Dow, and Braskem.