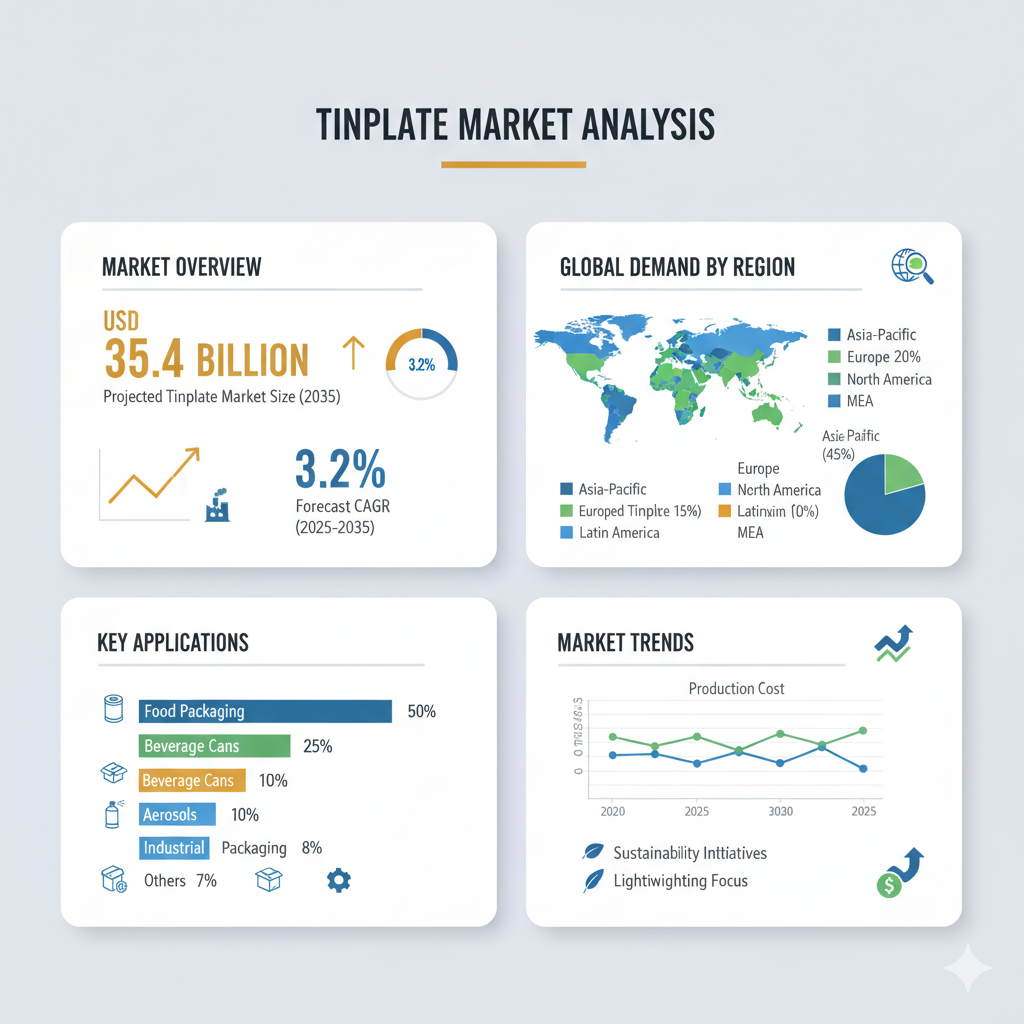

The global tinplate market is projected to increase from USD 25.8 billion in 2025 to USD 35.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2 percent during the forecast period. This growth is being driven by a rising emphasis on sustainable, recyclable packaging solutions, alongside the strong performance of the food and beverage industry. Tinplate is increasingly favored due to its durability, corrosion resistance, and recyclability, making it an ideal choice for industries seeking environmentally responsible materials.

Consumer preference for packaged food, beverages, and household products continues to support the use of tinplate containers. At the same time, regulatory bodies are encouraging manufacturers to adopt packaging that is eco-friendly and recyclable, which further accelerates the adoption of tinplate across various sectors.

Segmentation by Application

Tinplate serves multiple industries, with food cans representing the largest application segment. This dominance is attributed to the material’s ability to provide a high level of protection, extending shelf life and ensuring the safety of packaged food. Beverage cans also represent a significant share of the market, though they often face competition from aluminum alternatives. Nevertheless, tinplate maintains relevance in certain beverage categories, particularly where strength and barrier properties are essential.

