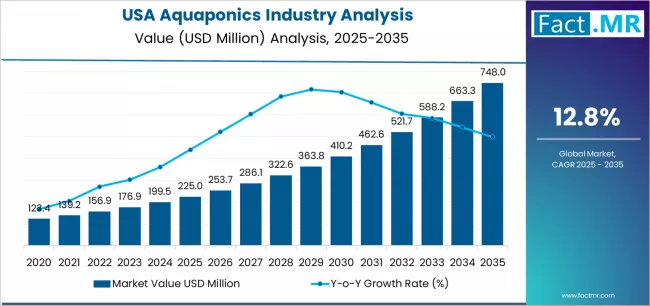

The USA aquaponics industry is set for exponential expansion over the next decade, fueled by the rising shift toward sustainable food systems, local farm-to-table demand, and increasing adoption of high-efficiency agriculture technologies. According to a detailed analysis by Fact.MR, the market is forecast to grow significantly from USD 225.0 million in 2025 to USD 748.0 million by 2035, marking an absolute growth of USD 523.0 million and an impressive total increase of 232.4%. During this period, demand is projected to rise at a robust CAGR of 12.8%.

As consumers, businesses, and policymakers accelerate focus on resource-efficient farming and chemical-free food production, aquaponics is rapidly becoming a preferred solution. The integration of aquaculture and hydroponics is enabling the industry to deliver high yields with minimal water, land, and labor input—positioning aquaponics as a cornerstone of future-ready agriculture.

Strategic Market Drivers

Sustainable Farming Gains Mainstream Momentum

Growing concerns around water scarcity, climate change, and food safety have accelerated the adoption of closed-loop agriculture systems. Aquaponics—renowned for recirculating up to 95% of water—offers a compelling alternative to conventional farming. Increasing consumer preference for chemical-free, pesticide-free, and nutrient-rich produce is further strengthening industry uptake across the USA.

Commercial growers are implementing systems that support year-round production of leafy greens, herbs, tomatoes, tilapia, catfish, and ornamental fish, helping meet the rising demand for fresher, locally sourced foods.

Browse Full Report: https://www.factmr.com/report/usa-aquaponics-industry-analysis

Demand for Local & Organic Food Drives Growth

The farm-to-table movement continues to reshape consumer buying behavior in the U.S., with strong preference for locally grown and traceable produce. Aquaponic farms—located closer to urban and suburban markets—significantly reduce transportation costs, carbon emissions, and post-harvest losses.

Restaurants, retailers, and meal-kit brands are increasingly sourcing aquaponic produce for consistent quality, longer shelf life, and clean-label certifications.

Technological Integration Enhances Efficiency

Advanced monitoring sensors, AI-driven nutrient balancing, water-quality automation, and controlled-environment agriculture (CEA) technologies are improving scalability and profitability. These innovations help stabilize yields, reduce operational risks, and optimize plant and fish growth cycles.

With advancements in LED grow lighting, climate-control systems, and modular farming units, aquaponics operations are transitioning from small-scale hobby setups to large commercial enterprises.

Government Support & Sustainability Incentives Boost Adoption

Federal and state-level programs such as USDA grants, vertical farming incentives, sustainability credits, and local cooperative assistance programs are propelling industry growth. Subsidies supporting climate-smart agriculture and urban farming have emerged as a major catalyst for both startups and established growers.

Regional Growth Highlights

West Coast: Climate Challenges Accelerate Aquaponics Adoption

California, Washington, and Oregon lead adoption due to water scarcity concerns, strong organic food consumption, and vibrant urban farming ecosystems.

Midwest: Expansion of Controlled-Environment Agriculture (CEA)

States like Illinois, Ohio, and Michigan are witnessing higher adoption driven by indoor farming investments and demand from retail grocery chains.

Northeast: Strong Urban & Rooftop Farming Models

New York, Massachusetts, and Pennsylvania showcase robust demand for aquaponic produce, supported by dense urban markets and sustainability-focused consumers.

South & Southeast: Rising Commercial Farming Investments

Texas, Florida, and Georgia are emerging high-growth zones due to climatic suitability, aquaculture expertise, and expanding large-scale greenhouse operations.

Market Segmentation Insights

By System Type

- Deep Water Culture (DWC) – Ideal for commercial-scale production, strong in leafy greens.

- Nutrient Film Technique (NFT) – Preferred for herbs and lightweight crops.

- Media-Based Aquaponics – Popular among small and mid-sized farms for versatility.

- Hybrid Systems – Gaining traction due to operational flexibility and yield optimization.

By Fish Type

- Tilapia – Dominant due to resilience and fast growth.

- Catfish – Growing in southern regions.

- Trout & Bass – Suitable for colder climates.

- Ornamental Fish – Increasing share due to higher profitability.

By Crop Type

- Leafy Greens (Lettuce, Kale, Arugula) – Largest segment.

- Herbs (Basil, Mint, Parsley) – Rapidly expanding in specialty retail.

- Tomatoes & Peppers – High value in commercial greenhouse units.

- Microgreens – Fast-growing segment driven by premium restaurants.

By Distribution Channel

- Direct-to-Consumer (DTC) – Farmers’ markets, subscription boxes, CSA models.

- Retail & Supermarkets – Increasing shelf presence of aquaponic produce.

- Foodservice (Hotels, Restaurants) – High demand for premium-grade greens.

- Online Grocery Platforms – Growing adoption in urban regions.

Challenges Impacting Market Growth

- High Initial Setup Cost – Infrastructure, climate control, and automation systems require substantial capital.

- Technical Complexity – Balancing plant and fish ecosystems demands skilled operators.

- Energy Consumption Concerns – Climate-controlled environments may increase operational costs.

- Regulatory Uncertainty – Varying state-level standards for aquaculture and controlled-environment farming.

Competitive Landscape

The USA aquaponics market consists of a mix of established CEA companies, aquaculture ventures, and new-age agri-tech innovators. Companies are prioritizing:

- Sustainable system designs

- Automated monitoring technologies

- Crop diversification

- Energy-efficient greenhouse models

Key Companies Profiled:

- Nelson and Pade Inc.

- Pentair Aquatic Eco-Systems

- Aquaponics USA

- Upward Farms

- Superior Fresh

- Endless Food Systems

- Ouroboros Farms

- Urban Organics

- AeroFarms (strategic collaborations)

- The Aquaponic Source

Manufacturers and operators are heavily investing in R&D, modular systems, greenhouse expansion, and AI-enabled controls.

Recent Developments

2024:

Expansion of commercial aquaponic greenhouses integrating automated nutrient balancing systems and AI-enabled monitoring.

2023:

Launch of new urban farming hubs in New York, Chicago, and Denver, backed by sustainability grants and tech-driven farming solutions.

2022:

Major collaborations between CEA companies and retail chains to supply aquaponic leafy greens and herbs with consistent year-round availability.

Future Outlook: A Decade of Sustainable, High-Efficiency Food Production

The next decade will be transformative for the U.S. aquaponics industry. Rising demand for environmentally sustainable, pesticide-free, and nutrient-rich produce—combined with increasing urbanization—will drive large-scale system installations across cities and suburban regions. Companies adopting renewable energy integration, precision-farming analytics, and modular expansion will lead the next wave of innovation.

With strong momentum from health-conscious consumers, supportive policies, and climate-resilient agriculture trends, the USA aquaponics industry is poised for multi-fold growth through 2035.