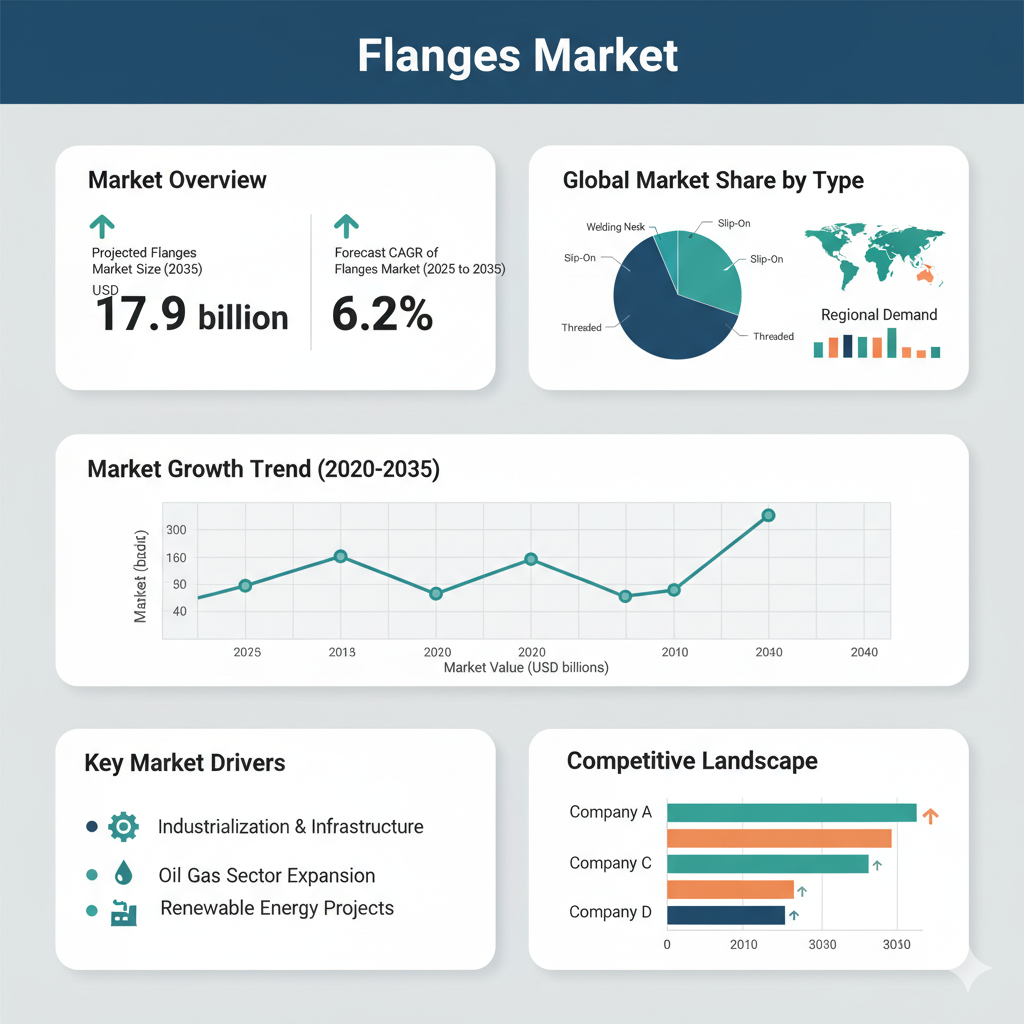

The global flanges market is projected to increase from USD 9.8 billion in 2025 to USD 17.9 billion by 2035, with a compounded annual growth rate (CAGR) of 6.2 % during the forecast period. The market’s growth is driven by rapid industrialization, infrastructure expansion, and technological innovations in materials and manufacturing processes.

Market Overview by Type, Material, End-Use and Region

By Type

The flanges market is segmented by type into welding neck, long welding neck, slip-on, socket weld, lap joint, and other variants such as threaded and blind flanges. Among these, the welding neck flange holds the largest market share due to its reliability and durability under extreme temperature and pressure conditions. It is widely used in critical applications such as oil refineries, petrochemical plants, and power generation.

Slip-on flanges are also gaining traction owing to their ease of installation and cost-effectiveness, particularly in medium-duty applications where operational pressures are moderate. Meanwhile, long welding neck flanges are primarily used in high-pressure environments, while socket weld and lap joint flanges serve specialized industrial setups requiring alignment flexibility and maintenance efficiency.

