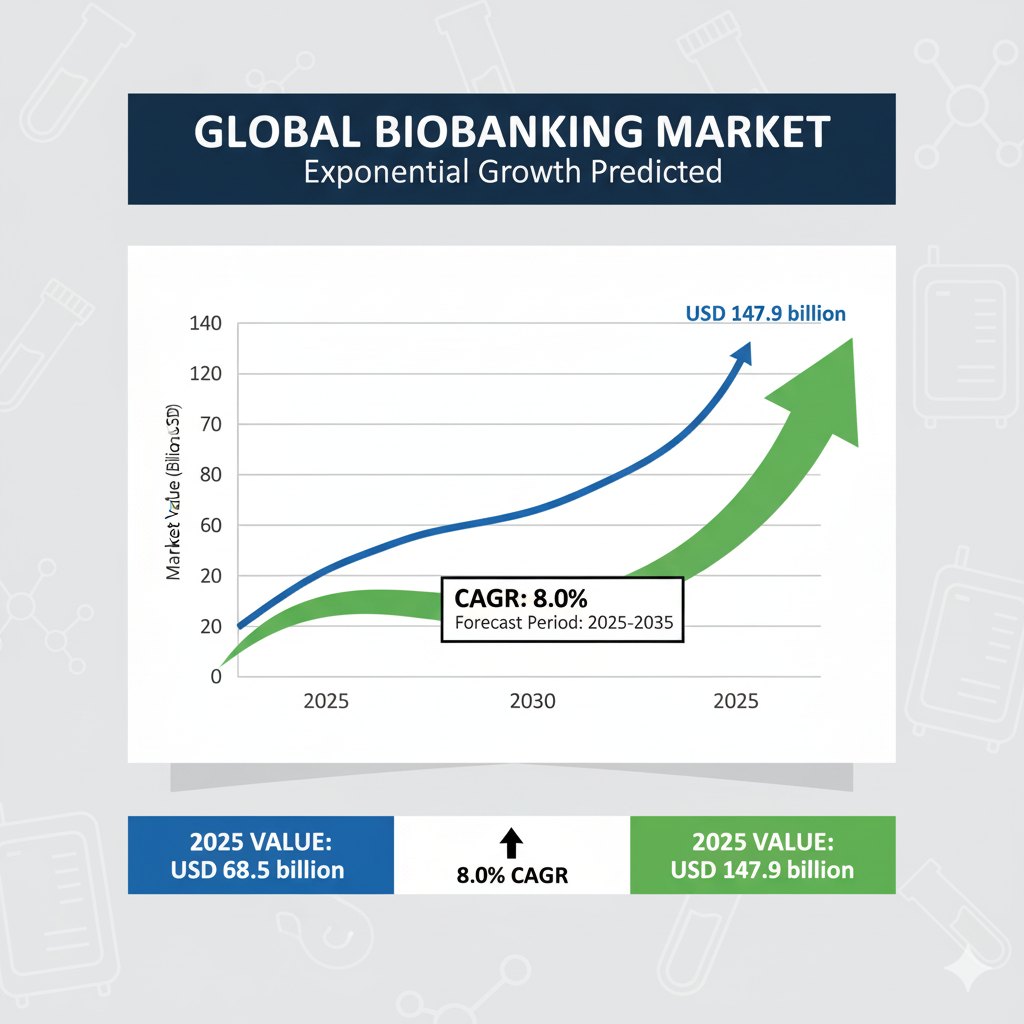

The biobanking industry stands at the threshold of a decade-long expansion trajectory that promises to reshape biological sample storage and research infrastructure technology. The market’s journey from USD 68.5 billion in 2025 to USD 147.9 billion by 2035 This expansion underscores the industry’s pivotal role in modernizing biological sample storage and advancing research infrastructure for pharmaceutical and biotechnology applications.

Biobanking’s critical contribution to personalized medicine, drug discovery, and disease research positions it as a cornerstone technology for global healthcare innovation. Research organizations and pharmaceutical manufacturers are increasingly prioritizing high-integrity sample storage systems, reflecting a decisive shift from traditional preservation methods to advanced automated platforms.

