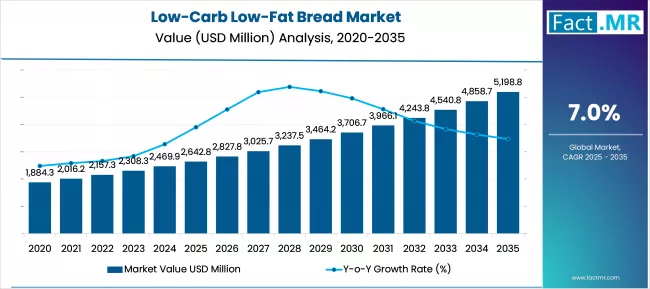

The global low-carb low-fat bread market is on a strong upward trajectory, driven by accelerating consumer interest in healthier eating, rising lifestyle-related diseases, and the rapid adoption of diet-led food choices. According to a new report by Fact.MR, the market is set to rise from USD 2,642.8 million in 2025 to USD 5,198.8 million by 2035, reflecting a robust 7.0% CAGR during the forecast period.

As consumers shift toward bakery alternatives that support weight management, metabolic health, and diet-specific preferences, low-carb low-fat bread continues to gain traction across global food retail shelves and commercial bakery operations.

Strategic Market Drivers

Surging Demand for Health-Focused Bakery Products

The rise in global obesity, diabetes, and cardiovascular risks is driving consumers to adopt low-carb and low-fat food options. This shift is directly increasing demand for bakery products offering reduced calories, lower glycemic impact, and clean-label ingredients.

Low-carb low-fat bread is emerging as a mainstream alternative in retail and foodservice channels thanks to improved formulations that enhance taste, texture, and nutrient density.

Growth of Diet-Specific Eating Patterns

Keto, paleo, diabetic-friendly, and weight-loss diets are reshaping bakery innovation. Manufacturers are introducing breads made from almond flour, coconut flour, seeds, and high-fiber grains to cater to these dietary preferences.

This segment is particularly gaining momentum among fitness-oriented consumers, millennials, and working professionals seeking convenient and healthy meal options.

Expansion of Premium and Functional Bakery Categories

The market is benefiting from premiumization trends, including:

- High-protein low-carb breads

- Gluten-free low-fat formulations

- Fortified breads with omega-3, fiber, plant proteins, and micronutrients

Functional benefits—such as digestive health, satiety, and sustained energy—are strengthening product adoption.

Regional Growth Highlights

North America: Leader in Health-Oriented Bakery Consumption

The U.S. and Canada dominate global demand due to widespread adoption of low-carb diets, high obesity rates, and strong retail availability. Major bakery manufacturers are reformulating classic products with alternative flours and natural sweeteners to meet evolving dietary preferences.

Europe: Clean Label and Wellness Trends Drive Expansion

Europe’s health-conscious population, along with strict nutrition-labeling regulations, is accelerating adoption of low-fat and low-carb bakery items. Germany, the U.K., and the Nordics are at the forefront of innovation in high-fiber and plant-based bread formulations.

East Asia: Rapid Growth in the Urban Health Consumer Base

Rising lifestyle-related conditions, busy work culture, and increased interest in Western-style bakery products are fueling demand in China, Japan, and South Korea. Local bakeries are introducing novel, light, and nutrient-optimized bread formats tailored to regional taste preferences.

Emerging Markets: Rising Urbanization and Modern Retail Boost Market Penetration

Latin America, South Asia, and the Middle East are experiencing a sharp increase in health-focused bakery consumption. Expanding supermarket penetration and growing awareness of diet-related diseases are supporting market entry for new low-carb low-fat bakery offerings.

Browse Full Report: https://www.factmr.com/report/low-carb-low-fat-bread-market

Market Segmentation Insights

By Product Type

- Low-Carb Bread – Gains strong preference among keto and diabetic consumers.

- Low-Fat Bread – Widely adopted for calorie control, weight management, and cholesterol reduction.

- Low-Carb Low-Fat Hybrid Bread – Fastest-growing category offering balanced nutritional benefits.

By Ingredient Formulation

- Whole grains and multigrain blends

- Almond and coconut flour

- Plant proteins (pea, soy, wheat gluten)

- Functional fibers (inulin, psyllium, oat fiber)

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Health Stores

- Online Retail & D2C Brands

- Bakery Chains & Artisan Bakeries

Key Challenges

Despite strong growth potential, the market navigates several obstacles:

- High Production Costs due to premium flours and specialized ingredients.

- Formulation Difficulties in balancing taste and texture while reducing carbs and fats.

- Price Sensitivity among consumers in developing regions.

- Regulatory Scrutiny relating to nutritional claims and labeling accuracy.

Competitive Landscape

Leading companies are focusing on improved taste, clean-label formulations, and dietary certifications (keto-approved, diabetic-safe, gluten-free). Strategic efforts include ingredient innovation, regional expansion, and product personalization.

Key Companies Operating in the Market:

- Grupo Bimbo

- Flowers Foods

- Keto & Co

- Atkins Nutritionals

- Arnold Bread

- Franz Bakery

- ThinSlim Foods

- Modern Foods

- Hain Celestial Group

- Unifood

Players are actively investing in:

- High-protein and plant-based formulations

- Shelf-stable low-carb bread technologies

- Clean-label and additive-free ingredient systems

Recent Developments

- 2024 – Leading bakery brands introduced multi-seed low-carb loaves fortified with plant proteins to meet rising fitness and diet-driven demand.

- 2023 – Several North American online bakery brands expanded their D2C portfolios with gluten-free low-fat options using advanced fiber blends and natural sweeteners.

Future Outlook: The Era of Functional, Clean, and Personalized Bakery

The next decade will redefine the low-carb low-fat bread market through:

- Cleaner ingredient decks

- High-fiber, gut-friendly formulations

- Plant-based protein enrichment

- AI-driven recipe development and quality control

- On-the-go and ready-to-eat functional bakery formats

With health-conscious consumption rising across global demographics, the low-carb low-fat bread segment is well-positioned for sustained growth. Manufacturers that innovate in taste, nutrition, and accessibility will shape the market’s next evolution—offering smarter, healthier bread choices for everyday consumers worldwide.