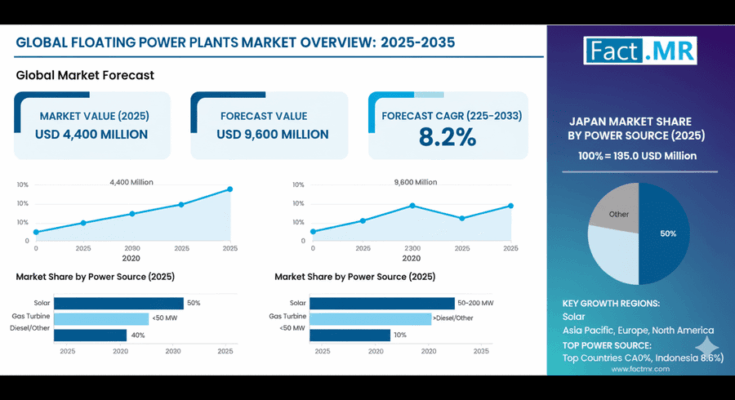

The global Floating Power Plants (FPP) market is poised for an era of sustained expansion, projected to reach USD 9.6 billion by 2035, up from USD 4.4 billion in 2025, according to the latest industry outlook. This remarkable 8.2% compound annual growth rate (CAGR) signals a decisive shift toward advanced offshore power solutions and sustainable marine energy technologies that are redefining global power generation.

Over the next decade, floating power platforms—engineered to deliver high-efficiency generation without permanent onshore infrastructure—will play a critical role in meeting the world’s renewable energy ambitions. As offshore development accelerates, energy producers and manufacturers are investing heavily in innovative floating systems that combine solar, gas turbine, and hybrid technologies with advanced marine engineering.

Manufacturers Reposition for a New Energy Frontier

From Wärtsilä and Siemens Energy to GE Vernova, Kyocera, and Hitachi Zosen, leading technology providers are reshaping the energy landscape through floating power innovation. Collectively, the top three market players command over 40% global share, leveraging decades of marine experience, modular platform design, and power electronics expertise.

“The floating power revolution isn’t a distant concept—it’s the next phase of global electrification,” noted an industry spokesperson. “For manufacturers, it represents one of the few segments where engineering precision, sustainability, and scalability intersect.”

As countries invest in offshore energy programs—from India’s National Offshore Wind Policy to the European Union’s Blue Economy Initiative—industrial leaders are accelerating R&D partnerships, building regional assembly capabilities, and developing next-generation floating platforms that integrate seamlessly with modern grid systems.

Asia Pacific at the Helm of Growth

Asia Pacific remains the nucleus of market expansion, contributing nearly 45% of total growth by 2035.

-

India is forecast to lead with a 9.2% CAGR, supported by large-scale offshore initiatives in Mumbai, Chennai, and Kochi, where marine energy hubs are deploying solar-based floating platforms to stabilize coastal grids.

-

China follows closely at 9.0% CAGR, driven by massive offshore energy modernization, government renewable targets, and technology integration through its Belt and Road projects.

-

Indonesia shows regional leadership with 8.6% CAGR, leveraging its multi-island geography to install compact floating units that strengthen local energy security.

These markets offer fertile ground for equipment manufacturers, engineering contractors, and marine specialists to establish long-term partnerships aligned with government-backed energy diversification goals.

Solar Dominates as Technology of Choice

By power source, solar floating power plants account for approximately 50% of global installations in 2025, maintaining their leadership through 2035. Manufacturers are scaling production of marine-grade photovoltaic modules and corrosion-resistant floats, designed to withstand saline environments and high wind exposure.

Key advantages—high efficiency, modularity, and low maintenance—make solar platforms the cornerstone of floating energy generation. The integration of intelligent tracking systems and AI-driven monitoring ensures generation reliability across variable marine conditions, giving manufacturers an edge in system performance guarantees.

Gas turbine-based floating systems capture around 30% share, addressing industrial and high-demand applications requiring flexible generation and superior power density. Diesel and hybrid units complete the remaining 20%, serving remote and backup operations.

Medium-Capacity Systems Lead Global Installations

The 50–200 MW segment dominates capacity-based demand with 45% market share, balancing output and installation complexity for utility and industrial operations.

Manufacturers focusing on this range benefit from economies of scale while maintaining agility to meet customized offshore requirements. Enhanced manufacturing automation, prefabricated platform modules, and standardized assembly practices are enabling faster deployment and lower lifecycle costs.

Smaller systems below 50 MW (about 40% share) cater to distributed and island-based energy needs, where compact floating modules can be rapidly installed. High-capacity systems above 200 MW account for 15%, primarily in large utility projects and integrated marine power zones.

Utilities Segment Drives 60% of Market Demand

Utility-scale installations continue to dominate applications, representing nearly 60% of total deployments in 2025. These systems underpin offshore grid reliability, especially in nations pursuing renewable energy targets and net-zero goals.

Industrial users follow with 25% share, while island and remote applications contribute 15%, addressing off-grid resilience and regional energy independence.

The growing alignment between floating power producers, grid operators, and technology manufacturers is transforming how energy is delivered to coastal and marine communities.

Drivers of Market Expansion

Three key demand catalysts define the decade ahead:

-

Offshore Energy Acceleration: Global offshore generation capacity is expanding by 12–18% annually, particularly in developing regions where floating plants bridge the infrastructure gap.

-

Government Policy Support: Targeted incentives, renewable mandates, and marine infrastructure programs are accelerating adoption of floating power technologies.

-

Technological Advancement: Breakthroughs in hybrid systems, AI-based performance analytics, and lightweight composite materials are enhancing reliability while reducing cost per megawatt.

While installation complexity and high capital intensity remain barriers, ongoing R&D and standardization efforts are expected to mitigate these challenges. Industry leaders are collaborating with regulatory bodies to streamline safety approvals, standardize component certification, and promote global interoperability.

Opportunities for Manufacturers and Investors

For component and system manufacturers, the floating power boom represents a multi-billion-dollar procurement pipeline. Opportunities exist in:

-

Platform fabrication (steel, concrete, and composite float structures)

-

Marine photovoltaic systems and high-efficiency inverters

-

Hybrid control and monitoring software for offshore grid optimization

-

Maintenance, logistics, and training networks for specialized marine power operations

Manufacturers investing now can secure first-mover advantages through long-term supply contracts, government partnerships, and early regulatory participation. Investors, meanwhile, are eyeing joint ventures with technology providers and utilities to expand production capacity and develop region-specific floating energy ecosystems.

Browse Full Report : https://www.factmr.com/report/floating-power-plants-market

Toward a Sustainable Marine Power Future

As the world transitions toward cleaner energy systems, floating power plants are emerging as the bridge between onshore generation and deep-sea renewables. By 2035, with market value approaching USD 9.6 billion, the technology’s contribution to global sustainability will extend far beyond power generation—creating thousands of manufacturing jobs, enhancing energy access for remote regions, and cementing leadership for companies that innovate early.