By Material

The flanges market by material includes carbon steel, stainless steel, aluminum, polymer, and other materials such as cast iron and bronze. Carbon steel continues to dominate in terms of volume due to its strength and affordability. However, stainless steel and alloy-based flanges are witnessing increasing demand, especially in industries requiring corrosion resistance and durability, such as chemical processing, marine engineering, and food and beverage manufacturing.

The use of lightweight materials like aluminum and polymer is also growing, particularly in sectors where weight reduction and non-corrosive properties are crucial, such as aerospace and architectural applications. These material innovations are expected to create new opportunities in the market over the next decade.

By End-Use Industry

End-use industries for flanges include aviation and aerospace, petrochemical, architectural decoration, food and beverages processing, and construction. The petrochemical sector remains the largest consumer of flanges globally, supported by extensive pipeline networks, refineries, and chemical plant construction.

In contrast, the food and beverage processing sector is emerging as one of the fastest-growing application areas, driven by the need for hygienic and easily cleanable flange systems in processing and packaging facilities. The aviation and aerospace segment also presents growth opportunities due to increasing aircraft production and maintenance operations that demand high-precision, lightweight flanges.

By Region

Regionally, the market spans North America, Latin America, Europe, East Asia, South Asia and the Pacific, and the Middle East and Africa. Asia-Pacific is expected to record the fastest growth due to large-scale industrialization, urbanization, and infrastructure investments in countries such as China, India, and Indonesia.

North America and Europe remain mature but stable markets, with significant demand from maintenance, repair, and replacement activities in energy and manufacturing sectors. Meanwhile, the Middle East and Africa are witnessing a surge in demand, propelled by oil and gas exploration projects and power generation infrastructure development.

Key Drivers and Market Dynamics

The primary factors driving the flanges market include expanding industrial infrastructure, the modernization of aging pipeline networks, and technological advancements in manufacturing techniques. Automation, computer-aided design (CAD), and precision forging have significantly improved product quality and consistency, while innovations in materials have enabled flanges to perform effectively under harsher conditions.

However, the industry also faces challenges such as fluctuating raw material prices, particularly for steel and nickel alloys, which affect production costs. Environmental regulations and the global shift toward renewable energy may also influence long-term demand, reducing reliance on traditional oil and gas applications while creating new opportunities in hydrogen, biofuel, and clean-energy projects.

Recent Developments and Competitive Landscape

The global flanges market is moderately fragmented, with both multinational corporations and regional manufacturers competing for market share. Key players include General Flange & Forge LLC, Outokumpu Armetal Stainless Pipe Co. Ltd, and Pro-Flange Limited, among others.

Recent developments highlight a trend toward smart and connected flange systems. For instance, some manufacturers have introduced sensor-integrated flanges capable of monitoring pressure, temperature, and leakage in real time. These innovations are expected to improve safety, reduce downtime, and enhance asset management in industries such as oil and gas, petrochemicals, and power generation.

Strategic mergers, acquisitions, and regional expansions have also been observed, with major companies seeking to strengthen their global footprint. Many firms are establishing production and service facilities closer to high-growth markets in Asia and the Middle East to improve supply chain efficiency and reduce transportation costs.

From a competitive standpoint, differentiation is increasingly achieved through innovation in materials, precision manufacturing, and value-added services. Companies are investing in the development of advanced corrosion-resistant alloys, improved forging techniques, and digital monitoring solutions. The growing emphasis on sustainability and lifecycle management is pushing manufacturers to focus on long-lasting, energy-efficient designs that comply with international quality standards.

Outlook and Future Trends

The flanges market outlook remains positive through 2035. The anticipated growth from USD 9.8 billion in 2025 to USD 17.9 billion by 2035 reflects a steady expansion supported by industrial upgrades, energy diversification, and the adoption of high-performance materials.

Future growth will be shaped by the integration of smart technologies, the adoption of advanced manufacturing processes, and an increasing shift toward specialized, high-value flanges. Manufacturers that can adapt to changing material trends and regulatory environments will have the greatest competitive advantage.

Furthermore, regional diversification will remain crucial. Asia-Pacific and the Middle East will continue to dominate new installations, while Europe and North America will drive demand through replacement and modernization projects. Emerging sectors such as renewable energy, hydrogen transportation, and wastewater management are expected to open new avenues for growth.