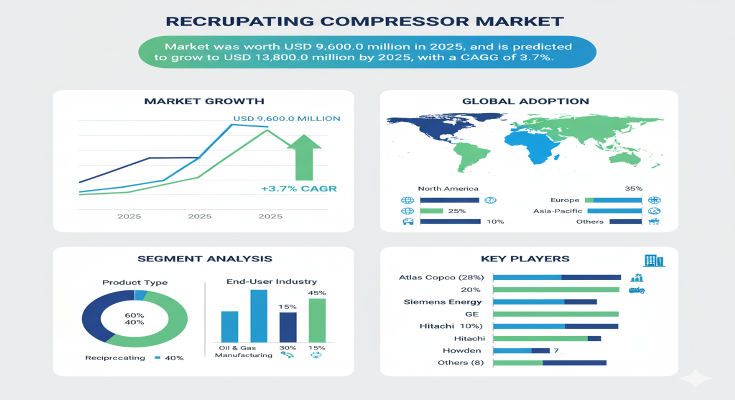

The global reciprocating compressor market is poised for steady growth over the the coming decade. Analysts estimate the market at USD 9,600 million in 2025, and project it to reach around USD 13,800 million by 2035, which implies a compound annual growth rate (CAGR) of about 3.7% over this period. This trajectory reflects growing adoption of advanced reciprocating compression systems in industries requiring high-pressure, reliable gas or air compression.

Market Drivers & Growth Catalysts

Multiple structural trends are driving growth. First, expansion in oil & gas production, natural gas pipelines, and gas processing plants drives demand for reciprocating compressors that can manage high pressures and complicated gas compositions. Second, industrial manufacturing sectors (chemicals, petrochemicals, manufacturing lines) rely heavily on compressed air or gas for processes, requiring robust compressors that can deliver consistent performance. Third, maintenance and operational efficiency are improving through integration of digital monitoring, predictive maintenance and energy-efficient designs, helping reduce operational costs and downtime.

Product & Technology Segmentation

Reciprocating compressors come in different types and designs. They can be single-stage or multi-stage depending on compression requirements, with single-stage machines covering many standard industrial applications, while multi-stage units are used for higher pressure or more advanced gas compression. In lubrication design, both oil-flooded and oil-free variants are significant; oil-flooded compressors are common for general industrial applications, while oil-free designs are preferred in applications where compressed gas purity is critical (e.g. food, pharmaceuticals).

Application & End-Use Insights

Industries such as oil & gas, chemical processing, utilities, and manufacturing are among the largest end users. In oil & gas upstream and mid-stream, reciprocating compressors are used for natural gas compression, pipeline transport, gas lift or injection applications. In manufacturing and industrial settings, compressed air is used in pneumatic tools, production lines, painting or coating systems, refrigeration plants, and other supporting processes. High-pressure gas compression is also needed in specialty industries (e.g. hydrogen compression or high-pressure process gases) where these compressors provide high reliability and ability to handle tough gas compositions.

Regional Outlook & Opportunities

Growth is varied by region. Developed industrial regions (North America, Western Europe) continue to adopt upgraded compressor technologies, retrofit aging systems, and adopt advanced automation and monitoring. Meanwhile, emerging economies – especially in Asia-Pacific – are witnessing rapid industrialization, expansion of chemical, manufacturing and energy sectors, which drives strong demand for new compressor installations. There is also increasing investment in infrastructure, refineries and gas pipelines in those regions, making them key growth markets. Regions like Latin America, Middle East & Africa offer further potential as energy infrastructure and industrial manufacturing develop.

Competitive Landscape & Strategic Trends

The competitive environment is populated by compressor manufacturers, component suppliers, and systems integrators specializing in compression equipment. Key players are investing in improved component design (pistons, cylinders, valves) for higher reliability, better materials to reduce wear, and features for lower vibration or noise. Many are also offering digital monitoring systems for predictive maintenance, condition monitoring of reciprocating compressors to minimize downtime. Companies are also customizing compressors for clean or oil-free operation or for special gas compositions.

Challenges & Market Restraints

Despite favorable growth trends, there are certain challenges. Reciprocating compressors often require significant maintenance—high wear on moving components, need for periodic overhauls, and downtime. High upfront capital cost for multi-stage, high-pressure units is also a barrier for smaller industrial players or emerging markets. Furthermore, retrofitting or replacing older compressor systems can be costly, especially in facilities running legacy equipment. Gas purity or gas composition (e.g. wet gas, corrosive gas) may require special materials or designs, increasing cost and complexity.

Forecast & Strategic Recommendations

With the market expected to grow from USD 9,600 million in 2025 to USD 13,800 million by 2035 at a 3.7% CAGR, the industry is set to see gradual, sustained growth. Suppliers should focus on offering modular multi-stage compressors with digital monitoring, lower vibration/noise, and solutions tailored for emerging industrial and energy markets. Expanding manufacturing capacity or local service presence in high-growth regions such as Asia-Pacific will be beneficial. Also offering maintenance contracts, refurbishment services, or upgrade kits for users of older systems can help with market penetration.

Browse Full Report: https://www.factmr.com/report/reciprocating-compressor-market

Editorial Perspective

Reciprocating compressors remain a backbone of industrial and energy infrastructure: whether compressing natural gas for pipelines or providing compressed air in manufacturing lines. As industries upgrade, automate, and expand, demand for reliable, efficient, and advanced reciprocating compression solutions will continue. Over the next decade, companies that combine robust mechanical design, advanced monitoring, and regional service capability will capture growth and become essential partners in compression-critical industries.