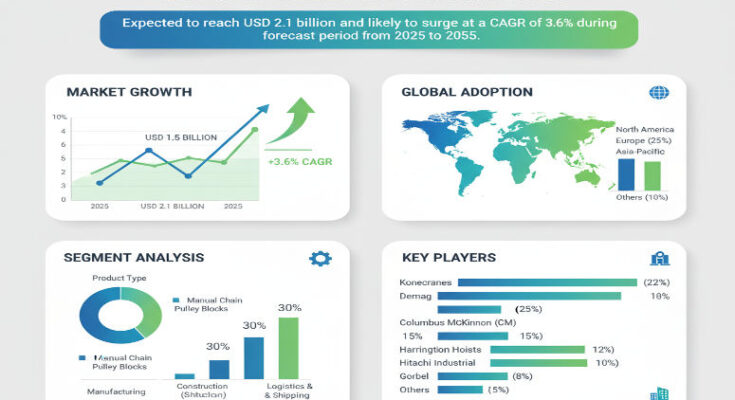

The global chain pulley block market is projected to grow from approximately USD 1.5 billion in 2025 to about USD 2.1 billion by 2035, representing a compound annual growth rate (CAGR) of 3.6% over that period. This steady expansion reflects increasing demand for reliable and efficient material-handling solutions across manufacturing, construction, warehousing, and logistics environments. Chain pulley blocks remain essential lifting devices that provide controlled lifting or lowering of loads with mechanical advantage, especially useful where infrastructure or automation is limited.

Market Drivers and Growth Catalysts

Several key factors are fueling this growth. First, the ongoing industrialization and infrastructure development in emerging economies are driving demand for lifting equipment in manufacturing plants, construction projects, and warehouses. As throughput requirements increase, industries adopt chain pulley blocks to handle heavy loads safely and efficiently. Second, workplace safety regulations and lifting standards are becoming stricter in many regions, pushing companies to upgrade manual hoisting equipment with compliant and certified chain pulley blocks. Third, the rise in e-commerce and logistics operations has increased demand for lifting devices in warehouses and distribution centers, where compact, manual or electric lifting aids are required for mezzanine or low-height lifting tasks. Fourth, cost sensitivity means that manual or straightforward mechanical lifting blocks remain attractive owing to their relative simplicity and lower maintenance compared to full automation.

Product Segmentation & Application Insights

Chain pulley blocks are segmented by operation type, load capacity, and application or end-use industry. In terms of operation, manual chain pulley blocks remain dominant, capturing a large portion of market share in 2025 because they offer lower cost, simplicity, and versatility for many lifting tasks without requiring power supply. Electric or powered versions are gaining adoption, especially in industrial or warehouse environments where repeated lifts and higher throughput are needed. Pneumatic or other powered variants also exist for specific environments or load requirements.

By capacity, lighter loads (≤ 1 ton) represent a significant share—smaller lifting tasks, maintenance operations or material handling in workshops or light industries often use blocks rated ≤1 ton. Medium or heavy capacities are also relevant in construction sites or manufacturing lines that require lifting of heavier components or materials. Each capacity segment has specific design requirements (chain strength, gearing, mechanical advantage) and standards to ensure safe operation.

Industries such as manufacturing, construction, and warehousing are the major end-users. In manufacturing, chain pulley blocks are used for assembly lines, equipment maintenance, or lifting heavy machine parts. On construction sites, they are used for lifting materials, tools, or temporary structures. Warehousing and logistics operations use them for mezzanine access, loading/unloading, and internal material movement. Because of their mechanical simplicity, they remain well suited for smaller facilities or remote locations where powered hoists may not be practical.

Regional Trends and Market Outlook

Regionally, Asia-Pacific is among the fastest-growing markets for chain pulley blocks. Rapid infrastructure development, industrial expansion, and investment in manufacturing hubs are driving demand for lifting equipment in countries such as India, China and Southeast Asia. Many small and midsize enterprises adopt manual lifting blocks due to lower costs and limited access to power infrastructure in some areas.

Mature markets like North America and Europe show steady demand driven by upgrade cycles, safety regulatory enforcement, and replacement of older manual lifting equipment with more efficient or powered blocks. In these regions, businesses are more likely to adopt electric or automated pulley block solutions to improve productivity, reduce manual labor and ensure regulatory compliance. Other regions such as Latin America or the Middle East & Africa are growing but more gradually, as industrial infrastructure improves and companies invest in better material handling tools.

Competitive Landscape & Strategic Initiatives

The competitive landscape comprises global and regional manufacturers of chain pulley blocks, hoists, lifting equipment, and material-handling tools. Key players compete on product reliability, chain strength, mechanical gearing, load rating, safety mechanisms (overload protection, certified load chain), and after-sales maintenance. Many companies are enhancing their designs to reduce weight, improve ergonomics, and provide modular or powered versions to meet different customer needs.

Manufacturers are also expanding distribution networks and service support in high-growth regions, especially in Asia-Pacific. They are offering training, certification, maintenance, and repair services to support manual-block users and help upgrade to electric blocks. Strategic partnerships with construction firms, warehouse operators and equipment integrators are also helping suppliers embed chain pulley blocks as part of lifting solutions.

Challenges and Market Restraints

Despite positive growth, the market faces some constraints. Manual chain pulley blocks, while cost-effective, require labor and can be slower or prone to fatigue if used continuously. For heavier loads, electric or powered versions are needed, which increases cost and complexity. In emerging markets, limited awareness of safety standards or lack of trained operators can lead to improper usage or reduced adoption. Also, alternative lifting solutions—such as hydraulic hoists, electric hoists or overhead crane systems—may compete with chain pulley blocks especially in automated or heavy-capacity environments.

Maintenance and chain inspection are also required to ensure safety, adding to total cost of ownership. Disposal or replacement of worn chains or gears may incur downtime. In some regions, regulatory certification and compliance with load handling standards can be a barrier for smaller manufacturers or users.

Forecast & Strategic Recommendations

Looking ahead to 2035, with the market projected at USD 2.1 billion, companies should focus on innovation in mechanism design, material upgrade (stronger lightweight chains, corrosion resistance), and offering electric or automated variants to expand from manual lifting use. Expanding presence in Asia-Pacific through local manufacturing or distributors can reduce costs and meet regional demand more effectively. Offering training programs, after-sales maintenance and certification will help drive adoption in emerging markets. Differentiation through product reliability, capacity diversity and compliance with safety standards will be key.

Browse Full Report: https://www.factmr.com/report/chain-pulley-block-market

Editorial Perspective

Chain pulley blocks remain a critical yet often overlooked part of the lifting and material handling toolkit. In sectors from small workshops to large industrial plants, the right block can improve safety and efficiency while keeping costs manageable. As industries expand globally and regulations tighten, manufacturers that can deliver proper load-rated, certified, and regionally supported pulley blocks will be ahead of the curve. Over the next decade, the steady growth will reward those who combine mechanical simplicity with improved capacity, better materials and smarter lifting capabilities.