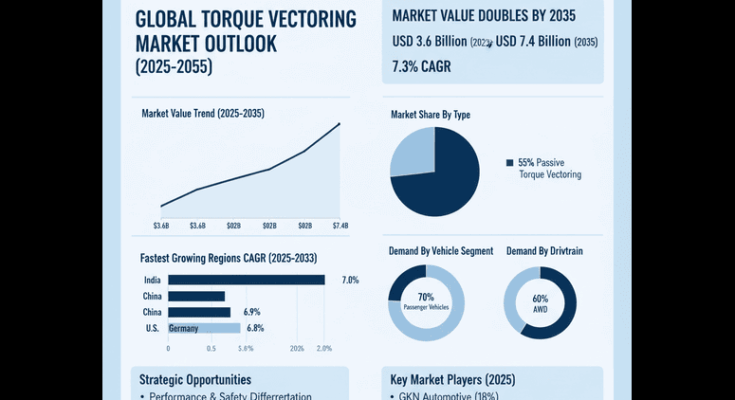

The global Torque Vectoring Market is entering a decisive decade of expansion, projected to reach USD 7.4 billion by 2035, marking an absolute increase of USD 3.8 billion from its 2025 valuation of USD 3.6 billion. According to the latest industry outlook, the market is poised to grow at a compound annual growth rate (CAGR) of 7.3%, doubling in value as automakers worldwide accelerate investments in vehicle dynamics optimization, electric drivetrains, and intelligent mobility systems.

This growth signals a pivotal opportunity for automotive manufacturers, component suppliers, and technology developers to redefine performance and safety through next-generation torque distribution technologies.

Driving Forces Behind the Torque Vectoring Boom

At the heart of this market expansion lies the global push for advanced driving stability, enhanced handling, and intelligent torque control—a critical enabler for next-generation electric and autonomous vehicles. As consumers demand superior safety, performance, and driving comfort, torque vectoring technologies are rapidly transitioning from luxury segments into mainstream automotive platforms.

Torque vectoring systems allow vehicles to independently control the distribution of torque to individual wheels, improving cornering stability, traction, and responsiveness. Industry data reveals that torque vectoring can deliver a 30–50% improvement in handling performance compared to traditional systems—an advantage automakers cannot overlook in the competitive global mobility landscape.

Market Snapshot and Outlook

| Metric | 2025 | 2035 | Growth |

|---|---|---|---|

| Market Value | USD 3.6 Billion | USD 7.4 Billion | +105% |

| CAGR (2025–2035) | – | 7.3% | |

| Leading Segment | Passive Torque Vectoring | 55% Market Share | |

| Dominant Vehicle Type | Passenger Vehicles | 70% Market Share | |

| Key Drive Type | All-Wheel Drive (AWD) | 60% Market Share |

Between 2025 and 2030, the market will expand from USD 3.6 billion to USD 5.2 billion, accounting for 42% of the decade’s total growth, driven by strong adoption of intelligent drivetrain systems and EV integration. From 2030 to 2035, the sector will gain an additional USD 2.2 billion, propelled by hybridization, autonomous driving, and performance optimization initiatives across both passenger and commercial vehicle categories.

Regional Momentum: Asia-Pacific Takes the Lead

The Asia-Pacific region is positioned to dominate global torque vectoring adoption, supported by rapid automotive industrialization, EV infrastructure development, and government-led mobility programs.

- India leads the charge with a CAGR of 8.5%, driven by local vehicle production surges and robust government incentives for advanced control technologies.

- China follows closely at 8.2% CAGR, leveraging its large-scale EV programs and modernization of manufacturing ecosystems.

- South Korea demonstrates 7% CAGR, underpinned by technological integration and vehicle innovation initiatives.

In Europe, Germany remains the benchmark for precision manufacturing and advanced control innovation, while the U.S. maintains strong momentum at 6.8% CAGR, anchored by smart mobility investments and autonomous system R&D.

Technology Landscape: Passive Systems Lead, Active Systems Accelerate

Torque vectoring technologies are bifurcated into passive and active systems:

- Passive torque vectoring, commanding 55% market share, dominates due to its proven mechanical reliability, scalability, and cost-efficiency. These systems are favored in mass-market applications for their performance consistency and manufacturing simplicity.

- Active torque vectoring, with a 45% share, represents the frontier of innovation, incorporating electronic sensors, advanced control algorithms, and adaptive torque management. Active systems are increasingly critical for electric vehicles, hybrid drivetrains, and high-performance segments, where precision control defines brand competitiveness.

Vehicle Segments: Passenger Cars Anchor Demand

Passenger vehicles will continue to lead torque vectoring adoption, representing 70% of total market share by 2025. The segment’s growth is attributed to rising consumer expectations for enhanced driving safety, ride comfort, and fuel efficiency.

Commercial vehicles capture 20%, reflecting fleet modernization and the push for durability and efficiency in logistics operations. Meanwhile, sports and off-road vehicles account for 10%, fueled by demand for dynamic performance and advanced traction control.

Strategic Opportunities for Industry Stakeholders

1. Automotive Manufacturers

OEMs and Tier-1 suppliers can leverage torque vectoring integration to differentiate on performance, handling, and safety—core consumer decision drivers in both electric and autonomous vehicle markets. The adoption of intelligent torque systems enables automakers to meet stringent global safety standards while improving operational efficiency.

2. Technology Innovators

Control specialists and software developers can expand through R&D partnerships with automotive leaders, focusing on smart control algorithms, predictive torque management, and cloud-based monitoring platforms that enable real-time optimization.

3. Investors and Financial Partners

Private equity and venture capital investors will find promising opportunities in advanced control startups and regional manufacturing expansion, particularly across India, China, and Europe, where localization strategies reduce cost barriers and accelerate adoption.

4. Policy and Government

Governments can catalyze local market development through tax incentives, R&D subsidies, and control certification programs, enabling smaller manufacturers to adopt torque vectoring technologies. National initiatives promoting vehicle safety, emission reduction, and intelligent transport will further support market acceleration.

Competitive Landscape: A Concentrated Yet Evolving Field

The torque vectoring market remains moderately concentrated, with top players commanding approximately 40% of global share.

Key companies include:

- GKN Automotive – leading in AWD and EV integration

- BorgWarner – innovating in electronic torque control

- ZF Friedrichshafen – specializing in high-performance active systems

- Eaton, JTEKT, Magna, Continental, Dana, Bosch, and Hyundai Mobis – expanding through niche solutions and strategic regional partnerships

Emerging entrants from India, China, and South Korea are disrupting the landscape with localized production, flexible service models, and cost-efficient torque management technologies, creating a competitive yet synergistic global ecosystem.

Future Outlook: A Market Poised for Intelligent Growth

As automotive technology converges around electrification, automation, and software-defined control, torque vectoring stands as a mission-critical enabler of intelligent mobility. Its integration ensures superior handling, safety, and energy efficiency, bridging the performance gap between human-driven and autonomous vehicles.

With the market forecast to double in value by 2035, torque vectoring technologies will underpin the next decade of automotive innovation, offering manufacturers a direct route to performance excellence and competitive advantage in the global vehicle ecosystem.

Browse Full Report : https://www.factmr.com/report/torque-vectoring-market