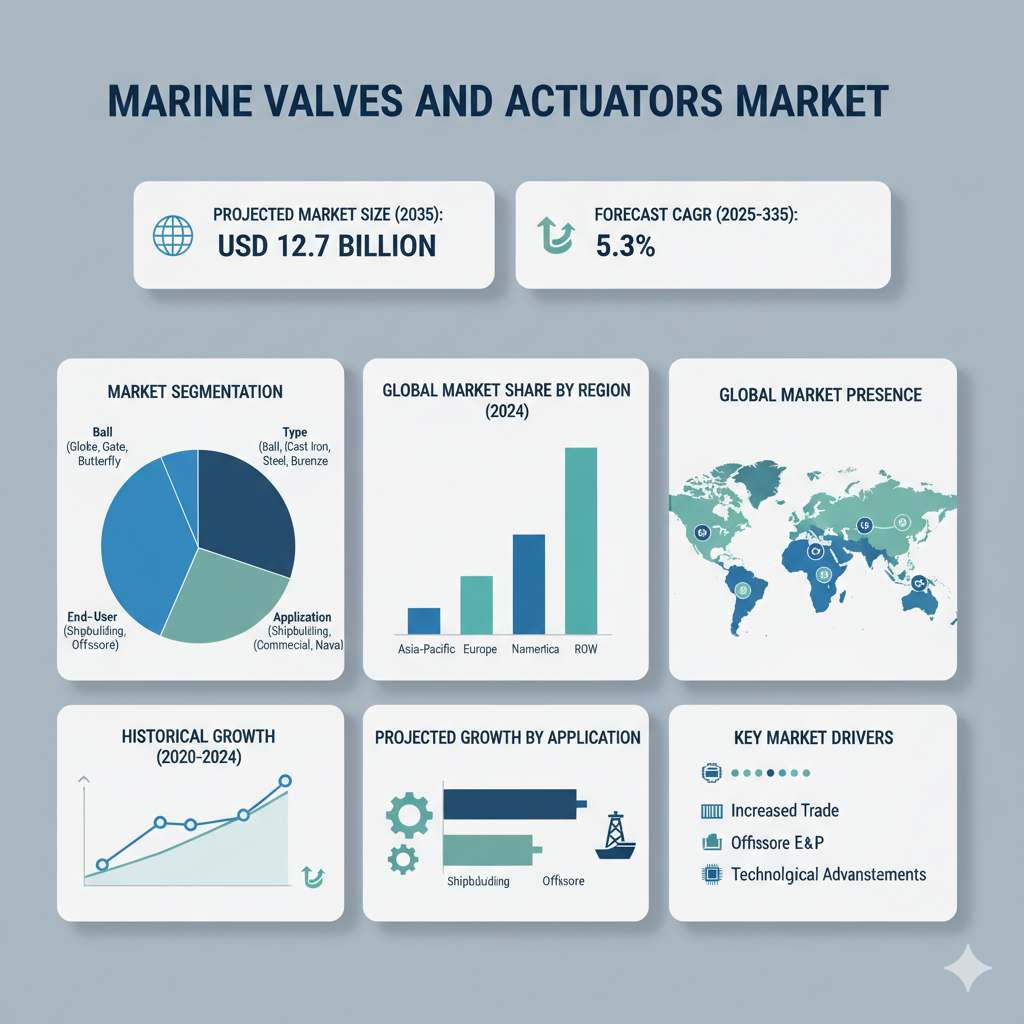

The global marine valves and actuators market is projected to increase from USD 7.6 billion in 2025 to USD 12.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% during the forecast period. This steady growth is driven by factors such as expanding offshore exploration, increasing shipbuilding activities, and the growing adoption of automation and environmental compliance technologies within maritime operations.

Market by Product Type

The market is categorized into ball valves, gate valves, actuators, and others (including butterfly, check, and control valves). Among these, ball valves are expected to maintain dominance throughout the forecast period due to their strength, efficient sealing, and adaptability for use in fuel systems, cooling circuits, and ballast operations.

Gate valves, while traditionally favored for large-bore applications, are gradually being replaced by advanced ball valves and actuator-based systems that provide faster operation and tighter shutoff capabilities. The actuators segment, encompassing electric, hydraulic, and pneumatic models, is becoming increasingly vital as modern vessels integrate automation and remote monitoring into their operations. The “others” category remains significant for specialized and customized valve applications in niche systems.

Market by End-Use

By end-use, the market divides into commercial shipping, naval defense, offshore oil & gas, and others such as marine research and support vessels. Commercial shipping represents the largest share, driven by the global expansion of maritime trade and the modernization of fleets to meet efficiency and emission standards.

The offshore oil and gas sector continues to boost demand for durable valve and actuator systems designed for extreme pressure, temperature, and corrosion conditions. Meanwhile, the naval defense segment contributes significantly due to the requirement for high-precision, secure, and redundant valve systems capable of withstanding rigorous operations. Other applications, including research and utility vessels, add to the market’s diversity and resilience.

Market by Region

Regionally, the marine valves and actuators market spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

North America continues to hold a strong position, supported by its robust offshore exploration activities, naval defense investments, and established shipping infrastructure. In Europe, regions such as Norway, the U.K., and the Netherlands maintain steady growth due to North Sea exploration and innovation in shipbuilding technologies.

The Asia-Pacific region stands out as the fastest-growing market, propelled by major shipbuilding hubs in China, South Korea, and Japan, as well as emerging offshore development in India and Southeast Asia. The Middle East and Africa are also witnessing growth opportunities, particularly driven by new oil and gas discoveries and port infrastructure developments.

Highlighting Recent Developments in the Market

Recent years have seen major technological and strategic advancements shaping the marine valves and actuators market. Companies are emphasizing innovation, mergers, and geographic expansion to strengthen their market presence.

In 2024, several leading manufacturers introduced next-generation proportional pressure control valves and digital actuators that enhance precision and reliability in pneumatic and hydraulic systems. Strategic acquisitions have also taken place, enabling larger corporations to expand their valve portfolios and enhance capabilities in slurry handling and flow control.

Key players such as Emerson, Flowserve Corporation, Honeywell International, KITZ Corporation, Rotork Plc, AVK Holding, Bürkert, KSB, and Pentair have been investing heavily in digital valve technologies, predictive maintenance systems, and IoT-enabled actuators. These innovations aim to improve operational efficiency, reduce maintenance costs, and extend the life of marine components.

Competitor Analysis

The competitive landscape of the marine valves and actuators market is marked by both established multinational corporations and emerging regional players. Large companies benefit from economies of scale, established distribution networks, and comprehensive service offerings. Their focus lies in developing smart valves and actuators with integrated sensors and advanced control algorithms, enabling real-time data collection and predictive maintenance.

Smaller and mid-sized firms, however, are finding success in niche markets, particularly in naval defense, LNG systems, and deepwater applications. These players often compete through customization, flexible production capabilities, and strong after-sales support.