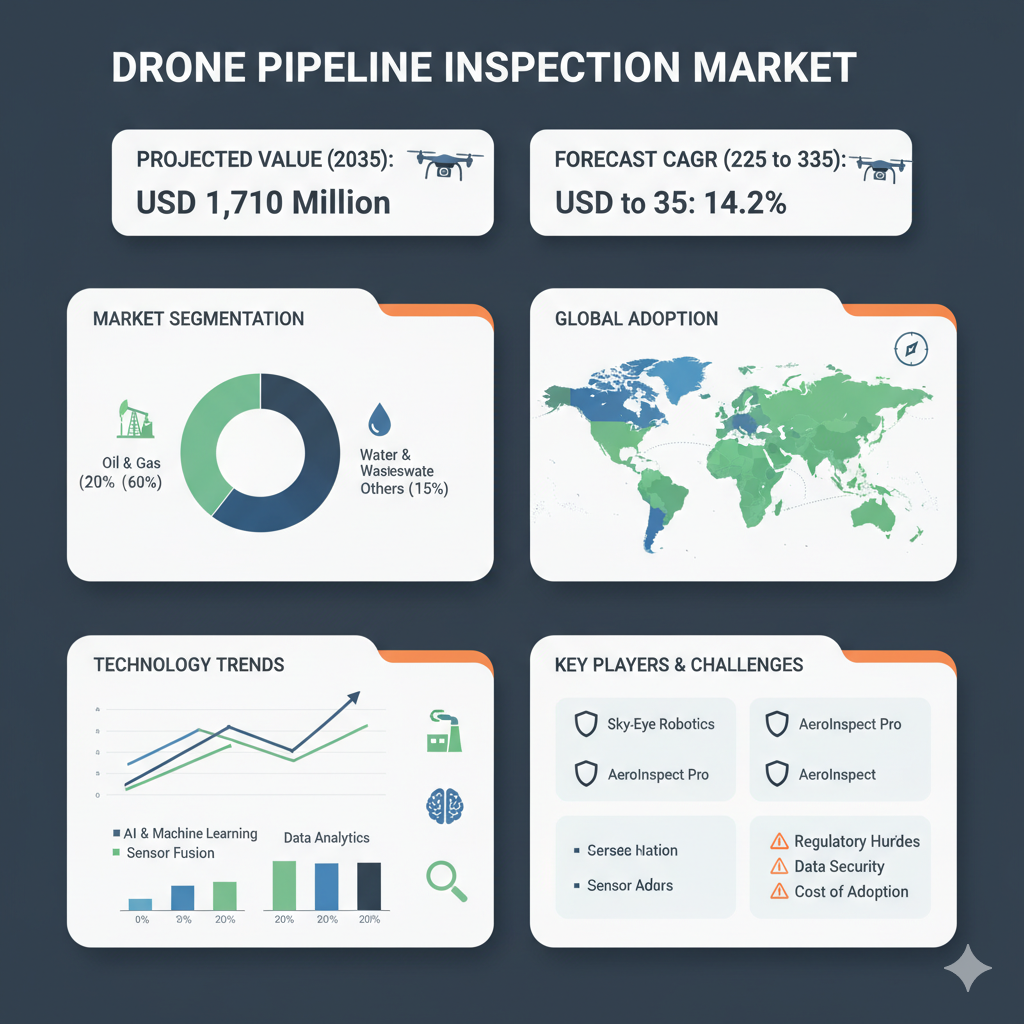

The global drone pipeline inspection market is gaining traction as operators in sectors such as oil and gas, chemicals, utilities, and infrastructure increasingly turn to unmanned aerial vehicles (UAVs) for pipeline integrity and monitoring work. The global drone pipeline inspection market is expected to reach USD 1,710 million by 2035, up from USD 390 million in 2024. During the forecast period (2025–2035), the industry is projected to expand at a CAGR of 14.2%.

Market Segmentation: Drone Type, Payload, Operation, Deployment, End Users & Region

By Drone Type (Fixed Wing, Rotary Wing, Others)

The market analysis identifies the major drone types used for pipeline inspection—fixed-wing, rotary-wing (multi-rotor), and hybrid/others. The rotary-wing segment is forecast to grow at a notable rate, while the hybrid segment is expected to see the highest CAGR, reflecting its growing appeal for combining endurance and maneuverability. Fixed-wing drones are projected to remain the leading segment through 2025 due to their long-range capabilities and suitability for monitoring extended pipeline corridors.

