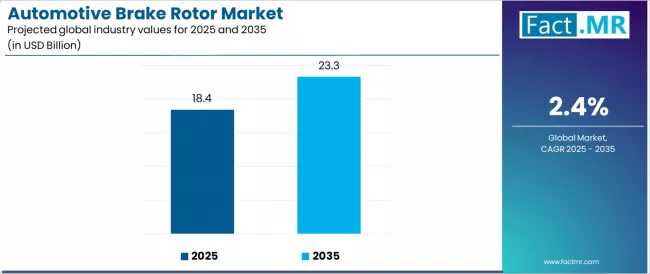

The global automotive brake rotor market is projected to grow from USD 18.4 billion in 2025 to approximately USD 23.3 billion by 2035, expanding at a compound annual growth rate (CAGR) of 2.4 percent, according to a new market intelligence report.

This growth is underpinned by rising global vehicle production, increasing emphasis on vehicle safety, and accelerating adoption of advanced braking technologies — particularly as the automotive industry shifts toward electrification and performance-based customization.

Key Growth Drivers

-

Vehicle Production & Safety Regulations: Expansion in both passenger car and commercial vehicle manufacturing is fueling demand for high-quality brake components. At the same time, stricter safety regulations and customer expectations are pushing manufacturers to invest in premium braking systems that deliver consistent stopping power and heat management.

-

Electric Vehicle (EV) Adoption: The transition to EVs is having a profound impact. Regenerative braking systems, which recover energy during braking, create opportunities for specialized rotor designs that meet both performance and efficiency needs. As EV penetration rises, demand for such rotors is set to increase significantly.

-

Performance & Aftermarket Demand: Enthusiasts and performance vehicle owners are increasingly seeking custom and high-performance brake rotors. These segments demand lightweight materials, improved thermal dissipation, and enhanced durability, prompting innovations in rotor technology.

Market Segmentation & Material Trends

The report breaks down the market by material, vehicle type, and distribution channel, uncovering important trends in rotor manufacturing and end use.

-

By Material:

-

Cast Iron dominates the market with a 62% share, preferred for its excellent heat dissipation, durability, and cost efficiency.

-

Other materials gaining traction include composite/ceramic and steel/alloy rotors, which appeal to high-performance and specialty vehicle segments.

-

-

By Vehicle Type:

-

Passenger Cars present the largest demand, with a projected 68% market share in 2025.

-

Light commercial vehicles, trucks, and performance/aftermarket segments also contribute meaningfully to growth, especially in niche and performance markets.

-

-

By Distribution Channel:

-

The OEM (Original Equipment Manufacturer) channel leads with 64% of sales in 2025, thanks to its alignment with vehicle production and supply chain integration.

-

The aftermarket segment is also expanding, driven by repair, performance upgrades, and replacement demand.

-

Regional Outlook

-

North America is expected to be a major growth engine, thanks to mature automotive manufacturing infrastructure, strong aftermarket demand, and a well-established performance vehicle culture.

-

Europe, especially countries with a rich automotive heritage, is set to benefit from performance rotor demand and ongoing innovation in materials.

-

Asia-Pacific, led by emerging automaker markets, is also expected to see significant traction as vehicle production scales up and consumer preferences shift to performance and safety-focused components.

Challenges & Restraints

Despite optimistic growth, several headwinds could challenge the market:

-

Material Cost Volatility: Cast iron and advanced composite materials face cost pressures due to raw material price fluctuations, which could hamper margins.

-

Complex Manufacturing: Producing specialty rotors (e.g., ceramic, alloy) involves complex manufacturing processes that raise production costs and technical risks.

-

Competition from Alternative Technologies: As EV adoption grows, regenerative braking and newer braking systems may reduce the relative demand for traditional rotors in certain vehicle segments.

Competitive Landscape

Prominent players dominate the brake rotor market, driving innovation and scale:

-

Brembo S.p.A. leads with strong presence in performance and OEM rotor segments.

-

Tenneco, Nisshinbo, Mando, Aisin, and ZF Friedrichshafen are also key players, balancing high-volume production, performance braking, and advanced material development.

These companies are investing significantly in R&D — focusing on lightweight designs, thermal efficiency, and rotor longevity — to capture both OEM and aftermarket opportunities.

Future Outlook & Technology Trends

Looking ahead to 2035, several trends are expected to shape the brake rotor market:

-

Lightweight Materials & Thermal Innovation: Composite, ceramic, and alloy rotors will become increasingly common, especially for high-performance and EV applications.

-

Regenerative Braking Synergy: As EVs become more prevalent, brake rotors integrated into energy recovery systems will be a key differentiator.

-

Customized & Performance Rotors: The aftermarket will continue to grow, driven by performance tuning, motorsports, and consumer demand for specialization.

-

Regional Growth in Emerging Markets: With rising vehicle ownership in developing economies, demand for replacement rotors and OEM parts will accelerate.

Quote from Analyst

“Brake rotors are no longer just mechanical discs — they are core to vehicle safety, thermal management, and performance. The projected rise to USD 23.3 billion by 2035 reflects not just more cars being produced, but a shift toward more advanced braking systems, lightweight designs, and the unique needs of electric and performance vehicles,” said a senior market analyst covering the automotive components space.

Browse Full Report : https://www.factmr.com/report/3873/automotive-brake-rotors-market

About the Report

The market intelligence report offers comprehensive coverage of the global automotive brake rotor market, including detailed segmentation by material (cast iron, composite/ceramic, steel/alloy), vehicle type (passenger, LCV/truck, performance), distribution channel (OEM, aftermarket), and region. It also includes competitive benchmarking, future trends, and growth forecasts through 2035.