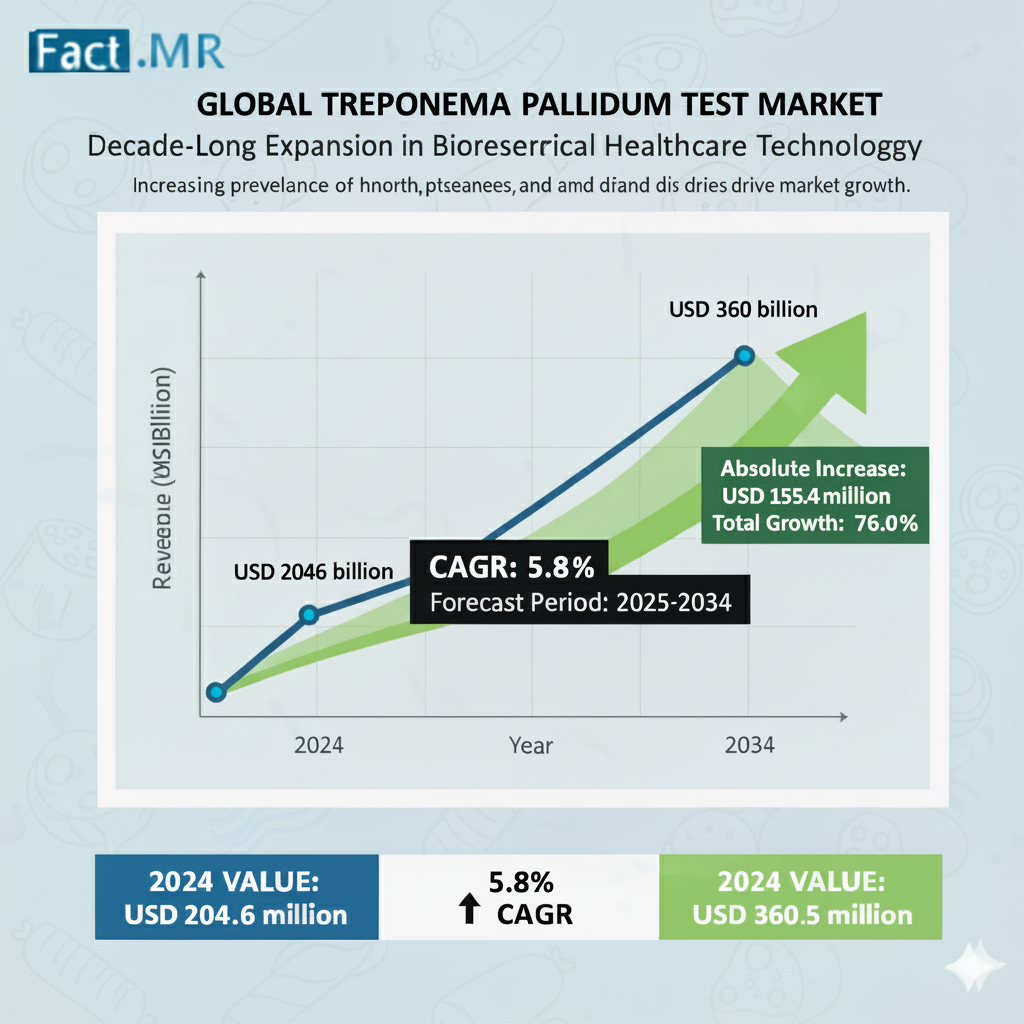

Worldwide revenue from the sales of Treponema pallidum test kits is expected to reach US$ 204.6 million in 2024. The global Treponema pallidum test market is analyzed to climb to a value of US$ 360 million by the end of 2034, expanding at a CAGR of 5.8%.This growth reflects increasing syphilis prevalence, technological advancements in diagnostics, and heightened public health focus on sexually transmitted infections (STIs).

Syphilis, caused by the bacterium Treponema pallidum, remains a significant global health concern. Diagnostic approaches fall into two categories: treponemal (confirmatory) tests and non-treponemal (screening) tests. Treponemal tests, such as fluorescent treponemal antibody absorption (FTA-ABS), Treponema pallidum particle agglutination (TP-PA), and enzyme immunoassay/enzyme-linked immunosorbent assay (EIA/ELISA), detect specific antibodies to the pathogen. These antibodies appear early after infection and persist lifelong, even post-treatment, indicating either current or past infection. Non-treponemal tests, including Venereal Disease Research Laboratory (VDRL), rapid plasma reagin (RPR), unheated serum reagin (USR), and Treponema pallidum hemagglutination (TPHA), measure non-specific antibodies and are used for screening, monitoring treatment response, and assessing disease activity.

Detection methods are broadly classified as direct (identifying the bacterium itself) or indirect (detecting immune responses). Key assays include VDRL, RPR, USR, TPHA, TPPA, FTA-ABS, EIA/ELISA, and emerging molecular techniques. Recent laboratory breakthroughs have enabled culturing T. pallidum, facilitating studies on its metabolism, gene expression, and virulence, which in turn supports advanced test development.

