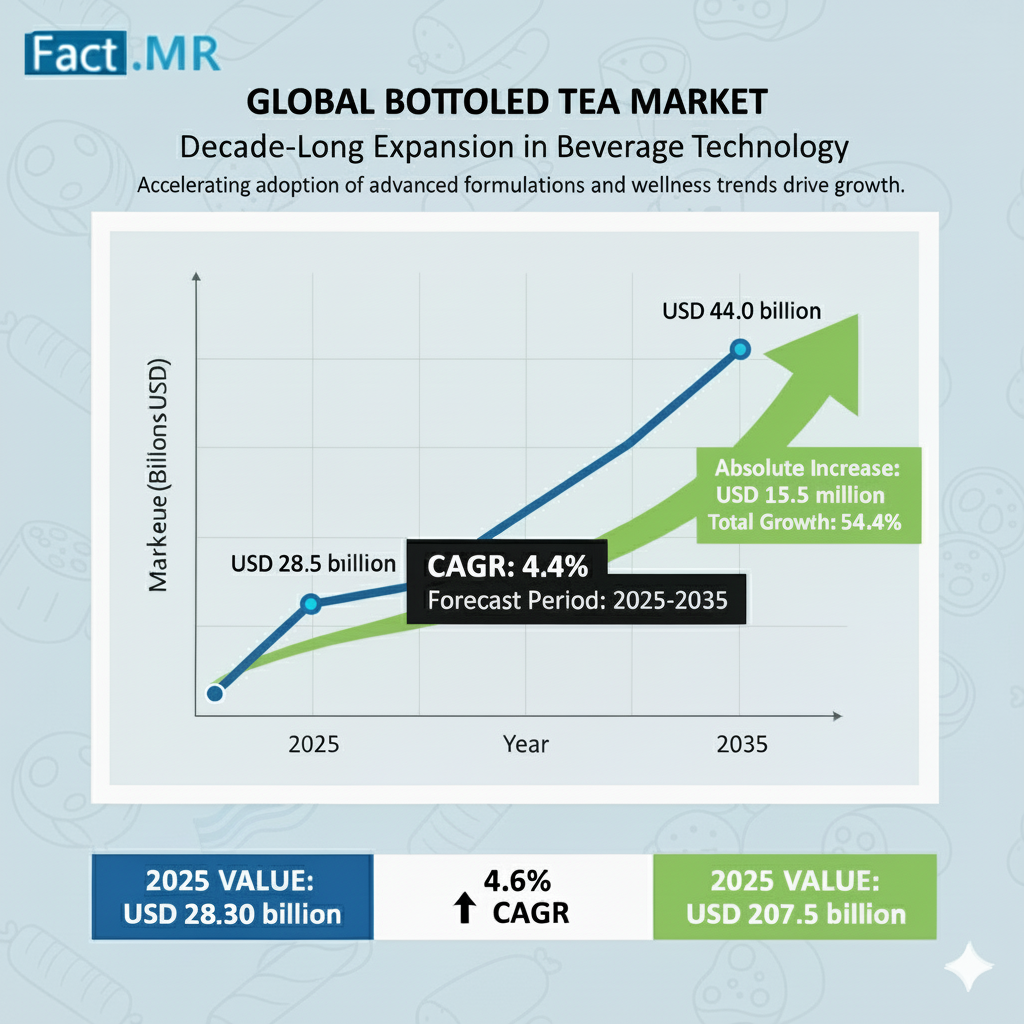

The bottled tea market stands at the threshold of a decade-long expansion trajectory that promises to reshape beverage technology and health-conscious drinking solutions. The market’s journey from USD 28.5 billion in 2025 to USD 44.0 billion by 2035 represents substantial growth, the market will rise at a CAGR of 4.4% which demonstrating the accelerating adoption of advanced tea formulation technology and wellness optimization across retail facilities, vending operations, and health-focused beverage sectors.

Bottled Tea Market Overview by Product Type:

The bottled tea market is segmented by product type into ready-to-drink green/functional teas, black/iced teas, and herbal blends, each catering to distinct consumer preferences and applications. Ready-to-drink green/functional teas dominate with a commanding 52% market share in 2025, driven by their advanced wellness features, including high antioxidant content and health-focused positioning. These teas appeal to health-conscious consumers seeking convenient hydration solutions with functional benefits, such as stress relief and energy enhancement through adaptogenic ingredients.

Black/iced teas hold a 31% market share, maintaining strong demand due to their traditional appeal and familiar flavor profiles, particularly in mainstream refreshment and social settings. Herbal blends, accounting for 17% of the market, cater to niche applications with targeted wellness benefits, leveraging natural ingredients to meet specialized consumer needs.

Looking ahead, the market is expected to see a shift toward advanced functional teas, projected to increase to 55-58% of the market share within the next 3-5 years. This evolution reflects growing consumer interest in enhanced wellness and premium artisanal blends, signaling a move away from commoditized standard tea formulations toward specialized, health-driven products.

