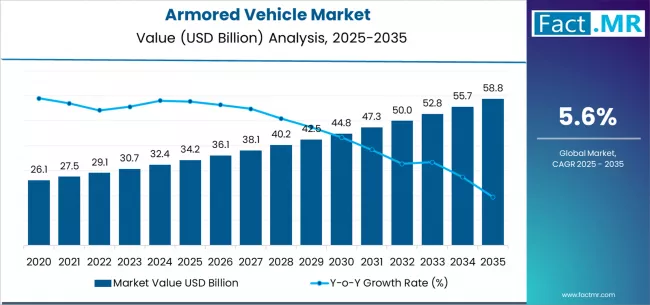

The global armored vehicle market is poised for substantial expansion over the next decade, driven by rising geopolitical tensions, escalating defense modernization initiatives, and rapid advancements in vehicle protection technologies. According to a new analysis by Fact.MR, the market is expected to grow from USD 34.2 billion in 2025 to USD 58.8 billion by 2035, reflecting an absolute increase of USD 24.6 billion, a total growth of 71.9%, and a CAGR of 5.6% throughout the forecast period.

Increasing cross-border conflicts, counterterrorism missions, and peacekeeping operations are accelerating global demand for high-performance armored platforms. Military forces and law-enforcement agencies are shifting toward next-gen armored systems featuring enhanced mobility, modular protection, AI integration, and superior situational awareness.

Strategic Market Drivers

Rising Global Defense Spending Boosts Vehicle Procurement

Nations worldwide are increasing defense budgets to address emerging security threats and strengthen ground force capabilities. This surge in spending is driving large-scale procurement of armored personnel carriers (APCs), infantry fighting vehicles (IFVs), main battle tanks (MBTs), and mine-resistant ambush-protected (MRAP) vehicles. Modern combat scenarios demand resilient and highly maneuverable vehicles capable of multi-domain operations.

Modernization & Upgradation Programs Gain Momentum

Aging military fleets across NATO countries, Asia-Pacific, and the Middle East are undergoing rapid modernization. Governments are investing in upgraded armor plating, active protection systems (APS), hybrid propulsion, and C4ISR-enabled platforms. Modular upgrade kits—supporting rapid deployment in diverse terrains—are further accelerating adoption.

Technological Advancements Enhance Survivability

Innovations such as advanced composite armor, V-shaped hull designs, electronic warfare (EW) suites, and autonomous navigation capabilities are transforming armored vehicle design. Integration of AI-enabled threat detection systems, thermal imaging, and remote weapon stations (RWS) is strengthening operational readiness.

Growing Demand for Law-Enforcement Armored Vehicles

Beyond military applications, law-enforcement agencies are increasingly procuring armored SUVs, tactical trucks, and riot-control vehicles to combat rising urban threats, civil unrest, and high-risk interventions.

Browse Full Report: https://www.factmr.com/report/armored-vehicle-market

Regional Growth Highlights

North America: A Dominant Defense Powerhouse

North America continues to lead global market share, backed by strong U.S. defense budgets and a robust pipeline of modernization programs. Investments in next-gen combat vehicles, autonomous platforms, and lightweight armor technologies are accelerating regional growth.

Europe: Modernization and NATO Commitments Fuel Demand

European nations—including Germany, France, the U.K., and Poland—are rapidly expanding armored fleets to bolster NATO interoperability. The Russia–Ukraine conflict has sharply increased procurement levels, especially for IFVs, MBTs, and tactical support vehicles.

Asia-Pacific: Rapid Militarization & Border Security Priorities

China, India, South Korea, and Japan are heavily investing in armored vehicles amid rising regional tensions. Indigenous manufacturing initiatives and joint ventures are further enhancing market growth.

Middle East & Africa: Security Threats Strengthen Procurement

Active conflict zones and counterterrorism operations across MEA are fueling demand for MRAPs, APCs, and armored tactical vehicles. Gulf nations continue investing in next-gen armored systems to enhance land-based warfare capabilities.

Market Segmentation Insights

By Vehicle Type

- Armored Personnel Carriers (APCs) – Widely used for troop transport.

- Infantry Fighting Vehicles (IFVs) – Fast-growing due to high tactical importance.

- Main Battle Tanks (MBTs) – Significant investments in advanced battle tanks.

- Mine-Resistant Ambush-Protected (MRAP) – Strong demand in conflict zones.

- Light Armored Vehicles (LAVs) – Increasing adoption for reconnaissance and patrol.

- Armored SUVs & Tactical Trucks – Rising uptake in law enforcement and VIP protection.

By Application

- Defense – Largest segment, driven by modernization programs.

- Homeland Security & Policing – Growing in urban security and anti-riot operations.

By Drive Type

- Wheeled Armored Vehicles – Preferred for mobility and cost efficiency.

- Tracked Armored Vehicles – Ideal for high-intensity combat operations.

By End User

- Military Forces

- Internal Security Agencies

- Special Forces Units

Challenges Impacting Market Growth

- High Development & Maintenance Costs – Advanced systems require significant investment.

- Supply Chain Disruptions – Steel, composites, and electronic components face price volatility.

- Regulatory & Export Restrictions – Defense export controls limit international trade.

- Weight & Mobility Trade-offs – Enhanced protection often increases vehicle weight, affecting performance.

Competitive Landscape

The armored vehicle market is moderately consolidated, with major companies engaged in strategic alliances, technology-sharing programs, and long-term government contracts. Manufacturers are prioritizing hybrid-electric propulsion, modular design, active protection, and advanced electronic warfare capabilities.

Key Companies Profiled

- BAE Systems

- General Dynamics Corporation

- Rheinmetall AG

- Oshkosh Defense

- Iveco Defence Vehicles

- ST Engineering

- Elbit Systems

- Hanwha Defense

- Thales Group

- Krauss-Maffei Wegmann (KMW)

Recent Developments

- 2024: Several manufacturers unveiled next-gen armored platforms featuring hybrid propulsion and AI-enabled battlefield management systems.

- 2023: Major procurement contracts awarded across Asia and Europe for MRAPs and upgraded IFVs.

- 2022: Introduction of lightweight composite armor technologies and autonomous navigation kits.

Future Outlook: Advancing Toward Smarter, Safer Combat Vehicles

Over the next decade, growth will be shaped by AI-driven defense technologies, electric propulsion systems, autonomous capabilities, and modular armor solutions. Increasing emphasis on border security, rapid-response missions, and multi-domain combat strategies will further elevate global demand.

With heightened defense readiness across regions and continual innovations in survivability and mobility, the armored vehicle market is set for resilient and sustained growth through 2035.