Key Market Growth Drivers:

Several factors propel market expansion. Rising syphilis incidence, driven by changing sexual behaviors, unprotected sex, promiscuity, and gaps in public health infrastructure, heightens testing demand. Inadequate healthcare access in underserved regions exacerbates prevalence, necessitating widespread screening.

Public awareness campaigns, educational initiatives, and advocacy for early STI detection—particularly syphilis—boost testing rates. Integration of syphilis screening with HIV programs, given co-infection risks, further amplifies demand among high-risk groups like men who have sex with men, transgender individuals, and pregnant women.

Technological innovations enhance testing efficacy. Rapid diagnostic tests (RDTs), point-of-care testing (POCT), and molecular diagnostics offer faster, more accurate, and accessible results, ideal for resource-limited settings. Regulatory support from bodies like the FDA and CDC standardizes protocols, ensures quality, and promotes adoption. Supportive reimbursement policies and increased healthcare investments in developed and developing nations improve access, including home-based kits.

Globalization and migration facilitate syphilis spread, underscoring the need for traveler screening. Emerging drug-resistant T. pallidum strains demand robust testing to guide therapy and contain outbreaks.

Market Opportunities for Manufacturers:

Manufacturers are capitalizing on healthcare funding surges and favorable STI testing reimbursements. Behavioral shifts toward high-risk practices elevate routine screening needs. Integration of testing into primary care, mobile units, and home kits expands reach. Opportunities also lie in developing affordable, resistant-strain-detecting assays and OTC options for underserved populations.

Challenges Impeding Adoption:

High costs pose a major barrier. Advanced instruments for molecular and immunoassay tests escalate expenses, compounded by frequent technological upgrades and regulatory changes requiring equipment interoperability. Laboratories in low-income settings face financial strain from these mandates, limiting adoption. Stigma, privacy concerns, and uneven global healthcare infrastructure further hinder progress.

Regional and Country-Wise Insights:

North America commands 23.5% of the global market in 2024, bolstered by economic strength, high purchasing power, and technological prowess. The United States alone holds 75% of North America’s share, with a 2024 value of US$ 37 million, projected to grow at 5.8% CAGR to US$ 64 million by 2034. Government initiatives enhance STI testing access via clinics, community centers, public health departments, and home kits. FDA and CDC regulations ensure quality, while urban growth and HIV-syphilis integration drive demand.

Latin America accounts for 13.9% in 2024. Brazil, valued at US$ 13 million, leads with a 6.6% CAGR, reaching US$ 26 million by 2034. A syphilis resurgence among key demographics prompts extensive screening. Efforts to integrate STI testing into primary healthcare, deploy RDTs, and use mobile units in remote areas fuel growth.

Asia Pacific sees rising demand from urbanization. Europe and other regions benefit from similar public health integrations.

Category-Wise Insights:

By test type, non-treponemal tests dominate with 69.7% share in 2024 (US$ 142.5 million), growing at 5.7% CAGR to US$ 248.6 million by 2034. Their advantages include speed, simplicity, affordability, and high sensitivity for primary/secondary syphilis detection. They enable large-scale screening and treatment monitoring, yielding rapid results.

Treponemal tests complement by confirming infections.

Service providers include hospitals (26.6% share, US$ 54.4 million in 2024, 5.9% CAGR to US$ 96.4 million by 2034), specialty clinics (23.4%), ambulatory surgical centers, diagnostic laboratories, and academic/research institutes. Hospitals excel due to comprehensive services, specialized staff (infectious disease physicians, lab experts), on-site facilities, and accurate result interpretation alongside clinical management.

Competitive Landscape:

Leading companies include AdvaCare Pharma, Beckman Coulter Inc., Bio-Rad Laboratories Inc., Becton Dickinson and Co., bioLytical Laboratories Inc., Bloodworks Northwest, Calibre Scientific Inc., Danaher Corp., OK Biotech Co. Ltd., DiaSorin SpA, Everlywell Inc., Hologic Inc., LetsGetChecked, Meril Life Sciences Pvt. Ltd., and F. Hoffmann-La Roche Ltd.

Players invest in RDTs, POCT, and molecular tech for accuracy and accessibility. In March 2024, Diagnostics Direct LLC formed a Medical Advisory Board to advance syphilis diagnosis, focusing on underserved groups and self-testing via Syphilis Health Check.

In January 2024, NowDiagnostics sought FDA de novo authorization for the First to Know OTC syphilis test—a 10-minute fingerstick assay. The company secured US$ 15 million in Series B funding and investment from Labcorp Venture Fund.

Fact.MR reports detail provider pricing, sales, capacity, and tech expansions.

Market Segmentation:

- By Test Type: Treponemal; Non-treponemal.

- By Service Provider: Hospitals; Specialty Clinics; Ambulatory Surgical Centers; Diagnostic Laboratories; Academic & Research Institutes.

- By Region: North America; Western Europe; Eastern Europe; Latin America; East Asia; South Asia & Pacific; Middle East & Africa.

In summary, the Treponema pallidum test market’s trajectory hinges on balancing innovation with affordability, amid evolving epidemiology and policy support. Sustained growth will depend on addressing cost barriers and expanding equitable access worldwide.

Browse Full Report-https://www.factmr.com/report/treponema-pallidum-test-market