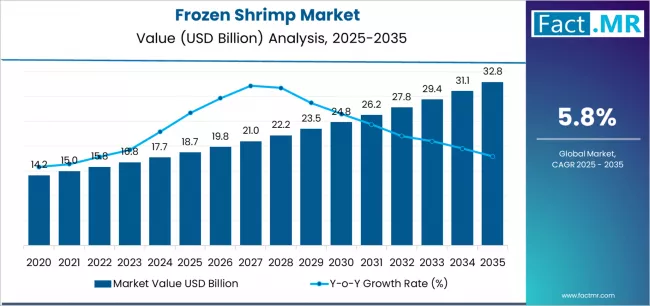

The global frozen shrimp market is set for strong expansion, driven by rising seafood consumption, rapid growth in organized retail, and increasing demand for high-protein, ready-to-cook foods. According to a new study by Fact.MR, the market is projected to grow from USD 18,742.6 million in 2025 to USD 32,847.3 million by 2035. This reflects an absolute increase of USD 14,104.7 million and a total growth of 75.3 percent over the period. Market valuation is expected to advance at a CAGR of 5.8 percent between 2025 and 2035.

As consumers prioritize convenience, nutrition, and frozen food safety, frozen shrimp continues to gain traction in retail freezers, restaurant supply chains, and global export markets.

Strategic Market Drivers

Rising Seafood Consumption and Protein Demand

Global protein intake patterns are shifting, with consumers opting for nutrient-dense seafood products. Frozen shrimp offers high protein content, low fat, and consistent quality, making it one of the most preferred seafood categories in households and commercial kitchens.

Growing awareness of the health benefits of shrimp, including omega-3 fatty acids, is further accelerating product uptake.

Expansion of Frozen Food Retail and E-commerce

The rapid growth of modern retail, coupled with the expansion of cold chain infrastructure, has significantly increased frozen shrimp accessibility. Online grocery platforms are widening product reach, offering extended shelf life and reliable temperature-controlled delivery.

Manufacturers are introducing innovative packaging formats that enhance storage efficiency and maintain product freshness.

HoReCa and Global Trade Momentum

Hotels, restaurants, and catering services remain major demand drivers as they increasingly rely on frozen shrimp for standardized quality and reduced prep time. Exporters across Asia, Latin America, and the Middle East are strengthening their supply capabilities to meet the rising global appetite for premium shrimp varieties.

Technological Improvements in Farming and Processing

Advancements in aquaculture, disease control, freezing technology, and processing automation are enhancing shrimp yield and quality. Investments in sustainable aquaculture practices are also supporting long-term market stability.

Browse Full Report: https://www.factmr.com/report/frozen-shrimp-market

Regional Growth Highlights

East and South Asia

Asia remains the world’s largest producer and exporter of frozen shrimp. India, Vietnam, Thailand, and Indonesia dominate global shipments, supported by aquaculture expansion, favorable coastal resources, and government-backed export initiatives.

Rising domestic consumption in China and Southeast Asia is reinforcing the region’s market leadership.

North America

The U.S. is one of the largest importers of frozen shrimp. Demand continues to grow due to strong retail performance, high seafood consumption, and the popularity of shrimp-based ready meals.

Restaurants and fast-casual chains are increasing their usage of frozen shrimp due to consistent quality, predictable pricing, and wide product availability.

Europe

European markets are advancing through stringent quality standards and a rising shift toward sustainably sourced seafood. The U.K., Spain, France, and Italy are leading consumption driven by expanding frozen food categories and preference for easy-to-cook protein options.

Emerging Markets

Latin America and the Middle East are witnessing increasing frozen shrimp adoption due to expanding urban populations, growing middle-class incomes, and westernization of diets. Improved cold chains and retail penetration are boosting uptake across retail and foodservice channels.

Market Segmentation Insights

By Species

- Whiteleg Shrimp

• Giant Tiger Shrimp

• Pink Shrimp

• Others

By Product Type

- Raw Frozen Shrimp

• Cooked Frozen Shrimp

• Peeled and Unpeeled

• Head-On and Headless

By End Use

- Household and Retail

• Foodservice and HoReCa

• Food Processing and Industrial Use

Challenges and Market Considerations

The market outlook remains positive, but several headwinds persist.

- Disease outbreaks in shrimp aquaculture disrupt production cycles

• Environmental and sustainability concerns require continued investment in responsible farming

• Price fluctuations across international markets affect exporter margins

• Cold chain limitations in emerging markets can restrict distribution efficiency

Competitive Landscape

The frozen shrimp market is moderately consolidated, with global and regional producers competing on quality, sustainability certifications, and processing capabilities.

Key companies include:

• Thai Union Group

• Avanti Feeds

• Nissui Group

• Maruha Nichiro

• Sandhya Marines

• Devi Seafoods

• The Waterbase Ltd

• Omarsa

• Cargill Incorporated

• Seaprimexco Vietnam

These players are expanding aquaculture capacities, investing in pathogen-resistant shrimp breeds, and enhancing traceability to meet global compliance standards.

Recent Industry Developments

- Expanding adoption of automated freezing and IQF technologies to preserve flavor and texture

• Launch of sustainable and certified shrimp lines catering to eco-conscious consumers

• Growth in value-added shrimp offerings like breaded, seasoned, and ready-to-cook formats

Future Outlook

The frozen shrimp market is on track for robust growth as global diets shift toward convenient seafood formats and aquaculture technology continues to advance. Companies that invest in sustainable farming, premium processing, and strong export networks will be positioned to lead the next decade of expansion.

With rising global demand across retail, foodservice, and processing industries, frozen shrimp is set to remain one of the most dynamic segments within the frozen seafood category.