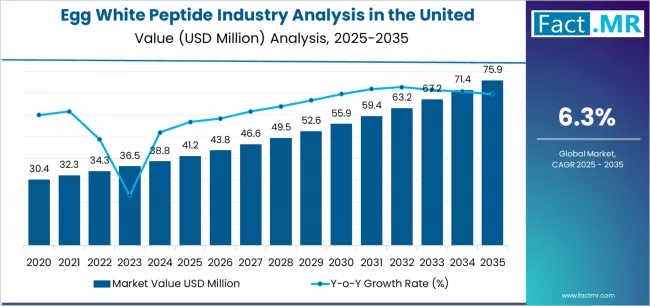

The United Kingdom egg white peptide industry is set for robust expansion over the next decade, supported by rising demand for clean-label protein ingredients, the growing popularity of performance nutrition, and accelerated use of bioactive peptides in functional foods and supplements. According to a recent analysis by Fact.MR, the UK market is projected to rise from USD 41.2 million in 2025 to USD 75.9 million by 2035, marking an absolute growth of USD 34.6 million. This reflects total growth of 84.0% and a CAGR of 6.3% during the forecast period.

As consumers increasingly prioritise natural, minimally processed, and high-efficacy nutritional components, egg white peptides—known for superior bioavailability, muscle-supporting amino acids, and anti-fatigue properties—are gaining strong traction across dietary supplements, sports nutrition, and clinical nutrition categories.

Strategic Market Drivers

Clean-Label Protein Demand Accelerates Adoption

The shift toward natural and recognisable ingredients is shaping the UK nutrition landscape. Egg white peptides, derived from hydrolysed egg proteins, deliver high-quality nutrition without artificial additives. Their ease of digestion, low allergenicity compared to dairy proteins, and compatibility with gluten-free and keto diets position them as a preferred clean-label protein source.

Performance & Sports Nutrition Witnesses Strong Uptake

The UK’s rapidly expanding sports and active-lifestyle segment is boosting demand for high-performance protein ingredients. Egg white peptides are increasingly incorporated into muscle recovery blends, energy formulations, and protein powders due to their fast absorption rate and rich essential amino acid profile. The rising population of gym-goers, athletes, and fitness-driven consumers continues to support market momentum.

Functional Foods & Beverages Gain Market Presence

Brands across the UK are integrating egg white peptides into functional food formats such as ready-to-drink beverages, fortified snacks, protein bars, and clinical nutrition beverages. Their neutral flavour profile and solubility make them ideal for R&D teams focused on developing nutrient-dense, convenient formats.

Advances in Processing & Bioactive Research Strengthen Market Value

Improvements in enzymatic hydrolysis, bioactive peptide extraction, and microencapsulation technologies are enhancing peptide purity, stability, and effectiveness. Ongoing research linking egg-derived peptides with immune health, anti-fatigue benefits, and metabolic support is further boosting industry confidence.

Browse Full Report: https://www.factmr.com/report/united-kingdom-egg-white-peptide-industry-analysis

Regional Growth Highlights

England: Largest Consumer Base with Strong Supplement Culture

England dominates demand due to widespread consumption of nutritional supplements, growing interest in high-protein diets, and the presence of leading wellness brands and retail channels.

Scotland: Rising Adoption in Active & Outdoor Lifestyle Segments

With a strong sporting culture and focus on outdoor recreation, Scotland shows increasing uptake of performance nutrition products fortified with peptides.

Wales & Northern Ireland: Emerging Markets with Expanding Retail Penetration

Expanding health-food stores, e-commerce channels, and awareness around functional nutrition are contributing to steady growth across Wales and Northern Ireland.

Market Segmentation Insights

By Application

- Dietary Supplements – Largest Segment

Driven by significant demand for capsules, tablets, and powdered supplements. - Sports Nutrition – Fastest Growing

Increased use in muscle recovery formulas, endurance blends, and pre/post-workout drinks. - Functional Foods & Beverages

Adoption in fortified snacks, RTD beverages, and protein-enriched bakery items. - Clinical & Medical Nutrition

Growing relevance in geriatric nutrition and recovery diets.

By Source

- Chicken Egg White Peptides – Dominant due to abundant availability and established processing technologies.

- Specialty Egg-Derived Bioactive Peptides – Growing interest in highly refined formulations for clinical applications.

Growth Challenges

Premium Pricing Limits Mass Adoption

Higher production costs related to hydrolysis and purification make egg white peptides more expensive than traditional proteins, limiting adoption in cost-sensitive consumer groups.

Competition from Plant & Whey Proteins

Whey, soy, and pea proteins remain strong competitors due to their widespread availability and lower cost.

Raw Material Price Instability

Fluctuations in egg prices and supply-chain constraints impact manufacturing margins.

Regulatory Compliance in Health Claims

Tightened UK regulations on protein and peptide-related health claims can restrict marketing opportunities.

Competitive Landscape

The UK egg white peptide market is moderately competitive, with companies focused on R&D optimisation, bioactive innovation, clean-label formulations, and expansion into high-value applications.

Key Companies Profiled

- Kewpie Corporation

- HiMedia Laboratories

- Merck KGaA

- New Alliance Dye Chem

- Thermo Fisher Scientific

- Naturalin Bio-Resources Co.

- Bioway (Xi’An)

- BioVencer Healthcare

- Titan Biotech Ltd.

- Archer Daniels Midland (ADM) – expanding into specialty proteins

Manufacturers are focusing on improved extraction, enhanced solubility, and integration into clean-label, high-performance nutrition products.

Recent Developments

- 2024: UK brands launched new protein and peptide-fortified powders aimed at athletes and high-intensity trainers.

- 2023: Integration of egg white peptides into functional RTD beverages and specialised clinical nutrition formats.

- 2022: Major advancements in enzymatic hydrolysis improved peptide absorption and bioactivity.

Future Outlook: A Decade of Science-Backed, Functional Nutrition

Over the next decade, the United Kingdom egg white peptide industry is expected to accelerate through advancements in clinical research, personalised nutrition, and bioactive ingredient science. Brands that invest in high-purity peptide innovation, clean-label claims, sports & clinical nutrition applications, and sustainable sourcing are poised to lead the market.

As awareness grows regarding the functional and performance benefits of egg-derived peptides, the market is well-positioned for strong, stable, and long-term expansion through 2035.