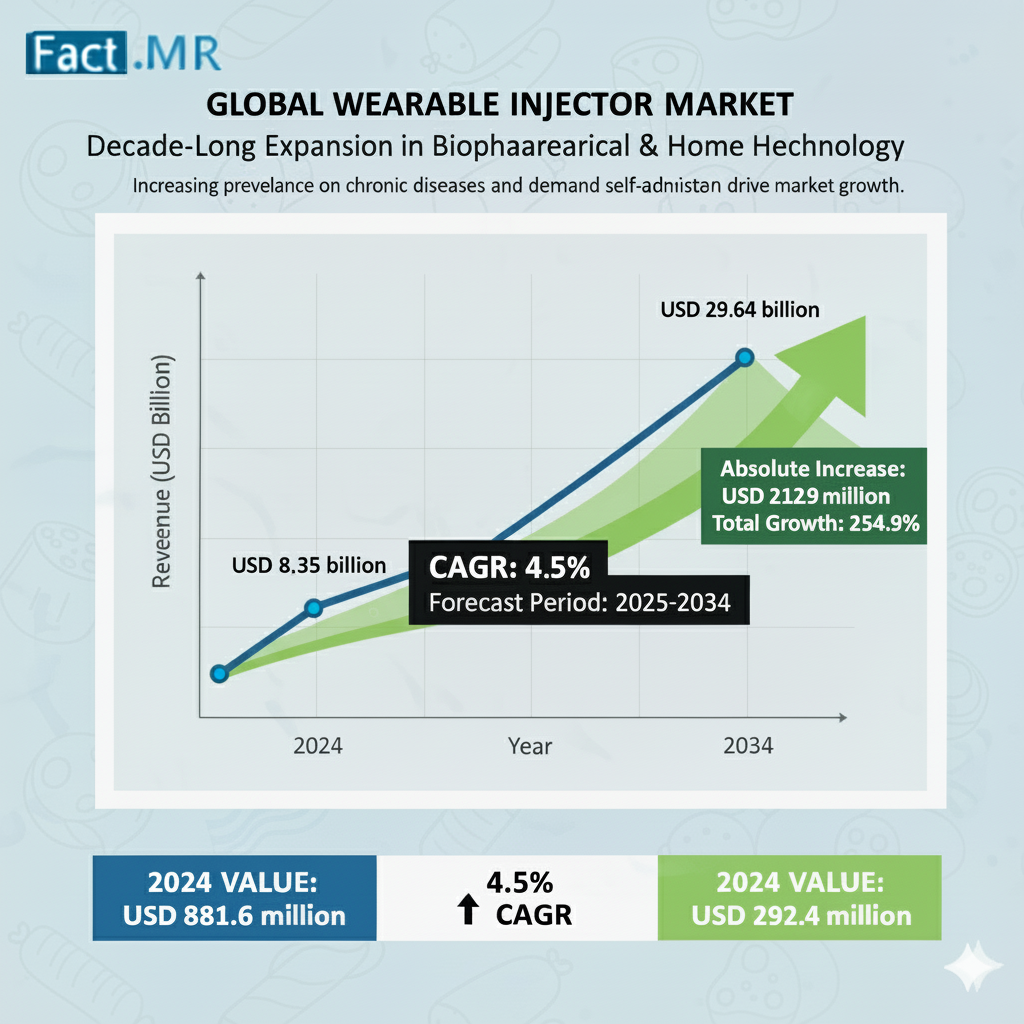

Worldwide revenue from wearable injector sales is estimated to reach US$ 8.35 billion in 2024. The global wearable injector market size has been analyzed to climb to a value of US$ 29.64 billion by the end of 2034, expanding at a remarkable CAGR of 13.5% over the next ten years (2024 to 2034). These compact, patient-worn devices—functioning as discreet pumps or patches—deliver medications subcutaneously with precision, offering basal, bolus, or continuous dosing options. By simplifying administration, enhancing adherence, and enabling long-term therapeutic effects, wearable injectors are revolutionizing drug delivery, particularly for chronic conditions.

What Are Wearable Injectors?

