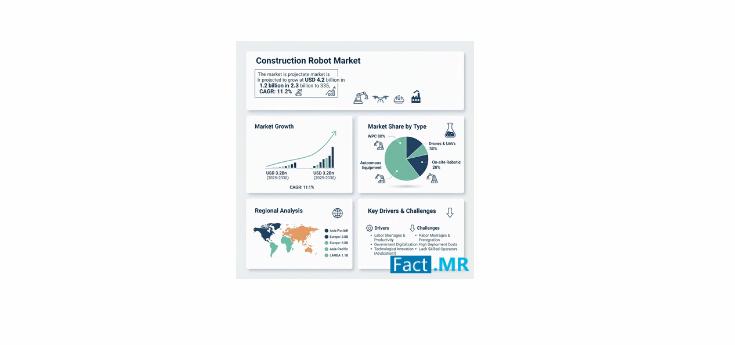

The Construction Robot Market is entering a decade of accelerated growth, projected to rise from USD 4.2 billion in 2025 to USD 12.3 billion by 2035, according to the latest industry forecast. This surge reflects a powerful global shift toward construction automation, robotics-driven efficiency, and digital transformation across residential, commercial, and infrastructure projects. The Construction Robot Market is set to expand at a robust CAGR of 11.2%, representing an absolute increase of USD 8.1 billion over the forecast period.

Between 2025 and 2030, the construction robotics industry is projected to grow by USD 3.2 billion, accounting for 39.5% of total decade-long expansion. From 2030 to 2035, market growth will accelerate further with an additional USD 4.9 billion, fueled by next-generation autonomous construction equipment, intelligent site systems, and strategic collaborations among global construction technology leaders.

Automation Revolutionizing Global Construction

The Construction Robot Market is reshaping how projects are executed, addressing labor shortages, safety challenges, and productivity inefficiencies. By integrating advanced construction robots, companies are achieving 50–70% improvements in productivity compared with traditional methods. These systems enable contractors to meet deadlines, enhance quality, and reduce operational costs.

Government-backed modernization programs and infrastructure investment initiatives are also accelerating adoption. As construction demand surges, automation technologies are becoming essential for maintaining competitiveness and ensuring compliance with evolving safety standards. However, the complexity of robotic integration and high deployment costs remain barriers for smaller contractors and emerging markets.

Autonomous Equipment Leads the Construction Robot Market

By robot type, autonomous equipment dominates the Construction Robot Market, accounting for approximately 40% of global market share in 2025. These robotic systems include self-operating excavators, bulldozers, and material handlers designed to perform repetitive and hazardous tasks with precision and safety. The integration of advanced navigation, AI-based control systems, and predictive maintenance tools gives this segment its competitive edge.

The drones and UAV segment, with a 30% share, is rapidly expanding as contractors adopt aerial robotics for surveying and inspection. On-site robotic arms represent 20% of the Construction Robot Market, serving precision applications in assembly, masonry, and finishing operations. The remaining 10% includes 3D printing robots and other emerging automation technologies.

Earthmoving Dominates Construction Applications

By application, earthmoving leads the Construction Robot Market with a 35% share in 2025. These robots perform excavation, grading, and site preparation tasks critical to infrastructure projects worldwide. The survey and inspection segment holds 30%, driven by the increasing adoption of UAVs and sensor-based monitoring for construction data analytics. Masonry and finishing robots capture 20% of the market, reflecting growing demand for precision finishing and detailing work.

Non-residential projects — including commercial buildings, transportation hubs, and industrial complexes — represent 60% of total construction robot deployments, highlighting the dominance of large-scale applications in the overall construction robotics industry.

Asia Pacific Dominates Global Growth

Regionally, Asia Pacific is leading the Construction Robot Market with exceptional growth rates. India is projected to record the highest CAGR at 13.8%, supported by infrastructure expansion, smart city projects, and government-backed digital construction programs. China follows with a 12.5% CAGR, driven by large-scale infrastructure modernization and smart construction initiatives in major cities such as Beijing and Shanghai.

North America remains a key innovation hub, with the U.S. forecast to grow at 9.6% CAGR due to strong federal infrastructure funding and rapid automation adoption. Europe continues to demonstrate engineering excellence, led by Germany (9.8% CAGR), which emphasizes robotics integration and regulatory compliance. Meanwhile, South Korea (9.2%) and Japan (8.5%) are advancing through intelligent construction technologies that enhance quality and safety.

Across Europe, the Construction Robot Market is expected to expand from USD 1.3 billion in 2025 to USD 3.8 billion by 2035, underscoring steady adoption of construction automation in Germany, the U.K., and France, alongside emerging deployments in Nordic and Eastern European regions.

Market Drivers and Emerging Trends

Three key drivers underpin the Construction Robot Market expansion:

-

Labor Shortages and Productivity Needs: Construction firms face growing pressure to automate, with 25–35% of major operations expected to be roboticized by 2030.

-

Government Digitalization Programs: National initiatives promoting construction innovation and sustainability are catalyzing robotics adoption.

-

Technological Innovation: Advances in AI, machine learning, and autonomous systems are producing smarter, safer, and more adaptable construction robots.

Emerging trends include AI-driven predictive analytics, integration with Building Information Modeling (BIM), and cross-platform interoperability. Together, these innovations make the construction robotics industry a critical enabler of future-ready construction ecosystems.

Competitive Landscape

The Construction Robot Market features approximately 12–18 major players, with moderate global concentration. Market leaders — Komatsu, Caterpillar, and Doosan Robotics — control about 30% of global share through comprehensive product portfolios and long-term construction partnerships. Challengers such as Hyundai CE and Built Robotics are leveraging regional expertise and specialized solutions, while technology innovators like Trimble, DJI, Leica Geosystems, Hilti, Boston Dynamics, and ABB focus on specific robotic applications such as surveying, monitoring, and site automation.

In high-growth regions such as India and China, domestic robotics manufacturers are emerging as agile competitors, offering localized, cost-efficient automation tailored to regional infrastructure demands.

Outlook: A Decade of Automated Construction

With the Construction Robot Market projected to nearly triple by 2035, the next decade will redefine how global construction projects are executed. Robotics adoption is not only transforming project productivity but also shaping safer, more sustainable, and more intelligent building environments. As automation technologies evolve, the construction robotics industry will continue to be a cornerstone of global infrastructure modernization — powering the transition to a fully automated construction future.

The report provides quantitative insights into the Construction Robot Market across key segments, including robot type, application, and region. It covers over 40 countries and profiles leading companies such as Komatsu, Caterpillar, Doosan Robotics, Hyundai CE, Built Robotics, Trimble, DJI, Leica Geosystems, Hilti, and Boston Dynamics.

Browse Full Report : https://www.factmr.com/report/construction-robot-market