The global air springs market is on a strong upward trajectory, projected to grow from USD 7.9 billion in 2025 to reach USD 13.2 billion by 2035, expanding at a CAGR of 5.3% over the forecast period. This growth is being powered by increasing consumer demand for enhanced vehicle comfort, stability, and safety, coupled with the rising adoption of air suspension systems in heavy commercial vehicles (HCVs) and electric vehicles (EVs).

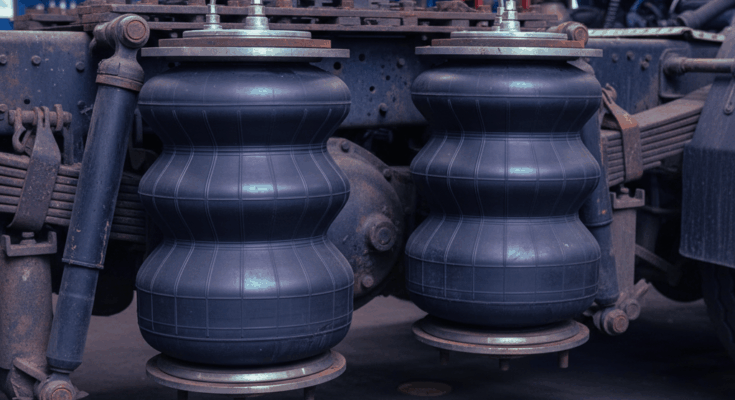

As automakers and fleet operators strive for optimized performance, reduced NVH (Noise, Vibration, and Harshness), and superior load management, air springs have become an indispensable component in the mobility and logistics landscape. Their unique ability to automatically adjust height and stiffness based on varying loads provides optimal stability, improved handling, and extended vehicle lifespan—making them the preferred choice across multiple transportation and industrial applications.

Air Springs Market Drivers: Comfort, Electrification, and Regulatory Compliance

Global OEMs are intensifying efforts to integrate air suspension systems in trucks, buses, luxury sedans, and EV platforms to achieve performance excellence. The surge in freight movement and e-commerce logistics has pushed fleet owners to focus on ride quality, driver comfort, and asset durability. By significantly reducing chassis vibrations, air springs extend vehicle service life and lower operational downtime—critical factors for logistics profitability.

The ongoing transition to electric and hybrid mobility is another strong catalyst. Air springs help balance the additional weight of EV batteries, ensuring consistent ride height, aerodynamics, and energy efficiency. As automakers pursue lightweight, electronically controlled systems to optimize range and comfort, air suspension integration is gaining strategic importance in vehicle architecture design.

In parallel, global safety and emission regulations continue to accelerate adoption. With governments enforcing stricter standards for road safety, braking efficiency, and ride stability, air spring technologies are becoming central to compliance strategies.

The urbanization wave and smart city infrastructure projects—particularly in Asia-Pacific and the Middle East—are also increasing demand for mass transit systems equipped with air springs. Metro buses and low-floor coaches use them extensively for passenger comfort, accessibility, and automated leveling.

Air Springs Market Regional Insights: North America Leads, Asia-Pacific Accelerates

North America holds the largest share of the air springs market, driven by premium automotive demand, stringent NVH regulations, and the dominance of heavy-duty commercial transport. OEMs in the U.S. and Canada are embedding advanced suspension systems across SUVs, pickup trucks, and freight vehicles to deliver enhanced ride comfort and fuel efficiency.

The U.S. market, growing at a CAGR of 5.8%, is witnessing strong momentum from fleet electrification and aftermarket modernization. Retrofitting older vehicles with air spring kits has become a cost-effective solution for fleet owners aiming to boost uptime and driver satisfaction. Digitally integrated air suspension systems with real-time damping and predictive maintenance features are emerging as the next wave of innovation.

Europe, led by Germany, France, and the U.K., continues to advance the market through vehicle safety mandates and premium segment adoption. OEMs are rapidly integrating electronically controlled air springs (ECAS) to meet evolving ride stability and emission standards. With the region’s strong emphasis on sustainability and lifecycle cost reduction, Europe remains a hub for high-value air suspension innovation.

Meanwhile, Asia-Pacific is the fastest-growing region, spearheaded by China (CAGR 6.6%) and India. Rapid industrialization, rising vehicle ownership, and expanding e-commerce networks are fueling adoption across passenger cars, commercial fleets, and railway applications. China’s booming EV production ecosystem and local manufacturing capacity make it a strategic growth center, while India’s aftermarket and refurbishment demand continue to rise sharply.

Japan, though mature, remains a steady market emphasizing sensor integration, product miniaturization, and industrial automation. Japanese OEMs are pioneering compact air spring solutions for robotics, EVs, and rail transport applications.

Air Springs Market Challenges: Cost, Complexity, and Durability

Despite robust growth prospects, the air springs market faces cost and maintenance challenges. High initial investment compared to conventional coil or leaf suspensions can deter adoption in cost-sensitive markets. The systems require specialized components such as compressors, valves, and air reservoirs, along with skilled technicians for maintenance.

Durability concerns in extreme climatic or off-highway conditions also limit deployment. However, manufacturers are responding with advanced composite materials, corrosion-resistant designs, and AI-driven condition monitoring, improving reliability and lifespan even under harsh conditions.

Air Springs Market Category Analysis: Product & Application Leadership

- Rolling Lobe Air Springs lead the product type segment, widely used in trucks, buses, and trailers for their high load capacity and durability.

- Sleeve Type Air Springs are the fastest-growing, finding favor in passenger and electric vehicles due to their compact design and smoother performance.

- By application, trailers and trucks dominate the market, supported by global freight growth and stricter road safety norms.

- Railway applications are rapidly expanding, propelled by smart city initiatives and investments in high-speed rail.

- The 3,300–7,300 N/m force range remains the most popular, offering balanced performance for medium-to-heavy vehicles, while >10,000 N/m systems gain traction in industrial and off-highway sectors.

Air Springs Market Competitive Landscape: Strategic Partnerships and Innovation Surge

The competitive landscape is defined by technological advancement, modularity, and cost optimization. Major players—Wabco Holdings Inc., ThyssenKrupp AG, BWI Group, Hendrickson LLC, Continental AG, Firestone Industrial LLC, Tata AutoComp Systems, VB AirSuspension, and Mando Corporation—are investing heavily in smart ECAS modules, sensor integration, and regional manufacturing to enhance responsiveness and reduce logistics costs.

Air Springs Market Recent developments highlight the sector’s innovation pace:

- In March 2025, thyssenkrupp Bilstein partnered with Baolong Automotive to create a global “one-stop-shop” solution for integrated air suspension systems.

- In March 2024, Hendrickson Truck Commercial Vehicle Systems launched ROADMAAX Z, its lightest 46,000 lb. capacity rear air suspension system, designed for optimal cargo protection and on/off-highway performance.

Air Springs Market Outlook: Digitally-Enhanced, Sustainable Suspension Systems

Looking ahead, the air springs industry is entering a new era of digital integration and sustainability. The next generation of products will feature IoT-enabled pressure monitoring, predictive diagnostics, and AI-based suspension control. Manufacturers are also exploring bio-based rubber materials and recyclable composites to meet ESG and circular economy goals.

With strong momentum from electrification, aftermarket expansion, and smart mobility trends, the global air springs market presents a compelling investment landscape for OEMs, component suppliers, and fleet technology innovators aiming to lead the transformation of modern suspension systems.

Browse Full Report: https://www.factmr.com/report/716/air-springs-market