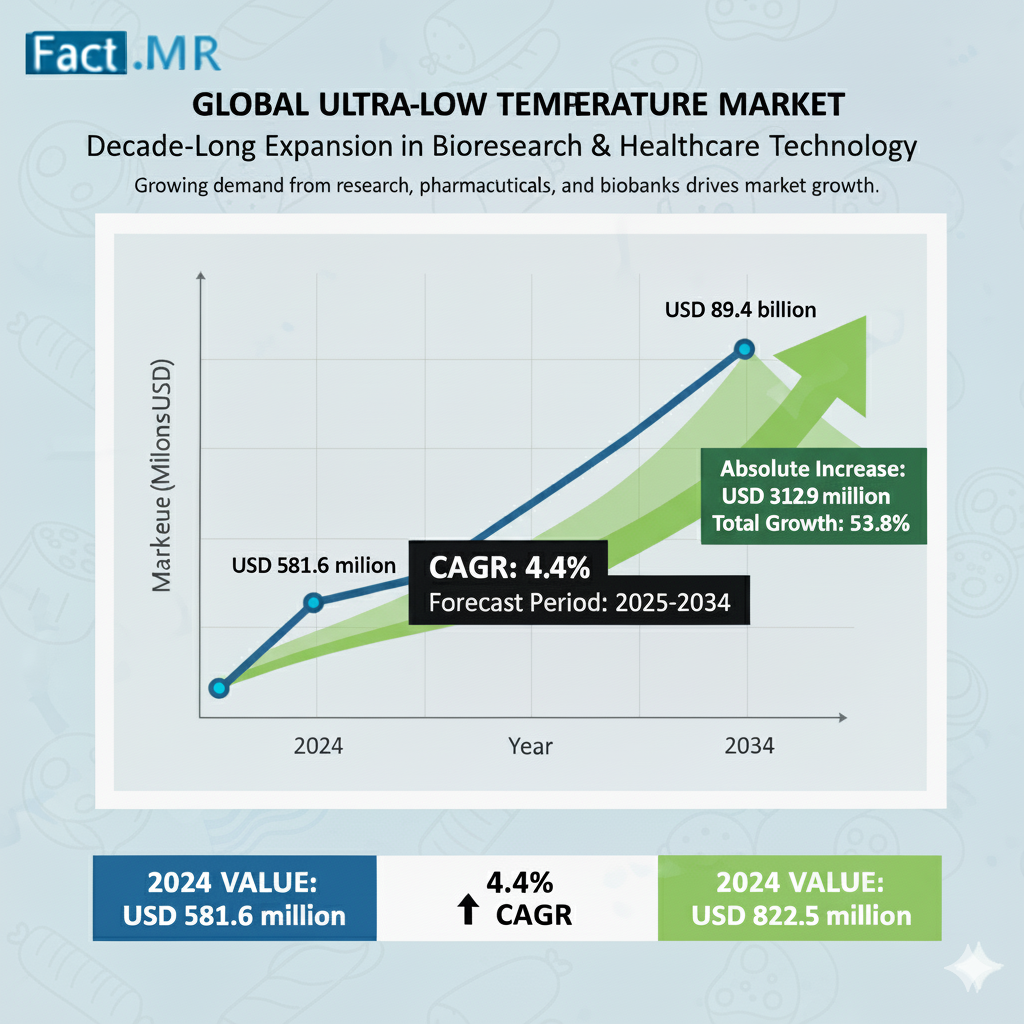

The global ultra-low temperature freezer market size is calculated at a size of US$ 581.6 million in 2024 and is projected to expand at a CAGR of 4.4% to reach US$ 894.5 million by 2034-end.This expansion reflects rising demand for reliable cold-chain solutions in healthcare, research, and biobanking, driven by the need to preserve temperature-sensitive biological materials, vaccines, and blood products at ultra-low temperatures (typically -40°C to -150°C).

The COVID-19 pandemic was a pivotal catalyst. Global blood and blood-component demand surged, underscoring the critical role of ULT freezers in vaccine storage and distribution. In February 2021, Godrej Appliances launched refrigerated mobile vans and ULT freezers in India to transport Covaxin and Covishield vaccines at 2–8°C. Similarly, in December 2020, Scientific Laboratory Services (SLS) partnered with Eppendorf to supply ULT freezers across the UK for COVID-19 vaccine logistics. These initiatives highlighted the indispensable nature of ULT infrastructure during public health crises.

Beyond the pandemic, market growth is fueled by expanding R&D in chronic and infectious diseases, supported by government funding for clinical trials. Energy efficiency and sustainability are emerging trends, with manufacturers prioritizing eco-friendly refrigerants and low-energy designs to meet regulatory and environmental standards.

