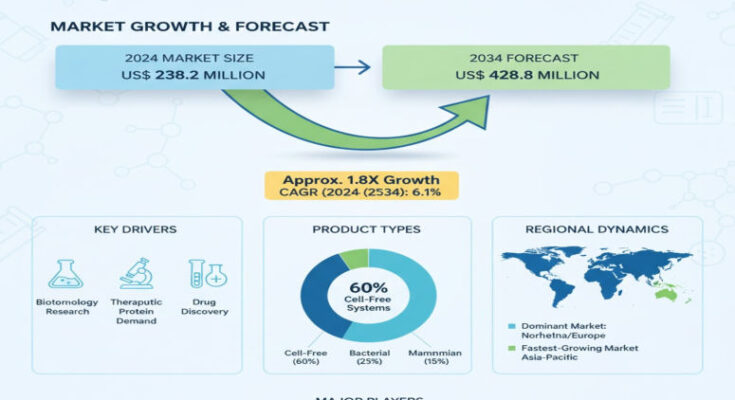

The global In Vitro Protein Expression market is poised for substantial growth over the next decade, propelled by rising demand for therapeutic proteins, precision diagnostics, and cutting-edge research workflows. Valued at approximately USD 238.2 million in 2024, the market is expected to reach USD 428.8 million by 2034, growing at a compound annual growth rate (CAGR) of about 6.1% over the forecast period.

Market Drivers & Key Growth Catalysts

The expansion of the in vitro protein expression market is being driven by several converging forces. First, the proliferation of biologics, monoclonal antibodies, vaccines, and enzyme-based therapeutics has increased demand for systems that can produce recombinant proteins rapidly and reliably. Second, academic, diagnostic, and pharmaceutical research institutions are investing heavily in technologies that support precision medicine and molecular diagnostics, both of which depend on high-quality protein production platforms.

Advancements in genetic engineering tools such as CRISPR, synthetic biology, and automated expression systems have elevated both throughput and reliability. These innovations are making it possible to express complex and previously difficult proteins—including membrane proteins, toxic proteins, or those requiring post-translational modifications—more efficiently, which widens the scope of in vitro expression systems beyond traditional, simpler targets.

The push toward continuous flow expression modes (versus batch) is also becoming a major catalyst. Continuous flow technologies promise higher yields, better reproducibility, and lower costs over time—attributes that appeal to both research labs and industrial players aiming for scale without compromising quality.

Segmentation Insights & Regional Outlook

By product type, the E. coli cell-free expression systems hold the largest share of the market in 2024, owing to their cost-effectiveness, ease of use, and familiarity in many laboratories. Mammalian, insect cell, wheat germ, and rabbit reticulocyte expression systems follow, each serving specialized applications where post-translational modifications, protein folding, or protein complexity are critical.

On the mode of expression, while batch expression remains widely used, continuous flow expression is projected to witness exceptional growth over the next decade. Research and educational institutions are adopting continuous systems more rapidly, motivated by efficiency gains and cost savings for high-volume or repetitive experiments.

Regionally, North America dominates the market, accounting for over 38% of global revenue in 2024. This leadership is owed to robust biopharma infrastructure, substantial R&D investment, and the presence of major platform providers and instrument developers. East Asia is emerging as the fastest-growing region, with China leading the way thanks to strong governmental support for biotechnology, increasing academic-industry collaboration, and expansion of diagnostic and therapeutic protein production capabilities.

Recent Developments & Innovation Trends

Several recent developments are reshaping the in vitro protein expression market. One important trend is the development of hybrid systems and enhanced cell-free platforms that more faithfully replicate in vivo protein folding and modification, helping to express complex proteins that were earlier difficult to produce.

Another major innovation is the integration of continuous flow expression modes into higher throughput workflows. Laboratories are increasingly seeking continuous flow solutions that reduce downtime, simplify scale-up, and improve consistency of protein yield, with many vendors introducing new modules or upgrades to support continuous production.

Also noteworthy is the emphasis on speed and flexibility. Some providers have shortened expression to hours rather than days, enabling swifter experimental timelines. This speed is especially attractive for applications like vaccine development, diagnostic kit manufacturing, and rapid screening of therapeutic candidates.

Investments by major industry players into early development services, contract research, and expression platforms are also accelerating. Collaboration between academic and industrial labs is helping push boundaries, both in terms of new protein targets and in making expression systems more user-friendly, automated, and scalable.

Challenges & Restraints

Despite strong momentum, the market faces substantial challenges. Producing large proteins or proteins with complex post-translational modifications (e.g., glycosylation) remains difficult and often expensive. Yield inconsistency, protein misfolding, and aggregation still plague many expression systems, especially outside of E. coli.

Upfront costs for advanced expression platforms—especially for continuous flow systems or mammalian cell expressors—are substantial. For many smaller research labs or institutions in lower-income regions, the cost barrier can limit adoption. Regulatory and quality control demands are also high for proteins destined for therapeutic or diagnostic use; compliance adds complexity, cost, and time.

Skilled personnel requirements, maintenance of expression systems, and reproducibility between batches are also constraints that researchers and manufacturers must constantly address.

Key Players & Competitive Landscape

The in vitro protein expression market is competitive and populated by both established incumbents and emerging innovators. Major companies profiled include Thermo Fisher Scientific, Lonza Group, Merck KGaA, GenScript Biotech Corporation, Bio-Rad Laboratories, Agilent Technologies, Promega Corporation, New England Biolabs, Qiagen, Genentech (Roche), Novartis, Amgen, Biogen, Pfizer, AstraZeneca, GlaxoSmithKline (GSK), Vertex Pharmaceuticals, Charles River Laboratories, Abcam, and Sartorius AG.

These key players are pursuing multiple strategic paths: expanding expression platform offerings into new cell-free or continuous systems; enhancing ease of use and automation; investing in partnerships with academic and clinical research centers; optimizing workflows for protein yield and purity; and broadening geographic reach into fast-growing markets in Asia and beyond. Many are also focusing on accessory services like purification, labeling, or downstream assay integration, which add value and strengthen customer loyalty.

Browse Full Report: https://www.factmr.com/report/in-vitro-protein-expression-market

Outlook & Editorial Perspective

From an expert editorial vantage point, the in vitro protein expression market is at an inflection point. The growth over the next decade is likely to be as much about quality, speed, and flexibility as about scale. Researchers and manufacturers who can deliver systems that reduce time to result, maintain high fidelity for challenging proteins, and integrate clean production practices will lead the narrative.

Emerging markets, particularly in East Asia, offer fertile ground—not just for adoption of existing systems but for local innovation, service support, and partnerships that can tailor expression systems to indigenous research priorities and cost structures.

Moreover, as precision medicine, molecular diagnostics, proteomics, and vaccine development continue to expand, demand for expression systems will become more specialized. There is a strong opportunity for firms specializing in continuous flow, mammalian expression, or advanced post-expression processing (purification, folding, quality control) to differentiate and capture premium segments.

About the Report

The In Vitro Protein Expression Market study provides a comprehensive forecast from 2024 to 2034. It encompasses segmentation by product type, expression mode (batch vs continuous flow), end-user (academic institutions, biotech, pharma, CROs), application (protein labeling, purification, protein-protein interaction studies, diagnostics), and region. It offers both quantitative forecasts and qualitative insights for stakeholders including researchers, manufacturers, academic labs, and policy makers.