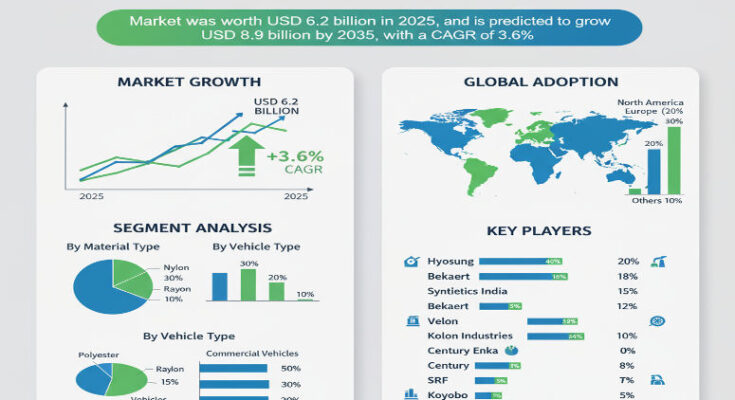

The global tire cord market is projected to grow steadily as vehicle production and tire manufacturing expand worldwide. The market was valued at USD 6.2 billion in 2025 and is forecast to reach USD 8.9 billion by 2035, representing a compound annual growth rate (CAGR) of 3.6% over the forecast period. This measured but consistent growth reflects strong demand from both original equipment manufacturers and the replacement tire market, driven by rising vehicle ownership in emerging economies, growing commercial vehicle fleets, and evolving tire design requirements for electric and high-performance vehicles.

Market Drivers and Growth Catalysts

Several structural dynamics underpin the tire cord market’s expansion. Increasing global automotive production and an expanding global fleet naturally raise demand for replacement tires, which supports ongoing need for tire reinforcement materials. Advances in tire engineering — including a shift toward radial constructions, low rolling resistance tires for improved fuel economy and EV range, and high-load commercial tire designs — require stronger, lighter and more fatigue-resistant cord materials. In addition, regulatory emphasis on safety and performance, and consumer demand for longer-lasting tires, are encouraging adoption of high-performance cords. The push to reduce vehicle weight without sacrificing durability further supports development of advanced cord materials and hybrid solutions that achieve tensile strength at lower mass.

Product and Material Segmentation

The tire cord market is segmented by material type and application. Polyester remains a widely used material for its cost-effective balance of strength and dimensional stability, while nylon 66 and rayon retain importance where higher flexibility or adhesion properties are required. Steel cord continues to be essential for heavy-duty tire belts and commercial radial constructions where extreme tensile strength and dimensional stability are critical. Specialty cords — including aramid and hybrid blends — are gaining traction in premium and specialty tires where high tensile strength, heat resistance and low stretch are required. Each material type addresses specific performance needs across passenger, commercial, agricultural and off-road tire segments.

Application Trends and End-Use Markets

Radial passenger tires represent a major share of cord consumption as they dominate modern vehicle fleets; however, commercial vehicle, off-road and specialty tire segments are important growth pockets due to heavier load demands and more rigorous performance criteria. The rise of electric vehicles introduces new design constraints — particularly around weight, heat management and rolling resistance — which motivate tire makers to adopt lighter, higher-performance cord materials to preserve range while maintaining safety and longevity. Replacement tire demand also remains a steady source of volume, especially in mature markets with established vehicle stocks.

Regional Outlook and Opportunities

Asia-Pacific stands out as the largest and fastest-growing regional market for tire cords, driven by rapid automotive production, growth in replacement tire demand, and the presence of major tire manufacturing hubs. China, India and Southeast Asian countries are significant contributors to global cord consumption as local OEMs and tire producers expand capacity. North America and Europe are mature markets that focus on performance, regulatory compliance and advanced materials, including higher adoption of specialty cords for premium and commercial tires. Latin America, the Middle East and Africa offer emerging upside as vehicle fleets grow and replacement cycles lengthen.

Competitive Landscape and Strategic Priorities

The tire cord market is competitive and technologically focused, with manufacturers differentiating through material innovation, quality of cord production (consistency, dipping/bonding processes), and ability to supply large OEM programs. Leading suppliers are investing in R&D to improve tenacity, fatigue resistance and adhesion to rubber matrices, while lowering weight and improving thermal behavior for EV applications. Strategic partnerships between cord suppliers and tire manufacturers help optimize cord formulations for specific tire architectures and performance goals. Expanding regional manufacturing footprints and improving supply chain resilience are also priorities to reduce lead times and control raw material volatility.

Challenges and Market Restraints

Despite positive drivers, the market faces challenges. Raw material price volatility (synthetic fibers, steel) can pressure margins and complicate cost planning for cord producers. Producing consistent, high-performance cords requires specialized manufacturing and quality control — particularly for nylon, rayon and hybrid materials — and small manufacturers may struggle with technical barriers. Competing reinforcement technologies, such as advanced steel formulations or novel textile blends, create substitution risk in specific applications. Finally, varying regulatory standards and certification requirements across regions require manufacturers to maintain robust compliance capabilities.

Forecast and Strategic Recommendations

With a market value rising from USD 6.2 billion in 2025 to USD 8.9 billion by 2035 at a 3.6% CAGR, the tire cord sector offers steady opportunities for suppliers that align product innovation with evolving tire demands. Manufacturers should prioritize development of lighter, higher-tenacity cords tailored to EV and low-rolling-resistance tire designs, expand local production capacity in Asia-Pacific to meet regional demand, and invest in dipping and bonding technologies that improve cord-to-rubber adhesion. Collaboration with tire-makers for co-developed solutions, diversification of raw material sourcing to mitigate price shocks, and value-added services such as testing and performance validation will also strengthen market position.

Browse Full Report: https://www.factmr.com/report/tire-cord-market

Editorial Perspective

Tire cords are fundamental yet often unseen contributors to tire safety, performance and longevity. As mobility evolves — with the twin trends of electrification and globalization of tire manufacturing — cord materials and manufacturing processes will play a central role in enabling lighter, stronger and more durable tires. The next decade will reward cord suppliers that combine materials science, manufacturing excellence and close collaboration with tire designers to deliver the reinforcement solutions that modern tires require.