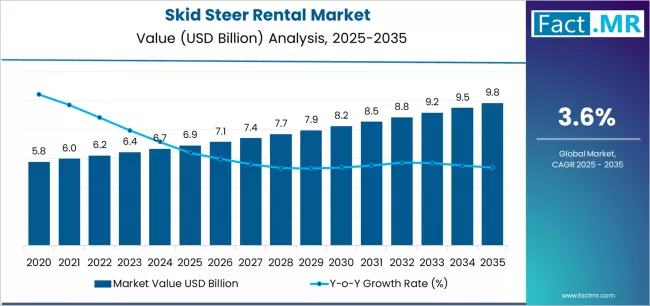

The global skid steer rental market is poised for steady growth over the next decade. It is forecasted to expand from USD 6.9 billion in 2025 to approximately USD 9.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.6%.

Key Market Highlights

-

2025 Market Value: USD 6,900 million

-

2035 Forecast Value: USD 9,900 million

-

Projected CAGR (2025–2035): 3.6%

-

Leading Type Segment: Wheeled skid steers (~65% share)

-

Top Application: Construction (~45% share)

-

Dominant Rental Term: Short-term (~70%)

-

Principal Regions for Growth: Asia‑Pacific, North America, Europe

-

Major Market Players: Bobcat, Caterpillar, Case

To Access the Complete Data Tables & in-depth Insights, Request a Discount on this report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8632

Key Drivers of Market Growth

-

Construction and Infrastructure Expansion

Ongoing global infrastructure development and increased construction activity are propelling demand for compact, versatile rental equipment like skid steers. -

Demand for Flexible Equipment Solutions

Many contractors prefer renting skid steers for short-term, project-based needs — especially when specialized tasks call for temporary access to compact machinery. -

Urbanization & Tight Workspaces

Wheeled skid steers, known for their maneuverability and minimal ground disturbance, are ideal for confined or developed urban job sites, boosting their rental demand. -

Landscaping Applications

The landscaping industry is increasingly relying on skid steer rentals for projects like grading, planting, and surface preparation, leveraging the machines’ attachment flexibility. -

Agriculture & Specialty Use

Beyond construction, agricultural and other niche sectors are adopting skid steer rentals for tasks such as feed handling, farm maintenance, and light excavation.

Market Segmentation

-

By Type

-

Wheeled: Leading the market due to speed, versatility, and lower surface impact.

-

Tracked: Preferred for challenging terrain where stability and traction are critical.

-

-

By Application

-

Construction: Largest share, used for site preparation, material handling, and compact excavation.

-

Landscaping: Growing rapidly, driven by both residential and commercial landscaping projects.

-

Agriculture / Other: Used in farm operations, maintenance, and seasonal work.

-

-

By Rental Term

-

Short-Term: Dominant, supporting project-based rental demand.

-

Long-Term: Favored for extended projects and continuous rental partnerships.

-

Regional Trends

-

Asia‑Pacific: Experiencing strong growth due to rising infrastructure investments, urban development, and rental model adoption.

-

North America: A well-established rental market with high demand for flexible, short-term equipment.

-

Europe: Growth is supported by increasing construction and landscaping projects, alongside a mature rental ecosystem.

Challenges & Risks

-

Inventory Availability: Rental companies may face capacity constraints, especially during peak construction seasons.

-

Maintenance & Operational Costs: Regular upkeep of rental fleets can be costly and complex, particularly for smaller operators.

-

Equipment Utilization Risk: Balancing high fleet utilization with downtime can impact profitability for rental companies.

-

Regulatory Compliance: Meeting emissions, safety, and certification standards adds to operational challenges.

Competitive Landscape

Leading rental companies and equipment manufacturers are focusing on:

-

Expanding skid steer rental fleets, especially wheeled models

-

Offering versatile attachment packages to appeal to diverse customers

-

Integrating telematics and fleet management systems to improve utilization and efficiency

-

Providing flexible rental terms and pricing to meet project-specific needs

-

Building regional networks to address high-growth markets in APAC and Europe

Major players include Bobcat, Caterpillar, Case, and other well-known equipment brands.

Strategic Recommendations

-

Scale Short‑Term Rental Capacity: Rental firms should increase fleet availability during peak construction seasons to meet high demand.

-

Invest in Telematics & Fleet Optimization: Use data-driven tools to monitor usage, maintenance needs, and utilization rates.

-

Develop Targeted Rental Packages: Create bundled offers for construction, landscaping, and agricultural customers to increase rental volume.

-

Enter Growth Regions: Focus on expansion in Asia-Pacific and emerging markets where infrastructure spending is rising.

-

Promote Rental Flexibility: Educate customers about the cost benefits and flexibility of renting vs. owning skid steers.

Market Outlook

Over the next decade, the skid steer rental market is expected to strengthen as more construction and landscaping firms opt for flexible equipment access. The projected growth to USD 9.9 billion by 2035, at a CAGR of 3.6%, highlights strong potential for rental companies, contractors, and fleet managers.

Companies that optimize fleet operations, offer customer-centric rental solutions, and expand into high-growth regions will be well-positioned to lead in this evolving and rapidly expanding segment of the heavy equipment rental industry.

Browse Full Report: https://www.factmr.com/report/skid-steer-rental-market

About Fact.MR:

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.