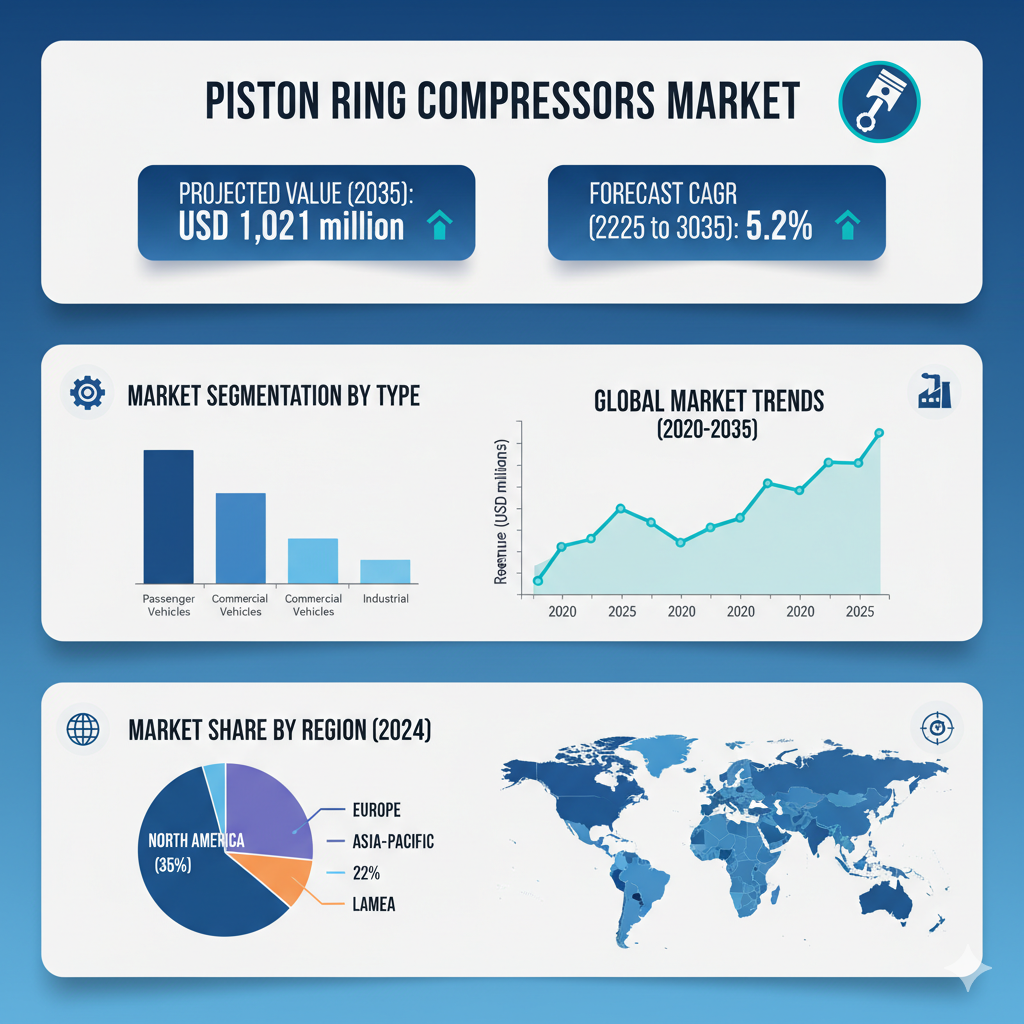

The global piston ring compressors market is projected to climb from approximately USD 615 million in 2025 to USD 1,021 million by 2035, representing a compound annual growth rate (CAGR) of 5.2% over the forecast period from 2025 to 2035. This growth underscores the rising demand from automotive OEMs, industrial machinery assembly, and aftermarket service sectors, driven by the need for precision, efficiency, and durability in piston ring installation tools.

Market Segmentation: Product Type, Material Type & Application

The piston ring compressors market is segmented into several key categories that define its structure and growth dynamics. By product type, the market includes manual piston ring compressors, pneumatic piston ring compressors, hydraulic piston ring compressors, and other specialized variants. Among these, the manual segment is anticipated to hold a significant market share and continue growing at a steady pace due to its affordability and wide applicability across repair workshops and small-scale assembly lines.