Wearable injectors are innovative medical devices worn directly on the body to administer drugs under the skin in a controlled, automated manner. Resembling small patches or pumps, they ensure consistent dosing while allowing patients mobility and discretion. Advanced models incorporate connectivity for integration with mobile apps or healthcare systems, enabling remote monitoring of adherence, dosing patterns, and treatment progress by providers.

Key Growth Drivers:

- Connectivity and Remote Monitoring: Most devices feature Bluetooth or app integration, facilitating personalized care and real-time data sharing with clinicians.

- Precision and Safety: Automated dosing minimizes errors, with built-in safeguards like needle-retraction mechanisms to prevent injuries.

- Cost-Effectiveness in Settings: Increasingly adopted in clinics, labs, and diagnostics due to lower costs compared to traditional controlled-delivery systems.

- Technological Advancements: Progress in strain sensors and sterile injectables supports multifunctional applications in robotics, therapies, and monitoring.

- Pharma Innovation: Emergence of biologics necessitates devices handling high-viscosity formulations, alongside auto-injectors and pen systems.

Body-worn patch injectors dominate, accounting for US$ 7.12 billion in 2024 sales (85.3% market share), projected to reach US$ 25.59 billion by 2034 at a 13.7% CAGR. These adhesive patches, up to mobile-phone-sized, excel in non-clinical subcutaneous delivery of large volumes and viscous drugs.

Regional Insights:

- North America: Holds 3%global share in 2024, driven by high adoption, reimbursement availability, aging populations, and government initiatives. The U.S. alone commands 89.1% of the regional market (US$ 2.77 billion in 2024), growing at 9.7% CAGR to US$ 6.99 billion by 2034. Key players like Becton, Dickinson and Company, and rising chronic diseases fuel demand.

- East Asia: 1%share, with Japan at 34% regionally (US$ 400 million in 2024, 14.9% CAGR to US$ 1.6 billion). The new “C150” insurance category simplifies reimbursements for Dexcom G6 CGM users injecting insulin daily, covering all diabetes types without hospital applications.

Category Insights:

- Off-Body Injectors: Belt-worn pumps with cannulas (14.7% share in 2024) suit extended infusions, promoting patient freedom.

- Distribution Channels: Retail pharmacies lead with 34.7% share (US$ 2.85 billion in 2024, 13.4% CAGR to US$ 10.17 billion), owing to easy access and variety for ultra-large-volume needs. Hospital pharmacies and e-commerce follow.

Adoption in Chronic Disease Management:

Wearable injectors align with patient-centric design, emphasizing human factors for instant, seamless care. Ideal for biologics and lifestyle-related illnesses (e.g., diabetes), they automate predetermined doses, boosting compliance in fast-paced societies.

Challenges Facing Manufacturers:

Despite promise, hurdles persist:

- High Costs: Significantly pricier than pens or prefilled syringes, limiting accessibility.

- Reimbursement Gaps: Public systems offer scant coverage, compounded by low awareness.

- Availability Issues: Restricted distribution hampers penetration, especially in cost-sensitive markets.

Competitive Landscape:

Leading firms include West Pharmaceutical Services, Amgen, Insulet, Ypsomed, Tandem Diabetes Care, Becton Dickinson, MannKind, Valeritas, Dexcom, and Bespak. Strategies focus on collaborations:

- May 2023: Viridian Therapeutics partnered with Enable Injections to evaluate enFuse technology for preclinical candidates.

- March 2023: Thermo Fisher Scientific and Stevanato Group teamed for pre-sterilized cartridges, assembly, and fill-finish.

Device makers also engage contract manufacturers to scale on-body injectors amid demand.

Market Segmentation:

By Product Type:

- Body-Worn Patch Injectors

- Off-Body Worn Injectors

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- e-Commerce

By Region:

- North America

- Western Europe

- Eastern Europe

- Latin America

- East Asia

- South Asia & Pacific

- Middle East & Africa

In summary, wearable injectors are transforming healthcare through innovation, connectivity, and patient empowerment, though cost and access barriers must be addressed for broader adoption. With strong regional leadership in North America and Asia, the market’s trajectory signals a shift toward efficient, home-based chronic care solutions.

Browse Full Report-https://www.factmr.com/report/wearable-injector-market