Key Growth Milestones:

The decade-long trajectory highlights two distinct growth phases:

2025–2030: Adoption and Transition Phase

- Market value to rise from USD 68.5 billion to USD 98.4 billion

- Growth of USD 29.9 billion (37.5% of total decade expansion)

- Rapid integration of automated biobanking equipment and preservation systems

- Increasing adoption by pharmaceutical companies and research institutions for standardized protocols and high sample integrity

2030–2035: Integration and Mainstream Deployment:

- Market to expand further from USD 98.4 billion to USD 147.9 billion

- Adds USD 49.8 billion in value (62.5% of decade’s growth)

- Full integration of comprehensive biobanking platforms with research management systems and laboratory infrastructure

- Consolidation of biobanking as a mission-critical component in drug development and personalized medicine workflows

Market Drivers Fueling Growth:

The surge in demand for biobanking technologies is propelled by several interlinked factors:

- Personalized Medicine Initiatives

The growing need for precision therapies is increasing demand for high-quality, degradation-free samples, ensuring consistent research outcomes. - Drug Discovery and Development

Pharmaceutical companies are embracing biobanking systems to maintain sample integrity during compound screening, clinical trials, and regulatory validation, reducing costs and enhancing research effectiveness. - Automation and Research Modernization

Automated sample handling, IoT-based monitoring, and predictive analytics capabilities are transforming sample storage into a strategic enabler of research efficiency. - Regulatory Compliance and Standardization

Regulatory bodies worldwide are promoting standardized storage protocols, driving adoption of compliant, advanced biobanking solutions.

Opportunities for Industry Leaders and Manufacturers:

Industry leaders and solution providers are presented with high-value opportunity pathways across product, application, and geographic segments:

- Equipment Dominance (USD 58.2–66.8 Billion Opportunity)

High-capacity storage equipment with automated handling, temperature monitoring, and research workflow integration will continue to command premium pricing. - Drug Discovery Applications (USD 62.4–71.8 Billion Opportunity)

Pharmaceutical modernization programs and clinical trial demands create sustained need for specialized drug discovery-oriented biobanking systems. - Regional Growth Markets (USD 48.6–62.4 Billion Opportunity)

United States (9.4% CAGR) and Germany (8.8% CAGR) lead with advanced research infrastructure, supported by government funding and strong biotechnology ecosystems. - Technology Integration & Automation (USD 36.4–48.8 Billion Opportunity)

Smart biobanking platforms enabling real-time sample tracking and predictive analytics support the next wave of Research 4.0 initiatives. - Personalized Medicine & Cell Line Applications (USD 22.8–32.6 Billion Opportunity)

Rising demand for cell line preservation and specialized sample management in precision medicine opens premium market segments for advanced biobanking solutions.

Competitive Landscape:

The biobanking market is moderately concentrated, with top players holding nearly 50% of the market share. Leaders such as Thermo Fisher Scientific, Brooks Automation, Azenta Life Sciences, PHC Holdings, and Panasonic Healthcare have established strong competitive positions through:

- Extensive research and development investments

- Integration of precision preservation algorithms

- Strategic partnerships with pharmaceutical operators and biotechnology firms

- Comprehensive global service and support networks

Emerging challengers like Chart Industries, Taylor-Wharton, and Worthington Industries focus on specialized storage solutions and agile technology development, catering to niche research applications and regional markets.

Regional Insights:

- United States: Leads global adoption with a 9.4% CAGR, driven by advanced pharmaceutical R&D hubs in Boston, San Francisco, and the Research Triangle.

- Germany: Europe’s research leader with an 8.8% CAGR, supported by strong government initiatives and pharmaceutical modernization programs.

- South Korea: Achieving a 9.1% CAGR due to advanced integration of biobanking in pharmaceutical research workflows.

- Japan: Focuses on drug discovery applications that prioritize reliability and high-integrity storage capabilities.

Strategic Outlook for Stakeholders:

As the biobanking market evolves from a specialized research tool to a mission-critical component of global healthcare innovation, manufacturers and solution providers have a unique opportunity to lead this transformation.

By focusing on equipment excellence, regulatory-compliant solutions, and research workflow integration, industry leaders can capture significant market share in this fast-expanding sector. Furthermore, strategic collaborations with pharmaceutical companies, research institutions, and government-funded programs will accelerate adoption and solidify competitive advantages.

Browse Full Report: https://www.factmr.com/report/4438/biobanking-market