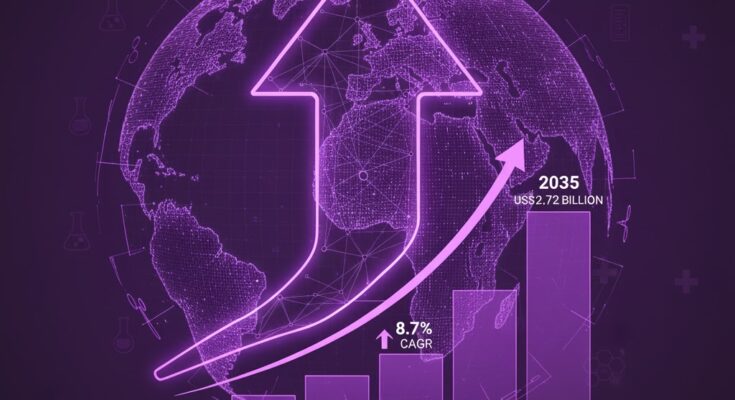

The global clinical trial kits market is projected to grow significantly, expanding from US$ 2.05 billion in 2025 to approximately US$ 4.72 billion by 2035, representing a robust compound annual growth rate (CAGR) of 8.7%, according to the latest analysis from Fact.MR. This surge is being driven by the increasing adoption of decentralized and hybrid trial models, coupled with the rising complexity of biologics development and personalized medicine.

Key Market Drivers: Decentralized Trials, Biologics, and Advanced Logistics

Several converging trends are fueling this market’s strong outlook:

-

Rise of Decentralized & Hybrid Trial Models

Clinical sponsors are increasingly designing trials that reduce patient site visits, using patient‑specific kits for home delivery and direct-to-patient supply. This shift greatly increases demand for reliable logistics and specialized kit management. -

Biopharmaceutical Innovation

The expanding pipeline of biologics, cell and gene therapies, and personalized medicines heightens the need for specialized sample collection and investigational product kits, often requiring strict cold-chain control and custom packaging. -

Greater Outsourcing

Contract Research Organizations (CROs) and logistics providers are increasingly offering integrated service models: combining kit assembly, validated packaging, and temperature-controlled distribution. This integrated approach is minimizing risks and improving trial efficiency. -

Digital & Real-Time Supply Chain Visibility

Technology-enabled platforms that combine automated labeling, real-time tracking, and inventory management are improving transparency and traceability across sites — critical for multinational and remote-participant trials.

Market Segmentation & Trends

-

By Service Type:

-

Logistics dominates, with approximately 54.9% share in 2025, driven by temperature-controlled transport, storage, and real-time tracking.

-

Kitting solutions, making up the rest, involve assembling and personalizing kits per protocol.

-

-

By Clinical Phase:

-

Phase III trials command roughly 53.3% of the market by 2025 — large-scale, multi-site efficacy studies require sophisticated logistics and kit strategies.

-

Phase IV (post-marketing) and other phases (e.g., Phase I/II) also contribute, with increasing adoption of patient-centric designs.

-

-

Regional Dynamics:

-

North America and Europe command strong shares, thanks to well-established trial infrastructure, CRO presence, and regulatory maturity.

-

Asia-Pacific, particularly in China and India, is emerging as a fast-growing region, supported by rising R&D investments, expanding logistics networks, and a growing number of decentralized trials.

-

Competitive Landscape

Several major players are leading the charge in this dynamic and service-intensive market, focusing on quality, compliance, and technology:

-

Q2 Solutions

-

Brooks Life Sciences

-

LabCorp Drug Development

-

Thermo Fisher Scientific (Patheon)

-

Charles River Laboratories

These companies are scaling their kitting and logistics capabilities, investing in cold-chain infrastructure, and integrating digital platforms to provide better visibility, regulatory compliance, and patient-centric delivery.

Challenges & Risks

While the outlook is positive, some headwinds remain:

-

Regulatory Complexity: Regulatory validation of trial materials (e.g., stability testing, documentation) imposes stringent demands on logistics and kitting providers.

-

Temperature Control Costs: Cold-chain logistics, especially for biologics and cell therapies, requires expensive infrastructure and high operational rigor.

-

Supply Chain Disruptions: Geopolitical uncertainty, import/export policies, and inconsistent global documentation standards can interrupt smooth operations.

-

Smaller Biotech Firms’ Barriers: Emerging biotech companies may struggle with capacity, compliance, or cost to leverage advanced kitting and logistics services at scale.

Strategic Implications & Opportunities

For Pharma Sponsors & CROs:

-

Invest in experienced logistics and kitting partners that provide validated, temperature-controlled solutions to safeguard investigational products.

-

Leverage patient‑centric designs, such as home‑delivered kits, to drive trial retention and adopt decentralized models.

For Service Providers (Logistics & Kitting):

-

Develop modular, scalable kitting capabilities tailored to advanced therapies (e.g., cell & gene therapy).

-

Expand digital capabilities: real-time tracking, connected inventory systems, and smart labeling to improve efficiency and compliance.

Browse Full Report : https://www.factmr.com/report/clinical-trial-kits-market

For Investors & Policy Makers:

-

Supporting infrastructure in emerging markets (cold-chain, validated logistics) can unlock high-growth regions.

-

Encouraging regulatory harmonization and certification standards for clinical trial material h andling will help reduce complexity and risk.

Future Outlook

Over the next decade, the clinical trial kits market is expected not only to more than double in size but also to transform fundamentally:

-

Home-based trials and decentralized models will drive higher demand for patient-specific kitting.

-

The growth of biologics, cell therapies, and personalized medicine will accelerate the uptake of highly specialized kit services.

-

Digital, traceable logistics combined with AI-enabled supply chain visibility will become standard, ensuring compliance, reducing waste, and optimizing cost.

As clinical research evolves toward more patient-centric and global models, kit service providers with validated, flexible, and technology-enabled offerings will become mission-critical partners.