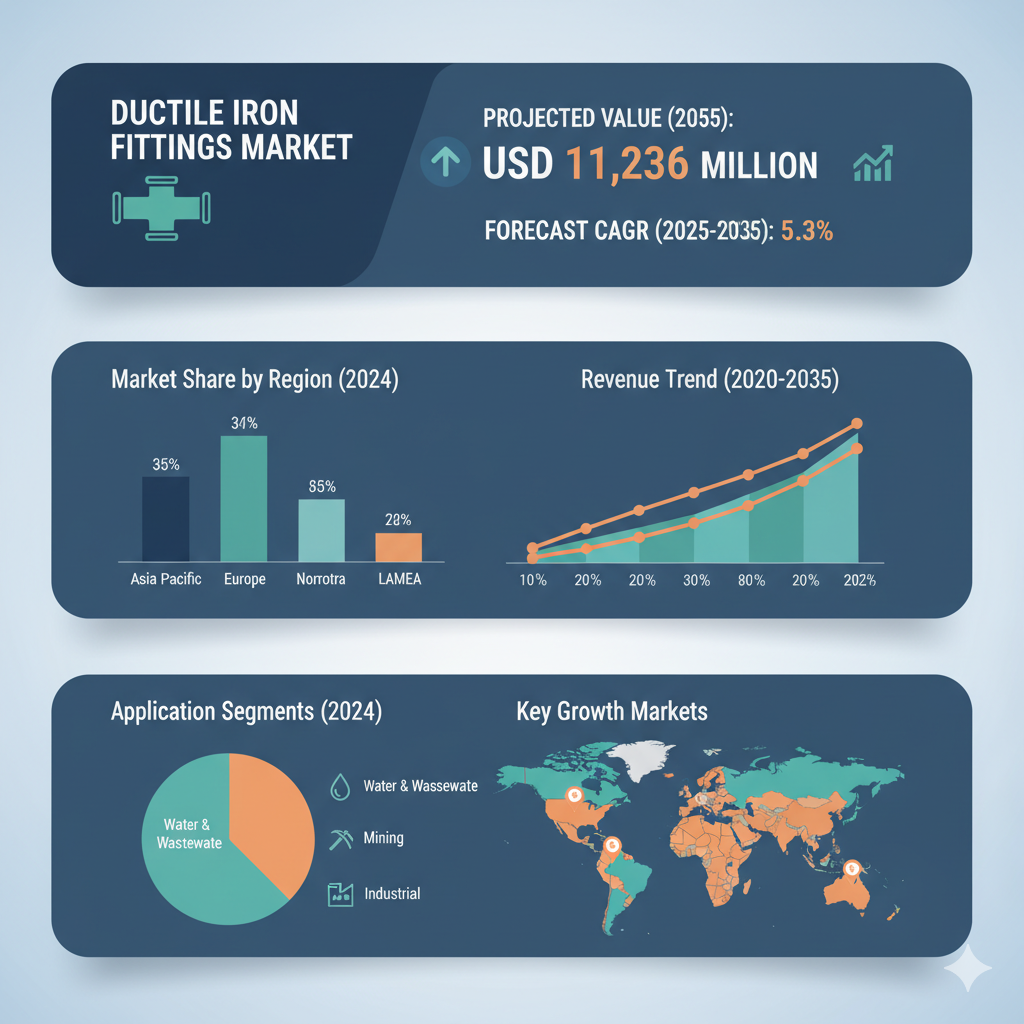

The global ductile iron fittings market is on a strong growth trajectory, driven by rising infrastructure needs and increasing demand for durable water and wastewater management systems. The market, valued at USD 6,704 million in 2025, is expected to reach USD 11,236 million by 2035, expanding at a CAGR of 5.3% over the forecast period. This upward trend is supported by government investments in urban development, industrial expansion, and modernization of aging public infrastructure.

Segmental Analysis

The market can be analyzed by product type, application, end-user, distribution channel, and region.