By material type, the market is classified into steel, aluminum, composite, and plastic. Manufacturers are increasingly adopting advanced alloys and lightweight materials to improve tool longevity and operator convenience. Aluminum and composite variants are particularly gaining popularity because of their superior strength-to-weight ratio and corrosion resistance.

By application, piston ring compressors are widely used across automotive manufacturing and repair, industrial machinery, marine, and aerospace sectors. The automotive segment continues to dominate the market, supported by consistent global vehicle production and expanding repair and maintenance services. The market is further divided by distribution channels, including online and offline sales. Online distribution is growing rapidly as more workshops and individuals turn to digital platforms for convenient purchasing options.

Finally, by end user, the market is segmented into OEMs and aftermarket users. OEMs require highly durable and precise tools for production lines, while the aftermarket segment caters to repair shops, service centers, and DIY enthusiasts. Geographically, the market spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, each contributing differently based on industrialization and vehicle production levels.

Key Market Trends & Recent Developments

Recent developments in the piston ring compressors market reflect the broader shift toward automation, efficiency, and aftermarket expansion. Innovation has been at the forefront, with several new products introduced that improve installation accuracy and reduce the risk of piston or ring damage during assembly. One example includes the launch of advanced compressor tools with “reverse chamfer” designs that enhance alignment and reduce oil ring issues. Another notable development has been the introduction of specialized compressors designed for specific engine models, offering greater precision for automotive professionals.

The growing demand from the aftermarket and the rise of do-it-yourself (DIY) vehicle maintenance culture have also bolstered sales. As more consumers and independent mechanics undertake repair work themselves, there is a higher demand for easy-to-use, cost-effective manual compressors. In addition, the trend of professionalization among small-scale repair workshops is driving interest in pneumatic and hydraulic tools for improved efficiency.

Regionally, Asia-Pacific is emerging as the fastest-growing market, driven by rapid vehicle manufacturing and industrialization in countries like India and China. India, in particular, is projected to experience a strong CAGR of over 7% through 2035, while China continues to benefit from large-scale automotive production and growing aftermarket demand. Meanwhile, North America and Europe remain key markets due to their advanced manufacturing infrastructure and the presence of major OEMs and aftermarket service providers.

The market is also witnessing a shift toward sustainable materials and ergonomic tool designs. Manufacturers are developing lightweight compressors that reduce operator fatigue and enhance performance. Online distribution has become an increasingly significant channel, especially for aftermarket and DIY buyers, offering better accessibility and competitive pricing compared to traditional industrial supply networks.

Competitive Landscape & Key Players

Competition in the piston ring compressors market is robust, with several leading manufacturers and tool companies investing in research, product differentiation, and distribution networks. Key market participants include MAHLE GmbH, Tenneco Inc., NPR Riken Corporation, Rheinmetall Automotive, TPR Co., Hastings Manufacturing, Shriram Pistons & Rings Ltd, Wiseco Piston Inc., and Draper. These companies compete through innovation, quality assurance, and customer service.

Firms are focusing on technological differentiation by introducing adjustable and ratcheting compressors designed to minimize assembly time and enhance precision. Many are expanding their global distribution networks, particularly in emerging markets where demand for affordable, high-quality tools is rising. Strategic alliances with OEMs, investments in R&D, and the introduction of new ergonomic and durable tool designs are among the key competitive strategies.

The competitive environment also reflects segmentation by price and performance. Premium brands cater to professional automotive assembly lines, while cost-effective manual compressors dominate the aftermarket and DIY categories. This dual-market structure ensures steady demand across varying customer segments and economic conditions.

Outlook & Strategic Implications

With the market expected to reach USD 1,021 million by 2035 and grow at a 5.2% CAGR, the piston ring compressors industry offers strong opportunities for both established players and new entrants. Growth is supported by the steady expansion of the automotive and industrial machinery sectors, as well as the rise in global vehicle ownership and maintenance activities.

To capture market share, companies should focus on developing high-precision, long-lasting tools suited for modern assembly environments. Expanding distribution networks—both online and offline—will be essential to reach the growing aftermarket and DIY customer base. Manufacturers must also tailor products by material and application, catering to diverse needs across automotive, marine, and industrial segments.

Regions such as India, China, and Southeast Asia represent the most promising growth markets due to their rising manufacturing capabilities and expanding vehicle fleets. Firms that prioritize innovation, sustainable materials, and ergonomic designs are likely to gain a competitive advantage.