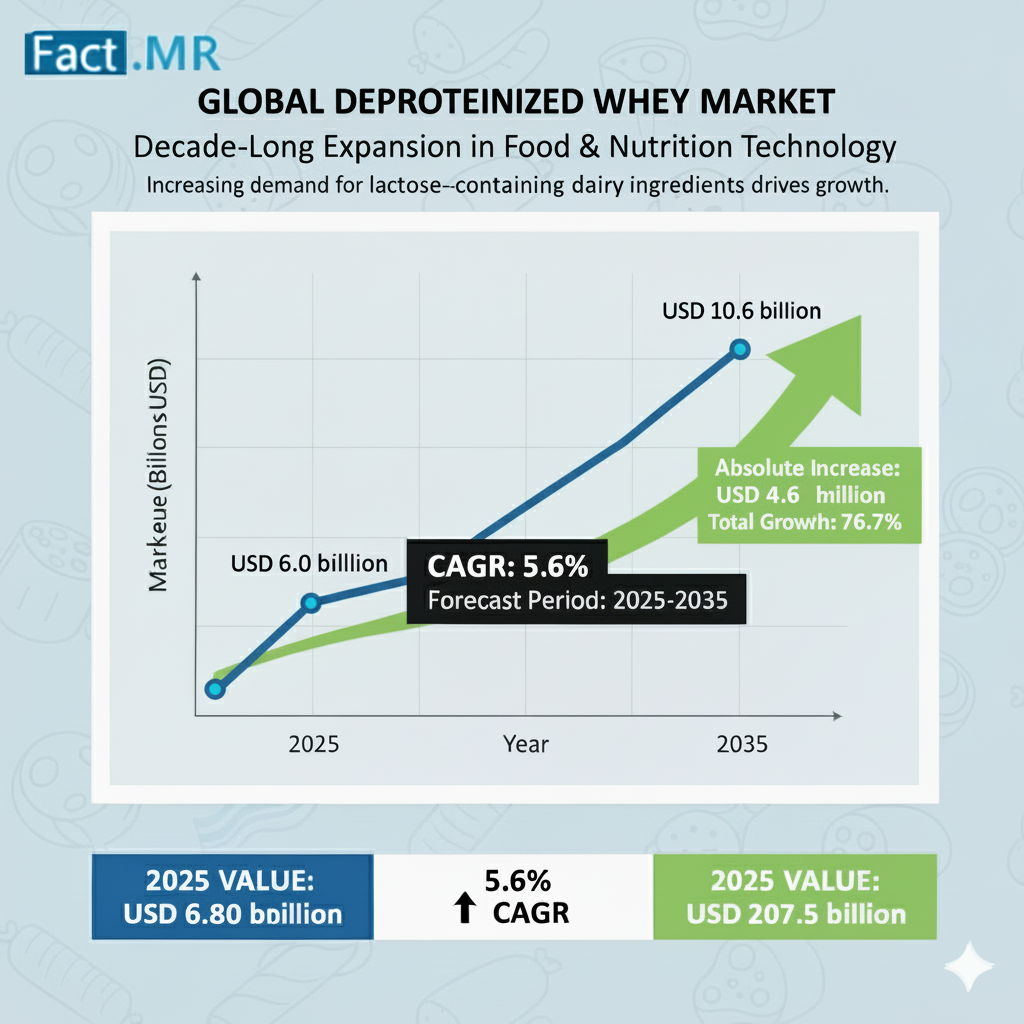

The deproteinized whey market is anticipated to expand from the estimated USD 6 billion in 2025 to USD 10.6 billion by 2035 with a CAGR rate of 5.6%. The growth is driven by some factors such as increasing demand for lactose-containing dairy ingredients in food, beverages, and infant nutrition Deproteinized whey, which is derived from proteins removed from whey, finds extensive application in confections, dairy products, and nutritional formulations and provides a cost-efficient and functional ingredient that is mild in taste and rich in lactose.

