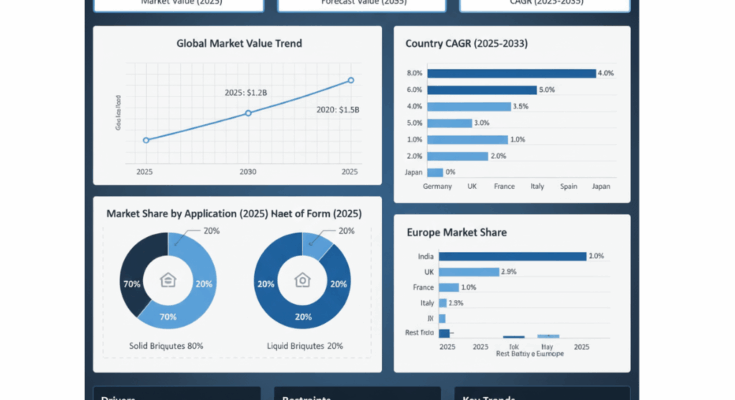

The potassium cyanide market is poised for steady expansion, with global demand expected to rise from USD 1.2 billion in 2025 to approximately USD 1.5 billion by 2035. This represents an absolute gain of USD 0.4 billion and a compound annual growth rate (CAGR) of 2.8% over the forecast period. The potassium cyanide market forecast highlights consistent demand across key industries including gold mining, electroplating, and specialty chemical synthesis, supported by modernization in extraction technologies and stricter environmental safety protocols.

According to the latest potassium cyanide market outlook, rising investment in precious metal recovery and industrial processing will remain the primary growth drivers through 2035. As the global economy transitions toward efficient and automated extraction systems, potassium cyanide continues to play an essential role in maximizing recovery efficiency and maintaining high purity standards in industrial and mining operations. Despite increasing regulatory scrutiny, the compound’s efficiency and cost-effectiveness sustain its importance in modern metallurgical and chemical processes.

Between 2025 and 2030, the potassium cyanide market size is projected to increase by nearly USD 0.2 billion, reaching USD 1.3 billion. This first phase of growth will be led by increasing applications in gold mining and electroplating, alongside the modernization of production and distribution channels in Asia-Pacific and North America. The subsequent five years, from 2030 to 2035, are expected to witness an additional USD 0.2 billion expansion, reflecting continuous advancements in process safety, chemical purity, and the growing adoption of sustainable cyanide management systems.

The potassium cyanide market growth is primarily driven by its dominant role in gold mining, which accounts for more than 70% of total global consumption. Potassium cyanide remains indispensable for achieving high gold recovery rates—up to 95%—through processes such as heap leaching, carbon-in-pulp, and carbon-in-leach techniques. Mining companies across regions such as Africa, Australia, and Asia are increasingly adopting controlled cyanide systems to meet environmental compliance standards while maintaining operational efficiency. The potassium cyanide market forecast indicates that steady gold production and exploration activities will continue to underpin strong demand through the next decade.

In addition to gold extraction, the potassium cyanide market is supported by significant applications in electroplating, accounting for approximately 20% of total usage. The compound enables high-quality metal finishing in jewelry, electronics, and precision machinery manufacturing. Meanwhile, the remaining share of demand originates from chemical synthesis applications, where potassium cyanide is utilized in producing pharmaceuticals, agrochemicals, and specialty intermediates. The diversification of end-use sectors continues to enhance the stability and resilience of the potassium cyanide market outlook globally.

In terms of product form, solid potassium cyanide dominates with roughly 80% of total market share in 2025. Solid briquettes and flakes are preferred for their stability, safety in transport, and ease of storage, particularly in mining and industrial applications. The liquid form accounts for the remaining 20% of demand, primarily used in immediate processing operations where precise chemical concentrations are required. Continuous innovation in liquid cyanide handling and automated dosing systems is expected to improve safety standards and operational control across multiple industries.

Regionally, the Asia-Pacific potassium cyanide market is forecasted to exhibit the strongest growth momentum, supported by mining expansion, chemical industry modernization, and government-backed infrastructure initiatives. India leads the region with an expected CAGR of 4.0%, driven by new gold mining projects, increased mineral exploration, and ongoing reforms to enhance domestic mineral production efficiency. China, with a projected CAGR of 3.4%, remains a key player in both mining and chemical production, supported by a robust industrial base and growing emphasis on regulatory compliance. In Latin America, Mexico is emerging as a critical hub, expanding at a CAGR of 2.6%, supported by gold extraction projects in Sonora, Durango, and Zacatecas. Meanwhile, developed markets such as Germany, South Korea, and the United States show steady progress as companies invest in advanced process safety technologies and sustainable cyanide management systems.

The potassium cyanide market size in Europe is anchored by Germany, where chemical safety innovation and environmental regulation are reshaping production standards. German chemical manufacturers are investing in automated monitoring and digital control systems to improve safety and ensure consistent quality in cyanide processing. In the United States, the focus remains on efficiency, purity, and compliance within key industrial hubs such as Texas and Illinois. South Korea and Japan are also key players in the regional potassium cyanide market outlook, emphasizing smart chemical processing systems, risk reduction, and digital safety management across facilities.

The global potassium cyanide market is moderately consolidated, with major producers accounting for approximately 45% of total supply. Key companies include Orica, Cyanco, and Chemours, which maintain strong positions through technological leadership, global distribution networks, and long-term supply contracts with mining and chemical manufacturing firms. Regional participants such as Taekwang, Anhui Shuguang, Hebei Chengxin, Tongsuh, and Sasol contribute significantly to localized production and distribution, particularly across Asia-Pacific markets. Emerging players like Hindusthan Chemicals and Suyog are focusing on domestic production capacity in India to meet rising internal demand and reduce dependence on imports.

Looking forward, the potassium cyanide market growth will be influenced by a balance of regulatory compliance, technological innovation, and end-user demand. As global authorities enforce stricter safety and environmental standards, manufacturers are investing in R&D to develop advanced cyanide management systems, improve handling efficiency, and minimize waste. These advancements are expected to create new opportunities for sustainable and compliant market expansion.

The long-term potassium cyanide market outlook suggests that while environmental regulations will remain stringent, advancements in chemical safety and closed-loop processing systems will ensure stable supply and responsible growth. As the mining, electroplating, and chemical industries evolve, potassium cyanide will continue to serve as a vital enabler of industrial innovation, performance reliability, and high-value material extraction across global markets.

Browse Full Report : https://www.factmr.com/report/potassium-cyanide-market