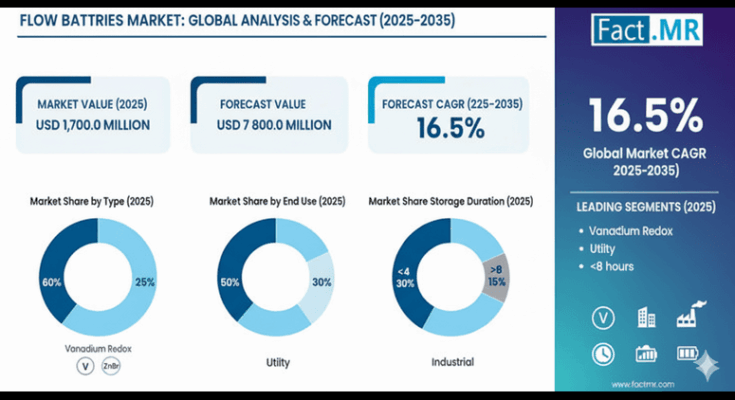

The global flow batteries market is entering a decade of transformative expansion, forecasted to grow from USD 1.7 billion in 2025 to nearly USD 7.8 billion by 2035, representing an absolute increase of USD 6.1 billion and a compound annual growth rate (CAGR) of 16.5%. This growth—equivalent to a 4.6X expansion—signals a major inflection point for manufacturers, suppliers, and energy technology leaders across global markets.

The surge in demand for long-duration energy storage systems, renewable energy integration, and grid modernization initiatives is redefining the competitive landscape for advanced battery technologies. As global utilities and industrial operators intensify their investments in sustainable infrastructure, flow batteries are emerging as a cornerstone technology—delivering extended discharge duration, performance reliability, and superior lifecycle economics.

Market Overview: A Decade of Accelerated Energy Transition

According to the latest industry forecast, Vanadium Redox Flow Batteries (VRFBs) dominate the market, accounting for 60% of total value in 2025, followed by Zinc-Bromine and other advanced chemistries. The utility sector represents the largest end-use category, commanding 50% of total demand, driven by large-scale energy storage projects supporting grid stability and renewable integration.

By storage duration, systems below four hours currently lead the market, though medium- to long-duration solutions (4–8 hours and >8 hours) are expected to grow rapidly as grid requirements evolve and technology costs decline.

The report identifies Asia Pacific, North America, and Europe as the key growth regions, with India, China, and Australia leading the global expansion. India alone is projected to record an impressive 20% CAGR, supported by grid modernization programs and large-scale renewable energy adoption.

Regional Highlights: Market Hotspots Driving Adoption

-

India: Expected to lead global growth, India’s flow battery revenue is set to expand rapidly, supported by nationwide grid modernization and renewable integration projects. Energy manufacturers are accelerating local production and deployment facilities to meet surging domestic demand.

-

China: The Chinese market continues to scale through massive renewable expansion and industrial energy management programs. Local manufacturers are investing heavily in raw material supply chains to support export-oriented production of flow batteries.

-

Australia: As a renewable powerhouse, Australia is deploying advanced grid storage systems to support its energy transition targets. High-performance flow batteries are becoming integral to its utility modernization and smart grid initiatives.

-

United States: Technical innovation and performance-driven R&D define the American market. The U.S. is expected to maintain a 16% CAGR, underpinned by federal energy transition programs and large-scale grid resilience projects.

-

Europe: Germany, the UK, and France lead Europe’s premium flow battery segment, focusing on grid reliability, manufacturing precision, and compliance with stringent EU energy storage standards. Consolidation across suppliers and vertical integration among utilities are defining market competitiveness.

-

South Korea and Japan: Both nations are setting benchmarks in advanced manufacturing and quality compliance. Their precision-focused production ecosystems create export opportunities for certified battery components meeting international reliability standards.

Industry Drivers: Innovation and Integration Define the Next Frontier

The global flow batteries market is being reshaped by several key growth drivers:

-

Renewable Energy Expansion: The ongoing acceleration of solar, wind, and distributed energy systems is driving demand for scalable, long-duration storage to stabilize intermittent generation.

-

Grid Modernization: Governments and utilities are prioritizing infrastructure upgrades to enhance grid flexibility and reliability, creating long-term procurement opportunities for advanced storage systems.

-

Performance and Efficiency Requirements: Flow batteries offer high energy density, long discharge durations, and superior cycle life—meeting the demanding operational standards of utility and industrial applications.

-

Regulatory and Quality Standards: Strengthening compliance frameworks in key markets (EU, Japan, USA) are fostering a preference for certified, high-quality battery technologies over untested alternatives.

-

Technological Innovation: Integration of advanced battery management systems (BMS), AI-based monitoring, and intelligent energy optimization is transforming the performance profile of next-generation flow batteries.

Competitive Landscape: Scale, Integration, and Specialization

The industry is witnessing increased vertical integration, as major energy companies secure supply stability and quality control through acquisitions of battery manufacturers and component suppliers. Profit pools are shifting toward value-added configurations—specialized systems tailored to specific applications and performance standards.

Leading market participants include:

-

Invinity Energy Systems plc

-

Sumitomo Electric Industries Ltd.

-

Rongke Power Co. Ltd.

-

ESS Inc.

-

Primus Power

-

Redflow Limited

-

Lockheed Martin Corporation

-

CellCube Energy Storage Systems Inc.

-

Zinc8 Energy Solutions Inc.

-

Enerox GmbH and JenaBatteries GmbH

These manufacturers are leveraging R&D, scale advantages, and strategic partnerships to address diverse utility, commercial, and industrial energy storage requirements.

Strategic Outlook for Manufacturers: Opportunity in Scale and Specialization

For energy technology manufacturers, the 2025–2035 decade represents a period of strategic expansion, collaboration, and innovation. With global energy storage demand expected to accelerate fivefold, manufacturers capable of delivering high-performance, cost-competitive flow batteries will gain long-term market advantage.

Key strategic imperatives for manufacturers include:

-

Localization of production to serve regional markets and minimize logistics costs.

-

Partnerships with utilities for co-development of performance-certified systems.

-

R&D investment in vanadium and zinc-bromine chemistries to improve efficiency and reduce raw material dependency.

-

Supply chain integration to secure raw materials and maintain production scalability.

-

Compliance leadership through adherence to global quality and energy standards.

As grid operators and renewable developers seek reliable, long-duration storage, manufacturers that combine technical performance, supply reliability, and regulatory alignment are best positioned to capture premium contracts and long-term partnerships.

Browse Full Report : https://www.factmr.com/report/flow-batteries-market

Conclusion: Flow Batteries Enter the Mainstream Energy Era

The decade ahead marks the transition of flow batteries from niche innovation to mainstream adoption. With the global market expected to surpass USD 7.8 billion by 2035, the opportunity for manufacturers, technology developers, and investors has never been greater.

Flow batteries’ ability to provide durable, scalable, and sustainable energy storage positions them as a critical enabler of the world’s clean energy transformation. As governments, utilities, and industries pursue carbon neutrality and energy resilience, flow battery manufacturers are set to become the central architects of the next generation of global energy infrastructure.