Bottled Tea Market by Packaging and Distribution:

Packaging plays a pivotal role in the bottled tea market, with PET bottles leading the segment with a 68% share in 2025. Their dominance is attributed to their convenience, portability, and cost-effectiveness, aligning with consumer demands for on-the-go hydration. Cans, holding an 18% share, cater to vending and convenience store applications, while glass bottles, with a 14% share, are favored for premium and gift-oriented products due to their upscale positioning.

Distribution channels further highlight the market’s accessibility, with retail commanding a 71% share, driven by widespread adoption in supermarkets and convenience stores. Vending and foodservice channels account for 19%, addressing immediate consumption needs, while online channels, with a 10% share, are gaining traction through e-commerce and subscription models, reflecting the growing digitalization of beverage sales.

Regional Analysis: A Global Perspective:

The bottled tea market exhibits diverse regional dynamics, with North America, Asia Pacific, and Europe emerging as key growth regions. The United States leads with a 4.9% CAGR, fueled by robust wellness programs and widespread adoption in major metropolitan areas like New York, California, and Texas. Mexico follows closely with a 4.6% CAGR, driven by value-oriented health positioning and urbanization trends in cities such as Mexico City and Guadalajara.

In Europe, the market is projected to grow from USD 6.8 billion in 2025 to USD 9.6 billion by 2035, at a CAGR of 3.6%. Germany holds a leading 26.2% share, supported by advanced beverage processing and premium organic systems, while the UK and France, with 22.1% and 19.4% shares respectively, benefit from strong health-conscious consumer bases and artisanal integration.

Asia Pacific showcases significant growth potential, with Japan (3.6% CAGR) and South Korea (3.8% CAGR) leveraging traditional tea culture and innovative formulations. Urban centers like Tokyo, Seoul, and Osaka are driving demand for premium and wellness-focused teas, supported by advanced brewing technologies and consumer preferences for quality and health benefits.

Market Drivers, Restraints, and Trends:

Drivers: The bottled tea market is propelled by rising health consciousness and wellness trends, with consumers prioritizing antioxidant-rich and natural hydration options. The convenience of ready-to-drink formats aligns with busy, on-the-go lifestyles, while premium positioning and artisanal teas cater to demand for high-quality, differentiated products.

Restraints: Competition from other beverages, such as coffee and energy drinks, poses a challenge, requiring manufacturers to enhance differentiation through unique formulations. Price sensitivity in certain markets also limits adoption of premium products, particularly in economically volatile regions.

Trends: The rise of functional ingredients, such as adaptogenic teas for stress relief and energy boosts, is a key trend shaping the market. Additionally, sustainable packaging solutions, including recyclable materials, are gaining traction as manufacturers respond to eco-conscious consumer demands.

Competitive Landscape and Key Players:

The bottled tea market is highly competitive, with 20-25 credible players, the top five—The Coca-Cola Company, PepsiCo Inc., AriZona Beverage Company, Ito En, Ltd., and Suntory Holdings Limited—holding approximately 45-52% of the market share. These industry leaders leverage strong brand recognition, extensive distribution networks, and formulation reliability to maintain dominance. Other notable players include Unilever PLC, Nestlé S.A., Starbucks Corporation, Monster Beverage Corporation, and Califia Farms.

Recent developments highlight a focus on innovation and sustainability. Leading companies are investing in advanced functional tea formulations and eco-friendly packaging to align with consumer preferences and regulatory standards. For instance, functional innovators are prioritizing R&D to develop teas with enhanced wellness benefits, while regional specialists leverage local sourcing and taste preferences to capture niche markets.

Strategic Opportunities for Manufacturers:

For manufacturers, the bottled tea market presents significant opportunities to capitalize on health-driven demand and premiumization trends. Key strategies include:

- Investing in Functional Wellness: Developing teas with adaptogenic and antioxidant-rich ingredients to meet growing consumer demand for health-focused beverages.

- Emphasizing Sustainable Packaging: Adopting recyclable and eco-friendly materials to align with environmental regulations and consumer expectations.

- Expanding Regional Presence: Targeting high-growth markets like Asia Pacific and North America with tailored products that cater to local tastes and wellness trends.

- Enhancing Digital Channels: Leveraging e-commerce and subscription models to capture the growing online consumer base.

Bottled Tea Market Outlook and Key Takeaways:

The global bottled tea market is on a robust growth path, projected to expand from USD 28.5 billion in 2025 to USD 44.0 billion by 2035, at a CAGR of 4.4%. Ready-to-drink green/functional teas will continue to lead, driven by health-conscious consumers and innovative formulations. PET bottles and retail channels will remain dominant, while sustainable packaging and digital distribution gain momentum.

Manufacturers that prioritize innovation, sustainability, and regional expansion will secure a competitive edge. By aligning with consumer demands for wellness, convenience, and eco-friendly solutions, industry leaders can drive growth and capture significant market share in this evolving sector.

Browse Full Report-https://www.factmr.com/report/2371/bottled-tea-market