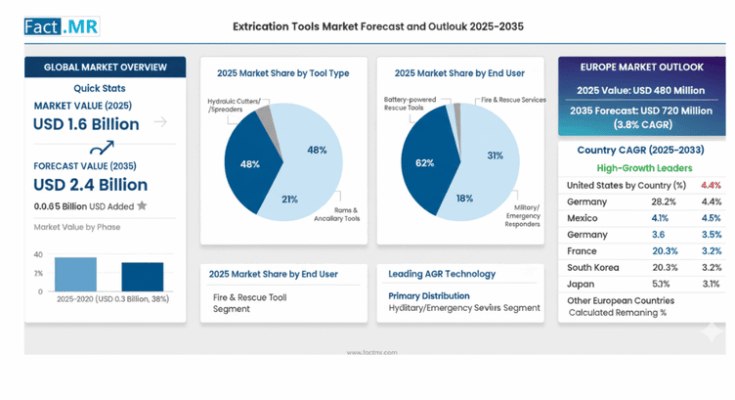

The global Extrication Tools Market industry is entering a transformative decade marked by steady expansion, technology evolution, and significant manufacturing opportunities. Valued at USD 1.6 billion in 2025, the market is projected to reach USD 2.4 billion by 2035, growing at a compound annual growth rate (CAGR) of 3.8%. This trajectory signals an era of heightened investment in hydraulic rescue technologies, battery-powered innovation, and emergency response integration, reshaping how fire, military, and industrial sectors approach professional rescue and safety operations.

Market Momentum and Structural Growth

Between 2025 and 2030, the industry will experience its “professional rescue adoption phase,” adding USD 0.3 billion in market value. This early period, contributing 38% of total decade growth, will be driven by the rapid adoption of hydraulic cutters and spreaders, reflecting rising global demand for precision, power, and portability in professional rescue operations.

By contrast, the 2030–2035 phase represents the “advanced integration era,” adding USD 0.5 billion and accounting for 62% of total growth. This phase will see battery-electric rescue technologies reach mass-market adoption, supported by integrated emergency platforms and advanced safety networks that redefine rescue tool interoperability and field performance.

Key Market Indicators

| Metric | Value |

|---|---|

| Market Size (2025) | USD 1.6 billion |

| Market Forecast (2035) | USD 2.4 billion |

| CAGR (2025–2035) | 3.8% |

| Leading Segment | Fire & Rescue Services (62% market share) |

| Dominant Tool Type | Hydraulic Cutters/Spreaders (48% market share) |

| Key Growth Regions | North America, Europe, Asia Pacific |

| Top Companies | Hurst Jaws of Life, Weber Rescue, Holmatro, Lukas, Paratech |

This stable but progressive growth profile reflects the market’s transition from traditional manual tools to high-performance hydraulic and battery-powered rescue systems that achieve 95–98% operational effectiveness in field conditions.

Growth Drivers: Safety, Technology, and Investment

The extrication tools market’s momentum is built on three converging factors:

-

Professional Rescue Demand:

Fire and emergency departments worldwide are adopting advanced extrication tools to enhance speed, reliability, and precision in life-saving scenarios. These systems minimize manual dependency and deliver consistent rescue performance across diverse operational environments. -

Emergency Response Modernization:

As governments and fire services invest in next-generation equipment, manufacturers are integrating automation, data-driven monitoring, and hydraulic optimization into product lines. These innovations not only improve rescue accuracy but also align with evolving safety and compliance standards worldwide. -

Public Safety Investment:

Global fire and emergency budgets are expanding to support infrastructure upgrades and specialized equipment procurement. This surge in capital allocation is propelling manufacturers to invest in production scaling, quality certification, and technology partnerships.

Opportunity Pathways for Manufacturers

The next decade presents a diversified set of strategic opportunities for industry participants seeking to expand or consolidate their market presence:

-

Pathway A – Fire & Rescue Leadership:

Strengthening dominance in the fire and rescue services segment (62% market share) through enhanced hydraulic engineering and automated deployment systems. Projected revenue pool: USD 149–200 million. -

Pathway B – North American Expansion:

Accelerating growth in the U.S. and Mexico markets, where emergency modernization initiatives and local distribution partnerships are fueling regional leadership. Projected revenue pool: USD 119–160 million. -

Pathway C – Hydraulic Cutters/Spreaders Dominance:

Leveraging the 48% market share of this core segment through innovation in cutting performance, safety optimization, and equipment integration. Projected revenue pool: USD 96–129 million. -

Pathway D – Battery-Electric Power Innovation:

Developing portable, cordless rescue systems to meet emerging field mobility demands. Manufacturers investing in battery optimization and wireless rescue tools could capture USD 63–85 million in new value. -

Pathway E – Environmental and Safety Compliance:

Positioning production through eco-efficient manufacturing, regulatory alignment, and safety-standard innovation, generating USD 44–59 million in premium procurement opportunities.

Regional Dynamics and Leading Markets

North America remains the growth leader with the U.S. expanding at a 4.4% CAGR and Mexico at 4.1%, supported by large-scale modernization projects and public safety programs.

Europe continues as a technology hub—Germany (3.6% CAGR) and France (3.5%) drive premium adoption through engineering excellence and EU-standardized rescue infrastructure.

Asia Pacific is gaining ground, led by Japan (3.1%) and South Korea (3.2%), emphasizing precision hydraulic systems, advanced safety integration, and long-term operational durability.

Competitive Landscape: Innovation at the Core

The industry’s competitive environment remains moderately concentrated, with approximately 10–12 global players commanding 45–52% of total market share.

-

Market Leaders — Hurst Jaws of Life, Weber Rescue, Holmatro — leverage decades of hydraulic engineering and deep integration with global fire service networks.

-

Technology Innovators — Lukas, Paratech, Collins Aerospace — are reshaping the market through advanced battery development and next-generation rescue platforms.

-

Regional Specialists — Resqtec, AEG, Flir — maintain agile positioning by serving local emergency markets and specialized industrial applications.

As automation, data analytics, and material optimization continue to redefine equipment design, leading manufacturers are transitioning toward “smart rescue ecosystems” that combine AI-driven diagnostics, battery telemetry, and system-level safety monitoring.

Browse Full Report : https://www.factmr.com/report/3723/extrication-tools-market

Strategic Outlook

By 2035, extrication tools will no longer be viewed as standalone devices but as integrated components of a connected emergency response network.

Manufacturers capable of combining hydraulic precision, battery efficiency, and digital intelligence will define the next era of rescue innovation.

Investment in supply chain resilience, R&D partnerships, and regional manufacturing localization will be central to capturing this USD 800 million growth opportunity over the next decade.