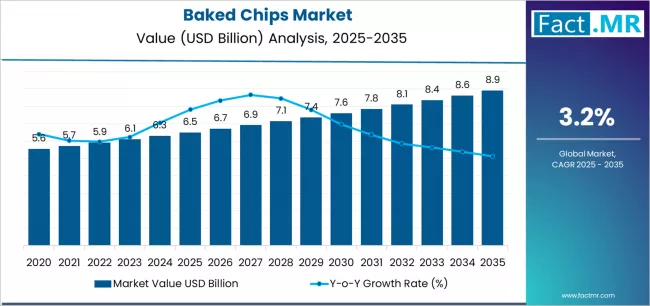

The global baked chips market is set for sustained growth through the next decade, supported by rising health-conscious snacking trends, clean-label product innovations, and strong penetration across retail and e-commerce channels. According to a new analysis by Fact.MR, the market is projected to expand from USD 6,500.0 million in 2025 to USD 8,900.0 million by 2035, reflecting a CAGR of 3.2% and an absolute increase of USD 2,400.0 million over the forecast period.

As consumers shift toward lower-fat, reduced-calorie snack options, baked chips are emerging as a preferred alternative to traditional fried variants. Demand is further accelerated by clean-label positioning, plant-based ingredients, and enhanced nutritional profiles.

Strategic Market Drivers

Health-Conscious Snacking Goes Mainstream

Escalating consumer awareness around obesity, cholesterol, and lifestyle diseases is reshaping global eating habits. Baked chips—positioned as low-fat and guilt-free snacks—are gaining traction across all age groups. Brands are leveraging whole grains, legumes, and vegetable-based formulations to capture demand for high-fiber, high-protein, and gluten-free options.

Clean-Label, Natural Ingredients Gain Ground

The shift toward additive-free, minimally processed foods is steering manufacturers to develop baked chips made with natural seasonings and non-GMO ingredients. The surge in plant-based diets has also opened avenues for products made from chickpeas, quinoa, lentils, sweet potatoes, and beets.

Retail & E-commerce Expansion Accelerates Penetration

Modern retail infrastructure, supermarket chains, and digital grocery platforms have strengthened product availability worldwide. Convenient pack sizes, attractive shelf placement, and online subscription models are boosting year-round consumption.

Innovations in Flavor & Texture Enhance Consumer Engagement

Manufacturers are broadening flavor profiles, incorporating globally inspired seasonings such as peri-peri, sriracha, Himalayan salt, herb blends, and smoky barbecue variants. Improvements in hot-air baking and extrusion technologies are helping bridge the taste gap between baked and fried chips.

Browse Full Report: https://www.factmr.com/report/baked-chips-market

Regional Growth Highlights

North America: The Health Snacking Powerhouse

North America leads global consumption due to the strong presence of better-for-you snack manufacturers and widespread consumer adoption of reduced-calorie diets. The U.S. market continues to expand through high product diversification and rapid launch cycles.

Europe: Clean-Label and Premiumization Drive Sales

Europe’s emphasis on clean-label compliance and sustainable packaging is shaping product development. The U.K., Germany, France, and Nordic countries are witnessing rising preference for organic baked snacks and artisanal flavored chips.

East Asia: Rapid Urbanization and Retail Transformation

China, Japan, and South Korea are accelerating demand, supported by modern retail growth, Western snack influence, and rising youth consumption. Flavor innovation and fusion-based products are fueling regional momentum.

Emerging Markets: Strong Growth Opportunities

Latin America, India, Southeast Asia, and the Middle East are experiencing increasing demand owing to expanding middle-class populations, higher disposable incomes, and strong marketing by global brands.

Market Segmentation Insights

By Product Type

- Potato Baked Chips – Largest segment driven by widespread acceptance.

- Vegetable & Legume-Based Chips – Fast-growing due to health and functional benefits.

- Whole Grain & Multigrain Chips – Preferred for fiber-rich, nutritious snacking.

By Flavor

- Classic Salted – Strong baseline demand.

- Barbecue & Smoky Variants – Popular across North America and Europe.

- Herb & Spiced Flavors – Rapid uptake in Asia and Middle East.

- Exotic & Gourmet Flavors – Premium segment expansion.

By Distribution Channel

- Supermarkets & Hypermarkets – Dominant due to broad assortment.

- Convenience Stores – Strong impulse-buy contributor.

- Online Retail – Fastest-growing, supported by subscription packs and health-food platforms.

- Specialty & Organic Stores – Rising traction among premium shoppers.

Challenges Impacting Market Growth

- Price Sensitivity in Emerging Markets – Higher production costs than fried chips pose pricing challenges.

- Competition from Alternative Healthy Snacks – Protein bars, baked crackers, and fruit snacks intensify rivalry.

- Shelf-Life Limitations – Natural ingredient-based formulations may reduce product shelf stability.

- Raw Material Price Volatility – Fluctuations in potatoes, grains, and vegetable inputs affect profitability.

Competitive Landscape

The baked chips market is moderately consolidated, with companies focusing on product innovation, portion-controlled packaging, and targeted marketing to health-conscious consumers.

Key Companies Profiled:

• PepsiCo (Baked Lay’s)

• Calbee Inc.

• General Mills

• Kellogg Company

• Bare Snacks

• Popchips

• BFY Brands

• Kettle Foods

• Herr’s Food

• Hain Celestial Group

Manufacturers are investing in healthier oils, advanced baking technologies, gluten-free formulations, and sustainability-focused packaging.

Recent Developments

- 2024: Several global snack companies launched air-baked chip ranges with reduced sodium and natural seasoning blends.

- 2023: Expansion of plant-based baked chips made from chickpeas, lentils, and root vegetables in North American retail chains.

- 2022: New product lines introduced in Europe featuring artisanal herbs, gourmet spice blends, and eco-friendly packaging.

Future Outlook: A Decade of Healthier Snacking Innovation

The next decade will see strong momentum in baked chips driven by nutritional reformulation, clean-label transparency, and flavor experimentation. Brands that invest in natural ingredients, sustainable packaging, and personalized nutrition—supported by data-driven product development—will shape the future of global snacking.

With rising adoption across mainstream and niche consumer groups, the baked chips market is positioned for stable and resilient growth through 2035.