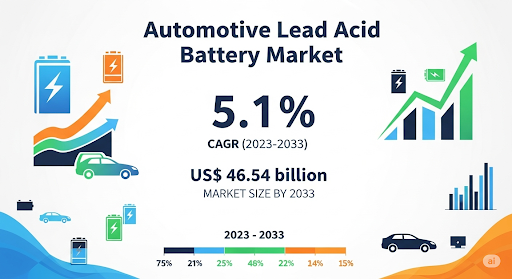

The global automotive lead acid battery market remains one of the most critical segments within the automotive industry, serving as the backbone for vehicle power systems across multiple categories of vehicles. Despite growing competition from lithium-ion and other advanced battery chemistries, lead acid batteries continue to dominate due to their cost-effectiveness, reliability, and established supply chain networks. The value of the global automotive lead acid battery market reached US$ 26.93 billion in 2022, according to the latest market study by Fact.MR. Over the projection period (2023 to 2033), worldwide sales of lead acid batteries are predicted to rise at a 5.1% CAGR to amount to US$ 46.54 billion by 2033-end.

This growth trajectory highlights how traditional battery technologies are evolving to meet modern mobility demands, particularly in light of rapid technological advancements, regulatory changes, and rising global vehicle ownership.

Market Overview

Automotive lead acid batteries are primarily utilized for starting, lighting, and ignition (SLI) functions in vehicles. They also provide energy storage for auxiliary systems in conventional vehicles, hybrid vehicles, and even electric vehicles in certain cases. While lithium-ion technology is gaining momentum for traction batteries, lead acid batteries continue to serve as an indispensable component due to their affordability, recyclability, and strong performance in providing high surge currents.

Factors contributing to the sustained demand include:

- Cost efficiency compared to advanced chemistries.

- Mature recycling infrastructure that ensures environmental sustainability.

- Robust compatibility with internal combustion engine vehicles, which continue to represent the bulk of global vehicle sales.

Market Drivers

The automotive lead acid battery market is driven by several interlinked factors that continue to fuel demand worldwide:

Rising Vehicle Ownership

Global vehicle ownership is on the rise, particularly in emerging economies where affordability and practicality outweigh advanced features. Lead acid batteries are the preferred choice for these regions, given their availability and cost advantage.

Growing Aftermarket Demand

Lead acid batteries typically require replacement every three to five years. This creates a robust aftermarket ecosystem that contributes significantly to overall market growth.

Advancements in Start-Stop Technology

Modern vehicles equipped with start-stop systems rely on enhanced flooded batteries (EFBs) or absorbent glass mat (AGM) lead acid batteries to handle the frequent cycling demands. The rising adoption of start-stop technology has expanded opportunities for higher-performance lead acid battery variants.

Recyclability and Sustainability

Over 95% of a lead acid battery is recyclable, making it one of the most sustainable energy storage technologies available today. This aligns with global sustainability initiatives and strengthens its position against competing technologies.

Market Challenges

Despite strong growth prospects, the automotive lead acid battery market faces several challenges:

- Competition from Lithium-Ion Batteries: As electric mobility expands, lithium-ion batteries are increasingly favored for traction power. This creates a potential long-term threat to the dominance of lead acid batteries.

- Weight and Energy Density Limitations: Lead acid batteries are heavier and offer lower energy density compared to alternatives, which restricts their usage in long-range EV applications.

- Environmental Regulations: Stricter global environmental policies may raise compliance costs for manufacturers, particularly regarding lead usage and disposal.

Regional Insights

- The adoption of automotive lead acid batteries varies across regions, influenced by vehicle ownership trends, regulatory frameworks, and technological adoption.

- North America continues to witness steady demand due to a mature automotive sector and strong aftermarket replacement sales. The region’s adoption of start-stop technologies further boosts the need for advanced AGM batteries.

- Europe is a leader in sustainable mobility and environmental regulations. While lithium-ion batteries dominate EV markets, the demand for lead acid batteries remains significant in hybrid vehicles and for auxiliary purposes. Strict recycling norms also enhance the relevance of lead acid battery ecosystems in the region.

- Asia-Pacific represents the fastest-growing market for automotive lead acid batteries, driven by rising vehicle ownership in countries like India and China. Affordable car ownership, coupled with a robust two-wheeler segment, ensures strong demand for SLI batteries.

- Emerging economies in Latin America and the Middle East are contributing to steady market growth, supported by expanding automotive sales and replacement needs. Limited penetration of EVs in these regions further solidifies the demand for lead acid batteries.

Key Market Trends

Integration of Advanced Battery Technologies

Manufacturers are focusing on innovations in AGM and EFB technologies to enhance the performance and cycling capabilities of lead acid batteries. These developments are aligned with the global trend toward energy efficiency and reduced emissions.

Hybrid Vehicle Adoption

While fully electric vehicles may rely on lithium-ion batteries, hybrid vehicles still incorporate lead acid batteries for auxiliary power. The increasing penetration of hybrid models sustains the demand for advanced lead acid batteries.

Digitalization in Battery Monitoring

Integration of IoT-enabled battery management systems is gaining momentum, allowing users to monitor battery health, predict failures, and optimize performance.

Sustainable Manufacturing Practices

As environmental concerns rise, manufacturers are adopting greener production methods and enhancing recycling facilities to ensure compliance with global sustainability goals.

Competitive Landscape

The automotive lead acid battery market is highly competitive, with numerous global and regional players striving to enhance their product portfolios, market presence, and technological capabilities.

Strategies Adopted by Key Players

- Product Innovation: Introduction of advanced AGM and EFB technologies tailored for start-stop vehicles.

- Strategic Collaborations: Partnerships with automotive OEMs to secure long-term supply agreements.

- Geographic Expansion: Establishing new manufacturing facilities in high-growth regions like Asia-Pacific.

- Sustainability Initiatives: Strengthening recycling programs and promoting closed-loop supply chains.

Notable Players

Some of the prominent players in the global automotive lead acid battery market include:

- Johnson Controls International

- Exide Technologies

- GS Yuasa Corporation

- East Penn Manufacturing Company

- EnerSys

- Clarios

These companies continue to lead the market by emphasizing innovation, sustainability, and strategic partnerships.

Future Outlook

The automotive lead acid battery market is poised for consistent growth over the next decade. While the rise of electric mobility may gradually alter the market landscape, several factors will ensure the continued relevance of lead acid batteries:

- Expansion of vehicle fleets in emerging economies.

- Increased adoption of start-stop systems in passenger cars.

- Growing demand for sustainable and recyclable battery solutions.

Manufacturers are expected to continue investing in technological innovations and sustainable practices to maintain competitiveness and align with evolving global mobility trends.

Conclusion

The automotive lead acid battery market, valued at US$ 26.93 billion in 2022, is projected to grow steadily at a CAGR of 5.1% through 2033, reaching US$ 46.54 billion. This growth is underpinned by rising global vehicle ownership, strong aftermarket demand, and advancements in start-stop technologies. Despite challenges from lithium-ion adoption and regulatory pressures, lead acid batteries remain indispensable due to their affordability, recyclability, and widespread availability.

As the automotive industry transitions towards sustainable and electrified mobility, lead acid batteries will continue to play a crucial role in supporting hybrid vehicles, auxiliary functions, and conventional automobiles. Stakeholders who embrace innovation, sustainability, and strategic partnerships will be best positioned to harness growth opportunities in this evolving market.