Deproteinized Whey Market Overview by Lactose Concentration:

The market is segmented by lactose concentration into 85%, 83%, and 70% variants, each catering to specific functional needs. The 85% lactose concentration segment dominates with a 40% market share in 2025, driven by its ideal composition for mimicking human breast milk in infant formulas. Its high solubility, mild taste, and digestibility make it indispensable in premium baby nutrition, confectionery, and dairy products. Leading manufacturers prioritize this high-purity grade to enhance texture, moisture retention, and stability in chocolates, caramels, and baked goods.

The 83% concentration holds a 35% share, finding strong uptake in sports nutrition, fermented dairy, protein bars, and pharmaceutical excipients. It serves as an energy source in animal feeds and specialized formulations requiring balanced lactose levels. The 70% segment, while smaller, supports niche applications in dry mixes and prepared foods. Advances in membrane filtration and ultrafiltration technologies are enabling higher purity across all concentrations, ensuring consistency and compliance with stringent infant nutrition standards.

Deproteinized Whey Market by Application:

Applications span dairy products (30% share), beverages (25%), dry mixes, prepared foods, bakery & confectionery, and others. Dairy products lead due to deproteinized whey’s contributions to yield efficiency, sweetness, and process stability in cheese, yogurt, ice cream, and condensed milk. In beverages, it provides superior solubility for infant formulas, sports drinks, coffee creamers, and functional shakes, aligning with clean-label trends.

Bakery & confectionery benefit from its role as a natural sweetener and texturizer, while emerging uses in plant-based hybrids and pharma lactose fortification signal diversification. Sustainability initiatives, such as zero-waste whey processing, are amplifying its appeal in eco-conscious formulations.

Deproteinized Whey Market Regional Analysis:

Growth varies by region, with Asia-Pacific emerging as a hotspot. China leads with a 6.5% CAGR, propelled by rising birth rates, health awareness, and government-backed child nutrition programs, projecting USD 740 million by 2035. South Korea (6.0% CAGR) and New Zealand (6.2% CAGR) follow, driven by wellness trends and export-oriented dairy sectors.

North America, anchored by the U.S. (USD 1.93 billion in 2025; 5.8% CAGR), benefits from a mature dairy infrastructure and demand for organic, clean-label products. Europe shows balanced growth—Germany (5.6% CAGR), U.K. (5.5% CAGR)—fueled by R&D in functional beverages and strict EU regulations. Australia (5.9% CAGR) leverages its strong dairy exports for sports nutrition. Emerging Latin American and MEA markets are gaining traction through hybrid dairy-plant innovations and pharmaceutical expansions.

Deproteinized Whey Market Recent Developments and Competitive Landscape:

The market is competitive, with key players focusing on innovation, sustainability, and global supply chains. Agropur Ingredients (22% share) leads with a broad portfolio of dairy-based solutions for food, nutrition, and pharma. Saputo Ingredients (18%) emphasizes high-quality expansion into emerging markets. Hoogwegt (15%) excels in distribution, while Vitusa (12%) and Eccofeed (10%) target customized nutrition and animal feed.

Other notables include Davis Feed, Graham Chemical, UGA Group, PhilChema, Lynn Dairy, and Ace International (23% combined). Recent launches of ultra-low-protein, high-purity variants address infant formula demands. Investments in green processing—renewable energy, waste minimization, and circular economy models—are rampant. Partnerships with food manufacturers and tech upgrades in whey fractionation enhance yield and lactose standardization. Regulatory compliance for sustainability and food safety remains a differentiator.

Deproteinized Whey Market Outlook and Key Takeaways:

The global deproteinized whey market is set for sustained growth from USD 6 billion in 2025 to USD 10.6 billion by 2035 at a 5.6% CAGR. Infant nutrition and functional dairy will dominate, with pharma and plant-dairy hybrids as high-potential frontiers. Challenges like milk price volatility and lactose intolerance concerns are offset by technological and sustainable advancements.

Industry leaders prioritizing advanced filtration, eco-friendly sourcing, and diversified applications will thrive. As consumer demand for nutritious, clean-label ingredients rises, deproteinized whey solidifies its position as a versatile, economical powerhouse in the global dairy ecosystem.

Browse Full Report-https://www.factmr.com/report/652/deproteinized-whey-market