Regionally, North America holds a significant share, valued at US$139 million in 2024, led by the United States (US$61.9 million). The U.S. benefits from a robust presence of key manufacturers, heavy investments in genetic research, precision medicine, and personalized therapeutics. Early adoption of advanced technologies positions the U.S. as the regional leader, with a projected 4.8% CAGR to reach US$99.1 million by 2034.

East Asia is expected to account for 23.1% of the global market by 2034, with South Korea alone reaching US$47.7 million. Japan, valued at US$37.6 million in 2024, is seeing a 4.9% CAGR driven by increased healthcare spending and improved blood product systems. Despite lagging in ULT availability during COVID-19, Japan has since accelerated infrastructure investments, boosting freezer adoption.

In Europe, Germany stands out due to its high cancer burden—Europe represents one-eighth of the global population but one-quarter of cancer cases, with 3.7 million new patients annually (WHO). Ongoing oncology trials and surgeries requiring blood transfusions are increasing demand for ULT freezers in hospitals and research institutes.

Key Market Drivers: Blood Transfusion and Emergency Storage:

ULT freezers are vital for storing blood and blood components during surgeries, chemotherapy, organ transplants, and trauma care. The World Health Organization identifies anemia as a major public health issue, disproportionately affecting pregnant women, children, and adolescent girls. Road traffic accidents claim 1.35 million lives annually (CDC), with victims aged 5–29 most at risk, further elevating blood demand. ULT freezers and refrigerated vans ensure safe, long-distance transport of viable blood products, especially in emergencies.

Barriers to Adoption: High Costs and Alternatives:

Despite demand, high capital costs deter adoption in budget-constrained facilities. Advanced automated ULT freezers are expensive, prompting hospitals to opt for cheaper alternatives like dry ice, liquid nitrogen, or standard biomedical refrigerators. These factors are expected to temper sales growth in cost-sensitive markets over the forecast period.

Start-up Innovation:

The ecosystem is seeing fresh disruption. India’s Yotuh Energy develops electric refrigeration systems for cold-chain vehicles, featuring variable-speed AC, rapid cooling, and energy-saving modes. U.S.-based Ember LifeSciences offers the cloud-connected, self-refrigerated Ember Cube, a reusable shipping box that simplifies logistics and reduces waste.

Product Preferences: Chest vs. Upright Freezers:

Chest ULT freezers dominate, valued at US$295.4 million in 2024 and projected to grow at 4.7% CAGR to US$466.1 million by 2034. Their superior energy efficiency, temperature uniformity, and high-capacity storage make them ideal for long-term sample preservation in biobanks and labs. Upright models, including floorstanding and benchtop/undercounter variants, grow slightly slower at 4.1% CAGR but remain popular in space-constrained settings.

End-User Landscape: Biobanks Lead:

Biobanks are the largest end users, holding a US$196.6 million share in 2024 and growing at 4.1% CAGR to US$294.3 million by 2034—capturing 32.9% of the market. They rely on ULT freezers to preserve cells, tissues, and DNA for personalized medicine and genomic research. Hospitals, pharmaceutical companies, and academic institutes follow, driven by drug development and clinical storage needs.

Cooling Range Segmentation:

- -41 to -86°C: Most common for vaccines, blood, and biological samples.

- -87 to -150°C: Used for specialized applications like drug compounds and flammable materials.

Application Breakdown:

- Blood & blood products

- Biological samples

- Drug compounds

- Flammable materials

- Others

Competitive Landscape:

Leading players include Thermo Fisher Scientific, Haier Biomedical, Eppendorf AG, PHC Corporation, Arctiko A/S, Helmer Scientific, Bionics Scientific, Glen Dimplex, BINDER GmbH, Azbil Corporation, Panasonic Healthcare, BioLife Solutions, LABCOLD, and Remi Group.

Innovation is intense. In October 2023, Haier Biomedical launched energy-efficient TwinCool Frequency Conversion ULT freezers for labs. In June 2021, Thermo Fisher Scientific introduced the TSX Series with exterior illumination, frost management, and cloud-connected monitoring—enhancing usability and reliability.

Companies are also pursuing partnerships, acquisitions, and capacity expansion to strengthen supply chains and meet global demand.

Regional Summary:

- North America: Innovation hub, led by U.S. genetic and precision medicine focus.

- East Asia: High growth in Japan and South Korea via healthcare modernization.

- Europe: Germany drives demand through oncology research.

- Other Regions: Latin America, South Asia & Pacific, Middle East & Africa show gradual uptake as infrastructure improves.

The ULT freezer market is on a firm growth trajectory, propelled by biobanking, personalized medicine, and emergency blood logistics. While high costs and automation premiums pose challenges, technological advancements, energy efficiency, and start-up innovation are broadening accessibility. With biobanks and chest freezers leading adoption, the market is poised to play a central role in global healthcare and research through 2034.

Browse Full Report-https://www.factmr.com/report/5115/ultralow-temperature-freezer-market