Other applications, such as specialty tins for cosmetics, paints, and chemicals, highlight the versatility of tinplate. These niche uses, while smaller in volume, contribute to the material’s continued importance in global packaging.

Segmentation by End-Use

When viewed from the end-use perspective, food cans again take the lead, underscoring tinplate’s central role in global food packaging. Another area of growth lies in aerosols, where tinplate’s strength and resistance to pressure make it particularly suitable. Products such as deodorants, insecticides, and household sprays often rely on tinplate for safety and reliability. Beverage cans remain an important category in the end-use segment, while other uses, such as specialty packaging and industrial applications, add further diversity to the market.

The aerosol segment, in particular, is gaining traction as demand for personal care and household products rises globally. This trend is expected to provide significant opportunities for tinplate producers over the forecast period.

Regional Outlook

The tinplate market is shaped by distinct regional trends. In North America, demand is driven by packaged and ready-to-eat foods, supported by regulations favoring recyclable packaging materials. Latin America is experiencing moderate growth, with expanding packaged food and beverage markets, especially in countries like Brazil.

Western Europe stands out as a leader in sustainable packaging due to stringent environmental regulations and strong consumer awareness around recyclability. Eastern Europe, while slower in growth, tends to follow these sustainability trends as consumer expectations and regulations gradually align with Western European standards.

East Asia is emerging as the powerhouse of tinplate demand, with countries such as China, Japan, and South Korea leading growth. Industrial expansion, rising consumption of processed foods and beverages, and large-scale domestic steel production make this region particularly dynamic. South Asia and the Pacific, including India and ASEAN countries, are also key contributors to growth. India, in particular, is showing rising demand for tinplate in edible oil containers and packaged food, reflecting the region’s changing consumer habits.

The Middle East and Africa represent a steadily growing market, supported by infrastructure development and the gradual rise of packaged goods consumption. Collectively, Asia-Pacific regions are expected to remain the fastest-growing markets due to their expanding middle-class populations and strong industrial bases.

Recent Developments & Competitive Landscape

The competitive landscape of the tinplate market is marked by ongoing innovation, sustainability initiatives, and regional expansion. Prominent companies such as Ball Corporation, JSW Steel, Ardagh Group, Nippon Steel Corporation, Baosteel, ArcelorMittal, JFE Steel, and Tata Steel dominate the global scene, competing on product quality, operational efficiency, and market presence.

Recent developments highlight the industry’s focus on regulatory compliance and sustainability. For example, leading producers in Europe have announced plans to eliminate the use of certain chromium-based chemicals in tinplate production in response to environmental and health regulations. Such moves demonstrate the industry’s shift toward safer, eco-friendly alternatives. In Asia, companies are expanding capacity to meet the growing demand for tinplate. Investments in new plating lines and production facilities underscore the confidence of global manufacturers in the region’s growth potential.

Sustainability remains a key driver of competition. Major players are investing heavily in recycling programs, energy-efficient production methods, and innovative coating technologies that enhance tinplate’s performance while reducing environmental impact. Strategic partnerships, mergers, and acquisitions are also shaping the competitive landscape, as firms seek to strengthen their global reach and consolidate market share.

Despite its strengths, the tinplate market faces challenges such as raw material price volatility, high processing costs, and competition from alternative materials like aluminum and plastics. Nevertheless, continuous innovation in product design and the growing regulatory push for recyclability are expected to keep tinplate competitive in the global packaging market.

Conclusion

The tinplate market is set to achieve steady growth over the next decade, rising from USD 25.8 billion in 2025 to USD 35.4 billion by 2035. This growth reflects strong demand across food, beverage, and aerosol packaging, coupled with increasing emphasis on sustainability and recyclability.

Applications in food cans dominate the market, while the aerosol segment is emerging as a promising growth driver. Regionally, East Asia and South Asia & Pacific will continue to lead expansion, supported by industrial strength and consumer market growth. Meanwhile, Western Europe and North America are expected to maintain stable demand, guided by strict sustainability regulations.

Key players are actively adapting to regulatory changes, expanding their production capacities, and investing in sustainable practices to remain competitive. With innovation, regional expansion, and environmental responsibility at the forefront, the tinplate market is well-positioned for long-term growth and resilience.