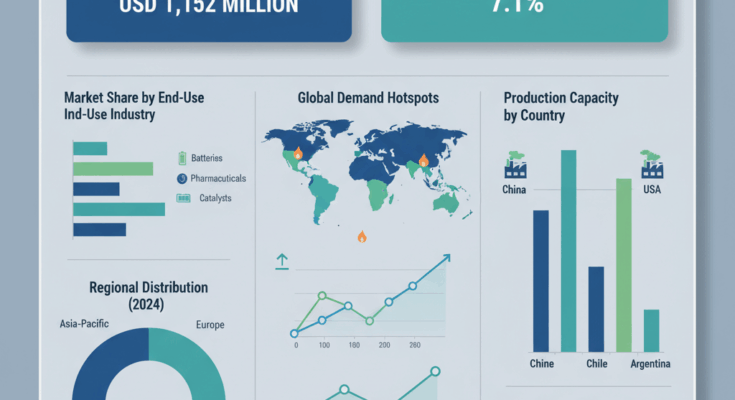

The global lithium acetate market is poised for robust expansion over the coming decade. The market is expected to reach USD 1,152 million by 2035, up from USD 580 million in 2025, registering a compound annual growth rate (CAGR) of 7.1% during 2025–2035. This growth is primarily driven by increasing demand from the electric vehicle (EV) sector, energy storage systems, and industrial applications requiring high-purity lithium compounds.

Market Segmentation and Demand Drivers

By Grade

The lithium acetate market is segmented into battery grade, industrial grade, pharmaceutical grade, and reagent grade. Among these, the battery-grade segment holds the dominant share due to its growing use in lithium-ion battery production and related applications. As the global shift toward electric mobility accelerates, battery-grade lithium acetate is experiencing strong demand because of its role in the synthesis of battery cathode materials.

Industrial-grade lithium acetate finds steady application in chemical manufacturing and polymer processing, while pharmaceutical and reagent grades cater to laboratory, diagnostic, and drug research industries, where high purity and consistency are critical.

By Form

Based on form, lithium acetate is available as powder, crystal, granules, and liquid. Powdered lithium acetate accounts for a significant market share because of its superior solubility, ease of mixing, and suitability in catalyst preparation and battery precursor formulations. Crystal and granule forms are used where handling stability and controlled dissolution are required, while the liquid form is often utilized in specific laboratory and industrial solutions.

By Application

Lithium acetate serves multiple industrial functions. It is widely used as a catalyst in organic synthesis, buffering agent in biochemical systems, and dye fixative in the textile sector. It also functions as a polymer additive to enhance material performance, a laboratory reagent in molecular biology, and a corrosion inhibitor in specialized metal treatments. The growth in catalyst and laboratory reagent applications is supported by increasing R&D activity across chemical and biotechnology industries.

By End-Use Industry

The compound is used across several end-use industries, including automotive, chemicals, textiles, electronics, pharmaceuticals, and research institutes. Among these, the automotive and electronics sectors are the primary drivers of demand due to the rising global emphasis on energy storage and electric mobility. The pharmaceutical and research sectors are also contributing significantly, with lithium acetate being used in buffer formulations and biochemical research.

By Region

Geographically, the lithium acetate market spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa. The Asia-Pacific region dominates the global market, driven by large-scale battery manufacturing in China, Japan, and South Korea. North America follows closely, supported by domestic efforts to strengthen the battery supply chain and reduce dependency on imported lithium compounds. Europe’s focus on sustainability and electric vehicle adoption is also fostering market growth, while other regions are gradually developing niche applications and expanding production capacities.

Recent Developments and Technological Advancements

The lithium acetate market has witnessed several important developments in recent years. Research advancements have demonstrated that lithium acetate can support one-step pre-metalation in battery anodes, improving charge rates and extending battery life. Sustainable manufacturing technologies, such as bipolar membrane electrodialysis, have enabled the production of high-purity lithium acetate at competitive costs with minimal waste.

In addition, the introduction of solvent-free crystallization methods, closed-loop acetate recovery systems, and modular conversion technologies has improved production efficiency and environmental performance. Companies are also embracing green chemistry practices and blockchain-based traceability systems to ensure ethical sourcing and sustainability across the supply chain.

Key Players and Competitive Landscape

The global lithium acetate market is characterized by a mix of established chemical manufacturers and specialized material suppliers. Prominent companies include Albemarle Corporation, Merck KGaA, Honeywell International Inc., Thermo Fisher Scientific, American Elements, Nacalai Tesque Inc., Santa Cruz Biotechnology, MP Biomedicals, and BOC Sciences.

These players compete based on purity levels, product specialization, and supply chain integration. Manufacturers focusing on ultra-high-purity battery-grade lithium acetate hold a strong advantage in the fast-growing EV and energy storage markets. Vertical integration—where companies control raw material extraction, refining, and final product synthesis—also provides cost stability and quality assurance.

Furthermore, innovation in synthesis technology and waste reduction processes helps manufacturers enhance profitability while meeting stringent environmental standards. Regional suppliers in Asia are gaining traction with cost-effective production, although established Western players continue to lead in high-quality, research-grade, and pharmaceutical-grade markets. Strategic partnerships with battery and energy storage firms are becoming a key competitive strategy, enabling co-development and ensuring steady demand.

Market Outlook and Strategic Implications

The lithium acetate market’s projected growth reflects its growing significance in the global transition toward clean energy and advanced materials. While still a niche within the broader lithium chemicals landscape, its expanding applications across energy storage, biotechnology, and catalysis underscore its strategic importance.

To capitalize on future opportunities, companies should prioritize the development of high-purity and battery-grade variants, invest in sustainable and modular production technologies, and strengthen regional manufacturing capabilities to meet rising local demand. Collaboration with research institutions and battery manufacturers can further enhance innovation and ensure long-term market resilience.