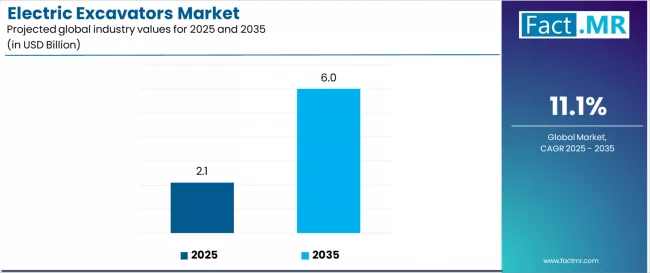

The global electric excavators market is projected to increase from USD 2.1 billion in 2025 to approximately USD 6.0 billion by 2035, representing a compound annual growth rate (CAGR) of about 11.1% over the forecast period. Growth is driven by accelerating adoption of battery-powered heavy equipment, increasing focus on zero-emission construction and mining operations, and deployment of advanced electric machinery for sustainable earthmoving solutions.

Electric excavators-featuring electric motors instead of diesel engines, often powered by lithium-ion battery packs-are becoming integral to modern construction, mining and utility applications. As equipment OEMs, contractors and rental fleets pursue reductions in emissions, noise and maintenance costs, these machines are moving from niche pilots toward mainstream deployment.

➤Key Market Insights at a Glance

Market Value (2025): USD 2.1 billion

Forecast Value (2035): USD 6.0 billion

CAGR (2025-2035): ~11.1%

Leading Product Category: Midi/Standard electric excavators (~48% market share)

Dominant Battery Type: Lithium-ion (pack) segment (~72% share)

Key End-Use Segments: Construction, Mining & Quarry, Utilities/Municipal

High-Growth Regions: North America, Europe, Asia-Pacific

Top Players: Epiroc, Volvo Construction Equipment, Caterpillar, Komatsu, Hitachi Construction Machinery

To Access the Complete Data Tables & in-depth Insights, Request a Discount on this report: https://www.factmr.com/connectus/sample?flag=S&rep_id=3492

➤Market Drivers / Growth Overview

Several interconnected factors are propelling the electric excavators market growth:

Sustainability and zero-emission trends: Regulations and corporate sustainability goals are driving adoption of electric excavators to replace diesel-powered machines in construction and mining.

Battery technology maturity: Advances in lithium-ion battery performance, cost-reduction and integration with heavy equipment are enabling larger electric excavator models.

Operational cost benefits: Electric machines offer lower fuel costs, reduced maintenance and quieter operation, making them attractive for rental fleets and urban use-cases.

Infrastructure and equipment OEM focus: Construction equipment manufacturers and rental firms are investing in electric excavator portfolios and charging systems to support the transition.

Emerging market readiness: Regions with rapid infrastructure build-out (such as Asia-Pacific) are increasingly open to electric equipment, supporting growth outside traditional markets.

At the same time, the market faces challenges: higher upfront capex for electric excavators, limited charging infrastructure at some remote sites, battery life and durability concerns in heavy-duty operations, and competition from hybrid and hydrogen-powered alternatives.

➤Segmentation & Key Drivers

By Size / Class:

Midi/Standard electric excavators (~48% share) dominate, offering the best balance of size, performance and price in many applications.

Mini/Compact electric excavators capture significant share due to urban construction and rental-friendly use-cases.

Large/Heavy electric excavators represent a smaller base now but are expected to gain as battery systems scale.

By Battery Type:

Lithium-ion (pack) leads the market (~72% share) thanks to better energy density and OEM focus.

Ni-based/hybrid systems serve transitional and specialised models.

Other chemistries (emerging battery types) cover niche or early-stage applications.

By End-Use Industry:

Construction is the primary end-use segment and the fastest adopter of electric excavators.

Mining & Quarry applications are growing as equipment electrifies and site-emission restrictions tighten.

Utilities/Municipal segments adopt electric excavators for urban, zero-emission and short-cycle operations.

Segmentation drivers include machine class suitability, battery cost and performance, site infrastructure readiness, and regulatory environment.

➤Regional & Country Insights

North America: A leading region, supported by strong infrastructure investment, rental fleet electrification, and emission-reduction mandates.

Europe: Steady growth driven by stringent emissions regulations, urban construction demand and OEM base for electric equipment.

Asia-Pacific: Poised for fastest expansion, driven by infrastructure projects, electric construction equipment initiatives and increasing machine electrification in China, Japan and India.

Latin America / Middle East & Africa: Emerging growth opportunities as equipment fleets modernise and electric machine adoption improves.

Regional variations are influenced by levels of construction activity, equipment fleet renewal, battery and charging infrastructure availability, and OEM local presence.

➤Competitive Landscape

The global electric excavators market is moderately competitive with several leading equipment OEMs and growing specialist entrants. Key players include Epiroc, Volvo Construction Equipment, Caterpillar, Komatsu, and Hitachi Construction Machinery.

Competitive strategies revolve around:

Developing electric excavator models across size classes with robust battery and drive systems.

Building charging infrastructure partnerships and rental-fleet programmes to accelerate adoption.

Expanding after-sales service, battery-swap or refurbishment systems to address operational challenges.

Launching innovative business models (equipment-as-a-service, leasing of electric machines) that reduce upfront cost burdens for users.

➤Market Outlook & Strategic Insights

Over the forecast period through 2035, the electric excavators market is expected to grow strongly, supported by technology maturation, regulatory push and fleet renewal cycles in construction and mining. Strategic imperatives for stakeholders include:

Prioritising development of midi/standard electric excavators where adoption is greatest.

Investing in battery technology and integration (especially lithium-ion systems) to support performance and cost targets.

Targeting high-growth regions (Asia-Pacific, North America) and working with local fleet operators and rental companies.

Collaborating with charging infrastructure providers and fleet operators to reduce operational barriers to adoption.

Monitoring regulatory trends and incentives in heavy equipment electrification to align product and market strategy.

Companies that align these strategic levers-while managing capex challenges, battery lifecycle issues and service readiness-will be well-positioned to capture value in a market projected to reach around USD 6.0 billion by 2035.

Browse Full Report: https://www.factmr.com/report/3492/electric-excavators-market

Have specific requirements or need assistance on report pricing or have a limited budget? Please contact sales@factmr.com

➤About Fact.MR:

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.