By product type, the market includes socket fittings, flanged fittings, mechanical joint fittings, push-on fittings, and other varieties. Among these, socket fittings currently account for the largest share of demand, favored for their ease of installation and reliability in high-pressure conditions. Mechanical joint fittings and push-on fittings are emerging as some of the fastest-growing categories as industries and municipalities increasingly opt for solutions that offer both durability and installation efficiency.

Applications of ductile iron fittings span across water supply, oil and gas, sewage and wastewater, and industrial sectors, with water supply and sanitation projects being the dominant drivers. Rapid urbanization, stricter environmental regulations, and the growing need for leakage-resistant systems are pushing governments and organizations to prioritize ductile iron fittings in new and upgraded pipelines. Industrial uses, particularly in power generation, mining, and chemical processing, also account for a notable share due to the superior strength of ductile iron.

From the perspective of end-users, the municipal sector leads the market, as large-scale projects for water distribution and sewage management dominate demand. Industrial end-users follow closely, with agricultural and commercial sectors contributing smaller yet important segments.

In terms of distribution, direct sales play a major role in large-scale infrastructure contracts, while distributors and dealers supply medium-sized projects and smaller contractors. Online retailing, though still relatively minor, is growing as procurement processes become more digitalized.

Regionally, Asia-Pacific stands out as the fastest-growing market, with India and China at the forefront. Both countries are investing heavily in water and sanitation infrastructure, which has created significant demand for ductile iron fittings. India, for example, is expected to register growth at over six percent annually, while China is not far behind. North America and Europe show steady growth, largely due to the replacement of old infrastructure and compliance with stringent environmental standards. The Middle East and Africa are also increasing their adoption of ductile iron fittings, particularly for water distribution and irrigation, spurred by challenges related to water scarcity.

Recent Developments and Competitor Analysis

The competitive environment of the ductile iron fittings market is dynamic, with companies focusing on innovation, sustainability, and geographic expansion. Manufacturers are investing in corrosion-resistant linings, coatings, and advanced designs to extend service life and ensure performance in challenging environments. A noticeable trend is the adoption of greener manufacturing processes and electric-powered production facilities that reduce carbon emissions.

One of the most significant developments occurred in January 2025 when the American Cast Iron Pipe Company announced an investment of USD 285 million over four years to modernize its ductile iron operations. This includes a transition to electric-powered furnaces, which promises greater flexibility and environmental benefits. Meanwhile, in India, Rungta Steel expanded into the ductile iron pipe segment, signaling an increase in regional production capabilities and competitiveness.

Several key players dominate the global market, including American Cast Iron Pipe Company, Tata Steel, Electrosteel Castings Limited, Asc Engineered Solutions, SIP Industries, China National Building Material Company Limited, and Sahara Pipes. These companies are expanding their manufacturing capacities, diversifying their product ranges, and exploring new markets to strengthen their positions. Some are focusing on sustainable practices and premium products for mature markets in North America and Europe, while others are competing aggressively on price in emerging regions.

Regional strategies also highlight the competitive dynamics. In India, local manufacturers are ramping up their export capabilities alongside meeting domestic infrastructure needs, positioning the country as both a major consumer and supplier of ductile iron fittings. China continues to play a dual role as a large consumer and a global exporter, with government policies supporting infrastructure upgrades. In more developed regions such as Western Europe, North America, and Japan, competition is centered on the replacement of outdated systems and the demand for products that meet strict safety and environmental standards.

Key Challenges and Risks

Despite the positive outlook, the market faces several challenges. The higher upfront cost of ductile iron fittings compared to alternatives such as PVC or HDPE pipes can make them less attractive for projects with tight budgets. Raw material price volatility is another significant issue, as fluctuations in the cost of iron and steel directly affect production expenses and profitability. Furthermore, plastic-based alternatives pose competitive pressure due to their lighter weight, ease of handling, and lower installation costs, particularly in applications where the durability of ductile iron is not strictly required.