Fixed-wing UAVs offer superior endurance and range, making them ideal for covering pipelines across remote or challenging terrains. Rotary-wing drones, on the other hand, provide flexibility and precise hovering ability, which is advantageous for detailed inspection in complex or congested areas. Hybrid drones are emerging as a solution that merges the benefits of both fixed and rotary configurations. This segmentation shows that the choice of drone type depends largely on terrain conditions, inspection requirements, and cost efficiency.

By Payload Type

Payload technology plays a critical role in the efficiency of drone-based inspections. Modern drones are equipped with advanced payloads such as thermal imaging systems, LiDAR, methane and gas sensors, and high-resolution cameras. The integration of these payloads allows for more accurate detection of leaks, corrosion, structural damage, and insulation issues along pipelines.

With the increasing emphasis on environmental safety and regulatory compliance, payload innovation has become a major driver for the industry. Advanced sensors combined with AI-driven analytics and digital twin systems are transforming traditional inspections into predictive maintenance solutions. This technological advancement enhances data precision and speeds up decision-making for pipeline operators.

By Operation

Based on operation mode, the market can be segmented into remotely piloted, optionally piloted, and fully autonomous drones. Currently, remotely piloted drones dominate due to existing regulatory and safety limitations. However, advancements in artificial intelligence, real-time data analytics, and beyond-visual-line-of-sight (BVLOS) technologies are paving the way for greater adoption of semi-autonomous and fully autonomous inspection operations.

As automation technology matures, autonomous drones are expected to handle longer and more complex inspection routes with minimal human intervention, significantly reducing operational costs and risks associated with manual inspections.

By Deployment Technique

Deployment techniques in the drone pipeline inspection market include scheduled inspections, condition-based inspections, real-time monitoring, and integration with digital twin and asset management systems. The market is witnessing a strong shift from traditional interval-based inspection methods to condition-based and predictive monitoring.

This evolution is driven by the need to minimize downtime, enhance efficiency, and reduce maintenance costs. Drones are increasingly being deployed in remote and hazardous environments where conventional inspection methods are costly, time-consuming, and potentially unsafe. The deployment technique adopted by an operator often determines the overall effectiveness of the inspection and the return on investment.

By End Users and Region

The primary end users of drone pipeline inspection services include the oil and gas industry, utilities, mining, chemicals, and water management sectors. The oil and gas industry remains the largest end-user segment due to the extensive network of pipelines that require regular monitoring for safety and environmental compliance.

Regionally, North America leads the global market due to its established energy infrastructure and favorable regulatory framework for drone operations. Europe and Asia-Pacific are also expected to experience rapid growth during the forecast period, driven by increasing investments in energy infrastructure and the modernization of aging pipeline systems. The United States, China, and Germany are projected to be the key contributors to global revenue growth, supported by technological innovation and the expansion of energy projects.

Recent Developments and Competitive Landscape

The competitive landscape of the drone pipeline inspection market is characterized by continuous innovation, strategic partnerships, and mergers and acquisitions among key players. Prominent companies operating in the market include SZ DJI Technology Co. Ltd., Lockheed Martin Corporation, Qualcomm Technologies Inc., BAE Systems PLC, Israel Aerospace Industries, Teledyne FLIR LLC, and AgEagle Aerial Systems Inc.

In recent years, several companies have introduced next-generation drones specifically designed for industrial applications. For instance, new AI-powered drones are being developed with increased payload capacity, carbon-fiber construction, and improved flight endurance to handle longer inspection missions. The integration of advanced sensors such as LiDAR, infrared, and methane detectors with cloud-based analytics platforms is becoming a standard feature, enabling real-time data processing and predictive insights.

Competition in the market is also intensifying as drone manufacturers, technology providers, and service companies seek to differentiate themselves through advanced sensor integration, superior data analytics, and cost-effective inspection models. Established aerospace and defense firms leverage their expertise in UAV technology and systems integration, while newer entrants focus on niche services such as automated data analysis and AI-driven inspection solutions.

Key factors influencing competitiveness include the range and endurance of drones, sensor accuracy, regulatory compliance (especially for BVLOS operations), and the ability to integrate inspection data with asset management systems. Companies that combine these capabilities effectively are expected to gain a significant market advantage over the next decade.