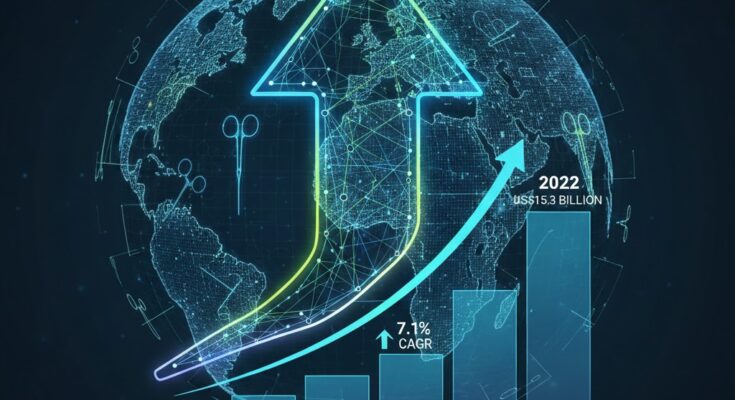

The global laparoscopic devices market, valued at approximately US$7.8 billion in 2022, is projected to grow to US$15.3 billion by 2032, nearly doubling in size over the next decade. Driven by the worldwide shift toward minimally invasive surgery (MIS), rapid technological breakthroughs, and rising incidence of chronic diseases, the market is expected to maintain a steady 7.1% compound annual growth rate (CAGR) throughout the forecast period.

Minimally Invasive Surgery Demand Continues to Reshape Global Healthcare

Hospitals and surgical centers are increasingly adopting laparoscopic procedures over traditional open surgeries due to benefits such as reduced post-operative pain, lower infection risk, shorter hospital stays, and quicker return to normal activities. This shift is one of the primary forces accelerating demand for advanced laparoscopic devices globally.

Simultaneously, the prevalence of chronic diseases—including obesity, colorectal cancer, gallbladder disorders, gynecological conditions, and gastrointestinal diseases—continues to rise. Many of these conditions require surgical intervention, and in most cases, laparoscopy offers safer, more cost-effective outcomes compared to open surgery.

Technological improvements such as integrated imaging systems, enhanced visualization, advanced energy solutions, and robot-assisted surgical platforms are further transforming laparoscopic workflows and enabling surgeons to perform complex procedures with greater precision and safety.

Product Segmentation: Energy Systems Remain the Fastest-Growing Category

Market growth is driven by strong uptake across multiple device categories, with energy systems leading the segment. Energy-based instruments—such as ultrasonic and bipolar devices—are projected to grow at over 8% CAGR, supported by enhanced tissue sealing efficiency, reduced blood loss, and broader compatibility with modern surgical platforms.

Other major product segments include:

-

Laparoscopes

-

Insufflators

-

Closure devices

-

Sample retrieval systems

-

Handheld instruments

-

Robot-assisted platforms

Together, these technologies form the backbone of modern MIS operating rooms.

General Surgery Expected to Maintain Dominance

Among all applications, general surgery remains the largest revenue contributor and is projected to grow at more than 7% CAGR through 2032. High-volume procedures—such as cholecystectomy, hernia repair, appendectomy, and bariatric surgery—continue to shift toward laparoscopic techniques due to their proven safety profile and reduced patient recovery times.

Other key application segments include:

-

Gynecological surgery

-

Urological surgery

-

Colorectal procedures

-

Cardiovascular surgery

-

Pediatric surgery

As laparoscopic education improves across surgical specialties, adoption is expected to expand further.

Hospitals Maintain 70%+ Share of Global Demand

Hospitals continue to represent the largest end-use segment, accounting for more than 72% of total global revenue. This dominance is attributed to:

-

Availability of advanced surgical infrastructure

-

Higher patient inflow

-

Greater access to specialized equipment

-

Presence of skilled surgical teams

-

Advanced reimbursement frameworks in developed markets

Ambulatory surgical centers (ASCs) are also gaining traction, particularly in the United States and parts of Europe, where outpatient minimally invasive procedures are rising due to favorable insurance policies and lower procedure costs.

Regional Growth: Asia-Pacific Leads Expansion; North America Holds Largest Share

Asia-Pacific (APAC) is expected to be the fastest-growing regional market, expanding at more than 7% CAGR during the next decade. This momentum is driven by:

-

Growing healthcare expenditure

-

Expansion of private hospital networks

-

Increasing penetration of medical devices in emerging economies

-

Rising adoption of MIS techniques among surgeons

-

Greater corporate and government investment in surgical training

North America, however, continues to dominate the global market in terms of overall revenue. Strong reimbursement frameworks, early technology adoption, a high number of laparoscopic procedures, and widespread availability of cutting-edge equipment contribute to its leadership position. The region is expected to create an absolute incremental opportunity of more than US$2.5 billion over the forecast period.

Europe remains another important market, driven by strong regulatory standards, well-developed healthcare systems, and a growing elderly population that increasingly benefits from minimally invasive interventions.

Competitive Landscape: Companies Accelerate Innovation and Market Expansion

Key players continue to invest heavily in R&D, product enhancements, and regional expansion to strengthen their position in the global laparoscopic devices market. Several industry leaders are focusing on:

-

Launching advanced energy devices

-

Integrating AI-assisted surgical features

-

Expanding robotic MIS platforms

-

Developing ergonomically improved handheld tools

-

Enhancing training ecosystems for surgeons

Recent strategic initiatives include new energy system launches, expanded robotic stapling solutions, and distribution partnerships designed to improve access across Asia, Europe, and Latin America.

Market Challenges: Surgeon Training and Infrastructure Constraints

Despite its strong growth outlook, the market faces potential barriers:

-

Limited surgeon training in some emerging regions continues to slow adoption.

-

Safety concerns—including trocar injuries, pneumoperitoneum mismanagement, and device misuse—highlight the need for structured training programs.

-

High device costs, particularly for robotic and advanced imaging systems, restrict access in low-income regions.

Addressing these challenges will be critical for accelerating global MIS adoption and ensuring safe, high-quality patient outcomes.

Browse Full Report : https://www.factmr.com/report/laparoscopic-devices-market

Future Outlook: Innovation and Accessibility Will Shape the Next Decade

By 2032, the laparoscopic devices market is projected to be more than double its 2022 value, reshaping surgical care on a global scale. Technological advancements, increased MIS training, and broader access to affordable surgical tools will drive the industry’s next phase of transformation.

The forecast signals strong opportunity for:

-

Healthcare providers investing in MIS capabilities

-

Device manufacturers developing high-precision, cost-efficient technologies

-

Investors targeting growth in robotics, energy systems, and disposable instruments

-

Governments and NGOs supporting skills development and infrastructure in emerging markets